We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

SDLT pantomime

I am worried if I buy now, come 1st April it will transpire that I have paid over the odds meaning a reduction in equity or possibly even negative equity.

As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.

Also, as a FTB I wouldn’t have paid SDLT on the first £300k anyway so I feel that the chancellors announcement has made property even more risky and unaffordable for FTBs.

Would you gamble and purchase now, or hold off until 1st April 2021 where property prices will fall by 3% effectively due to the SDLT becoming payable again? The chancellor could extend the holiday also.

I have a large enough deposit for the LTV requirements and a secure job, but if prices fall in April, I could effectively lose my equity.

What happens if there is a second wave of CV-19 in the winter. It seems like the government aren’t even planning for this.

Comments

-

As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.

You are overthinking it, as many do. You are buying something to live in, hopefully for a long time. Once you buy you'll have a mortgage you can afford and a place you can call home.

The value of the property in one or two years time will be irrelevant when you own it. The value when you come to sell might be relevant, but you can't predict prices 10 or fifteen years into the future so don't even try or worry about it.

1 -

jonnygee2 said:As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.

You are overthinking it, as many do. You are buying something to live in, hopefully for a long time. Once you buy you'll have a mortgage you can afford and a place you can call home.

The value of the property in one or two years time will be irrelevant when you own it. The value when you come to sell might be relevant, but you can't predict prices 10 or fifteen years into the future so don't even try or worry about it.

There is nothing stopping me staying put for say 12 months, although not ideal. As a FTB I won’t be buying a family home so will probably be moving again in 3-4 years - here lies my predicament.In my situation, I don’t want to be buying at the height of the market, as no one would.0 -

There is nothing stopping me staying put for say 12 months, although not ideal. As a FTB I won’t be buying a family home so will probably be moving again in 3-4 years - here lies my predicament.

Honestly if you are going to have to sell in 3 years, just don't buy for another 3 years. It's too short, the costs and risks of buying and selling outweigh any price gains.

Trying to predict the market is a fools game. Buy what you can afford when you can afford it, but do try and buy with at least 5 years in mind, preferably much more.

1 -

Then work out the difference between what you would pay in rent versus what you would pay in interest on a mortgage. If there's no difference unless prices rise you haven't missed out. If rent is more expensive then work out by how much. Compare this to what you predict the fall in property prices will be. That will give you a pure financial answer on whether now or waiting 12 months is right for you (assuming you're able to acurately predict the fall in value you're expecting). I suspect you'll find that the interest portion of your mortgage will be a good bit less than your rent.Sibbers123 said:jonnygee2 said:As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.You are overthinking it, as many do. You are buying something to live in, hopefully for a long time. Once you buy you'll have a mortgage you can afford and a place you can call home.

The value of the property in one or two years time will be irrelevant when you own it. The value when you come to sell might be relevant, but you can't predict prices 10 or fifteen years into the future so don't even try or worry about it.

There is nothing stopping me staying put for say 12 months, although not ideal. As a FTB I won’t be buying a family home so will probably be moving again in 3-4 years - here lies my predicament.In my situation, I don’t want to be buying at the height of the market, as no one would.1 -

It’s not as simple as interest versus rent. You also need to include:Wkmg said:

Then work out the difference between what you would pay in rent versus what you would pay in interest on a mortgage. If there's no difference unless prices rise you haven't missed out. If rent is more expensive then work out by how much. Compare this to what you predict the fall in property prices will be. That will give you a pure financial answer on whether now or waiting 12 months is right for you (assuming you're able to acurately predict the fall in value you're expecting). I suspect you'll find that the interest portion of your mortgage will be a good bit less than your rent.Sibbers123 said:jonnygee2 said:As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.You are overthinking it, as many do. You are buying something to live in, hopefully for a long time. Once you buy you'll have a mortgage you can afford and a place you can call home.

The value of the property in one or two years time will be irrelevant when you own it. The value when you come to sell might be relevant, but you can't predict prices 10 or fifteen years into the future so don't even try or worry about it.

There is nothing stopping me staying put for say 12 months, although not ideal. As a FTB I won’t be buying a family home so will probably be moving again in 3-4 years - here lies my predicament.In my situation, I don’t want to be buying at the height of the market, as no one would.

- the costs of buying and selling.- over 3 (Calendar) years as a FTB you can also get extra £4000 towards deposit if you are able to pay £4000 per year into LISA.- assuming stamp duty goes back to normal after this 6 months (not guaranteed of Course). Also need to consider you will then have lost FTB stamp duty relief.1 -

If you can hold on till next summer, by then people will have been weened off their furlough for a decent number of months and reality will start to hit. Measures announced yesterday make it more attractive for employers to keep / hire young people rather than older homeowners.The next 6 months will just be the final pump of air into the bubble before it bursts.0

-

I would personally not entertain that. I'd make an offer, taking into consideration the listed price before this increase and then make an offer accordingly. The value of a house does not go up because there is no SDLT to pay for a while. Don't play that game.Sibbers123 said:Looking on rightmove in my local area, I have seen a few properties that have their asking price increased. One from £335k to £350k.

I am worried if I buy now, come 1st April it will transpire that I have paid over the odds meaning a reduction in equity or possibly even negative equity.

As a FTB I am not already vested in the property market so any fall in value after purchase will cost me.

Also, as a FTB I wouldn’t have paid SDLT on the first £300k anyway so I feel that the chancellors announcement has made property even more risky and unaffordable for FTBs.

Would you gamble and purchase now, or hold off until 1st April 2021 where property prices will fall by 3% effectively due to the SDLT becoming payable again? The chancellor could extend the holiday also.

I have a large enough deposit for the LTV requirements and a secure job, but if prices fall in April, I could effectively lose my equity.

What happens if there is a second wave of CV-19 in the winter. It seems like the government aren’t even planning for this.2 -

They are. The NHS website explains what the guidance is to mitigate thisSibbers123 said:

What happens if there is a second wave of CV-19 in the winter. It seems like the government aren’t even planning for this.Gather ye rosebuds while ye may0 -

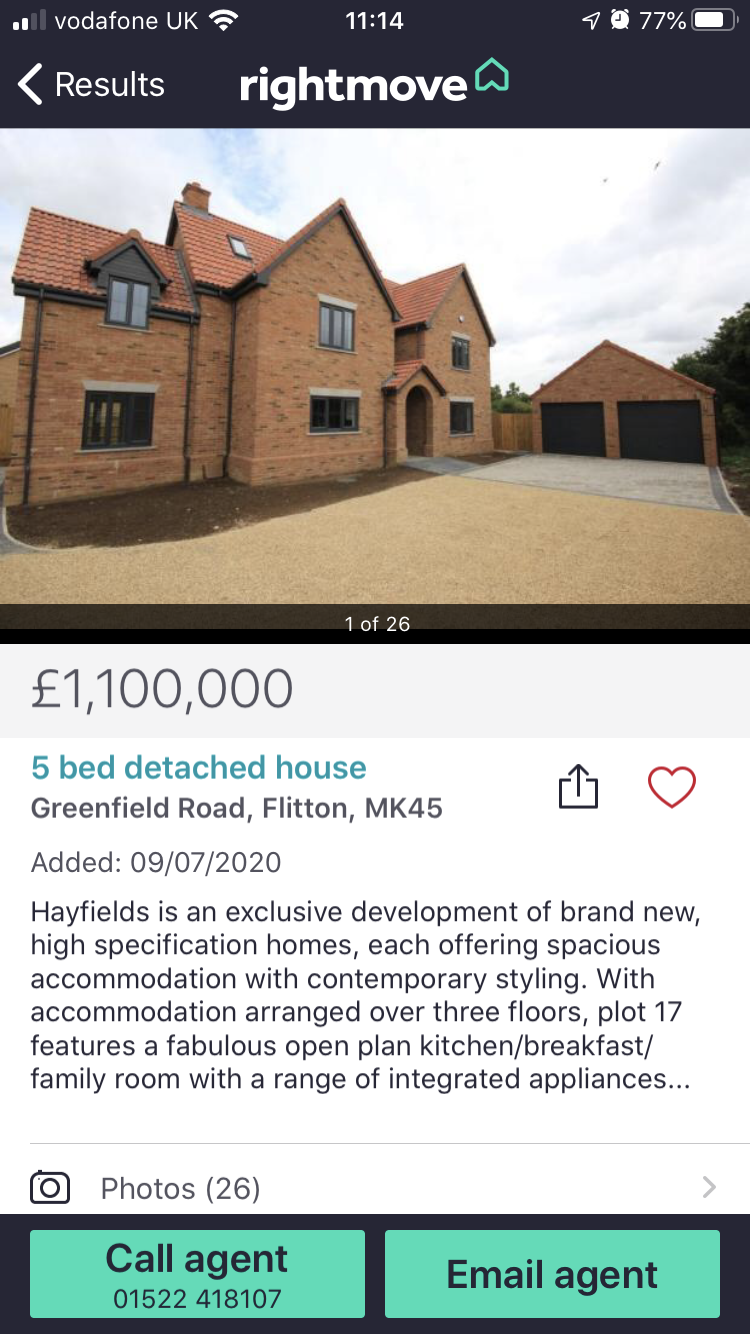

Here is one example of developers being greedy in my local area.

0

0 -

I drive through Silsoe every day and can't believe there is still a demand for so many new buildsGather ye rosebuds while ye may0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards