We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Closing a joint account ?

Comments

-

Are you 100% sure about that?Thrugelmir said:

The bank cannot offset.Chino said:

No, but the bank could if the ex mismanages the joint account and the bank decides that it's going to help itself to the OP's daughter's sole account to make good any losses on the joint account.jonesMUFCforever said:he could not touch her sole account.I came into this world with nothing and I've got most of it left.0 -

About 5 years I tried to close a joint bank account with Halifax. They would not close the account without both signatures, nor would they allow me to remove myself. The best they would do is allow the account to be frozen, once I had settled the overdraft.

0 -

This is, AFAIK, the most common approach banks will take. More progressive banks do allow either account holder to close the account if there is no overdraft.ischris85 said:About 5 years I tried to close a joint bank account with Halifax. They would not close the account without both signatures, nor would they allow me to remove myself. The best they would do is allow the account to be frozen, once I had settled the overdraft.

Insisting on both account holders to agree to closure is, of course, absolutely abysmal customer service, as the financial connection on credit reference files remains for as long as the current account remains, and the bank can thereby indirectly, but forcefully, cause havoc to a person's creditworthiness. I am fortunate in that I don't find myself shackled to a joint account (more by luck than by design, I hasten to add, as at some stage in my life I was financially naive), but if I was, I would appeal to the relevant bank's CEO about it, and I would not rest there if they did not let me out of an account that owes them nothing.0 -

https://supportcentre.natwest.com/Searchable/913233452/How-do-we-close-our-joint-account.htm

We’ll also need the number of signatories to match our records. For example, if the account is set up with "one to sign" then it can be closed by either person on the account. If it’s set up as "two to sign" then both need to sign to close the account.

OP should check the bank's policy.0 -

Halifax t+C's allow one account holder to close a joint account as long as the account is not in dispute or overdrawn. See page 40 of

http://www.halifax.co.uk/bankaccounts/pdf/reward-current-account-guide.pdf?srnum=40 -

Except if you happen to have a vindictive partner who empties the account and then closes it leaving the other party with no funds.colsten said:

Insisting on both account holders to agree to closure is, of course, absolutely abysmal customer service, as the financial connection on credit reference files remains for as long as the current account remains, and the bank can thereby indirectly, but forcefully, cause havoc to a person's creditworthiness. I am fortunate in that I don't find myself shackled to a joint account (more by luck than by design, I hasten to add, as at some stage in my life I was financially naive), but if I was, I would appeal to the relevant bank's CEO about it, and I would not rest there if they did not let me out of an account that owes them nothing.

To late then to start a joint account dispute when the monies gone.

It takes 2 parties to open a joint account. Therefor it is correct that 2 should be required to close it.Life in the slow lane0 -

It's not the bank's responsibility to ensure both partners have adequate funds, and it would be utterly impractical for a bank to assume such a role. The rights and responsibilities of joint account holders are laid open when opening a joint account, and many banks say that either account holder can close the account. I haven't checked recently, but I recall Santander and Lloyds are ones which allows either party to close an account, provided it is not overdrawn. IIRC, with Lloyds, it is even possible for one account holder to remove the other, without the other's agreement or knowledge.born_again said:

Except if you happen to have a vindictive partner who empties the account and then closes it leaving the other party with no funds.colsten said:

Insisting on both account holders to agree to closure is, of course, absolutely abysmal customer service, as the financial connection on credit reference files remains for as long as the current account remains, and the bank can thereby indirectly, but forcefully, cause havoc to a person's creditworthiness. I am fortunate in that I don't find myself shackled to a joint account (more by luck than by design, I hasten to add, as at some stage in my life I was financially naive), but if I was, I would appeal to the relevant bank's CEO about it, and I would not rest there if they did not let me out of an account that owes them nothing.

To late then to start a joint account dispute when the monies gone.

It takes 2 parties to open a joint account. Therefor it is correct that 2 should be required to close it.

It's a shame the OP never got back to tell us which bank the daughter's account is with, so we can't tell what the applicable T&Cs are.3 -

We have two joint accounts with Tesco, opened last year for the 3% up to £3000. We don't really need both of them now, so I'll attempt to close one of them myself and see what happens.I came into this world with nothing and I've got most of it left.0

-

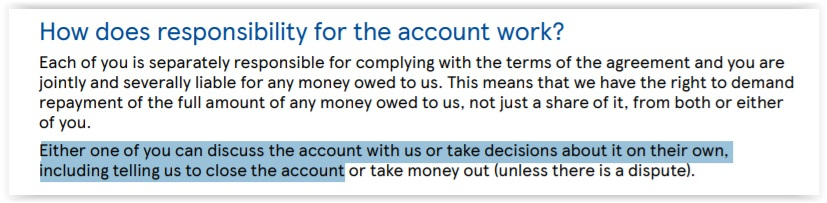

This is from the Tesco T&Cs:Shakin_Steve said:We have two joint accounts with Tesco, opened last year for the 3% up to £3000. We don't really need both of them now, so I'll attempt to close one of them myself and see what happens.

They will not, however, allow one account holder to remove the other. Both need to agree to that. This sounds a little bizarre to me, as closing the account can have same effect on the other account holder.1 -

My partner is still trying to get his joint account with ex closed down with Lloyds. They refer something from both parties. My partner has returned his card and form (to close account to branch), his ex is being a pain and won't contact the bank herself so he's stuck on it, Lloyds say there is nothing else they can do.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards