We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Renting out house and renting another: tax?

Comments

-

dutchcloggie said:

I hope to have about £40,000 equity.Norman_Castle said:dutchcloggie said:

I keep thinking it would actually be a good time to sell, rent for a bit and then buy something later.Slithery said:

It's only a bad idea when house prices are rapidly rising, I can't see the market increasing much in the next year.dutchcloggie said:But what about stepping off the property ladder with people saying that's a bad idea?How much equity in your current property? With a large deposit another mortgage should be easily available. Being chain free as both a seller and buyer is simpler.Instead of renting would being a lodger or a house share be cheaper?If you park that you'll be in the same financial position in a year as you are now. Prices are unlikely to rise in the next year, being off the property ladder is doable if you hold your equity and buy before any significant price rises.Can you have friends or family as lodgers while renting elsewhere for work and commute "home" on a regular basis?0 -

So you move out. You make the property ready to let. You advertise for a tenant. You finally find somebody willing to move in on a six month AST. They give notice at their old place, and move in.dutchcloggie said:All of that is true. But, I am talking about a period of a year. Max.

There's three of your 12 months before you get a penny of income.

Then you give them notice for the end of the fixed period. That's month nine. Miss that by a day, you're up to month eleven at the earliest. IF they then move out on the expiry of the notice...

Potentially, you've got just £7,200 income in the year. Before expenses, advertising costs, referencing, CtL, etc etc. Oh, yes - and £12k of mortgage payments... You're five-six grand down IF everything goes smoothly...I am security driven,money driven.

Let's put it simply: You're betting on one-year property price increases being higher than your losses on the let, and you're betting on the tenancy being zero-hassle. That doesn't seem particularly "money-driven" and definitely not "security-driven".

You've just got this "MUST NOT GET OFF LADDER" trope sellotaped front and centre in your consciousness.1 -

We were in a similar position about 15/16 months ago. We had a house where I was working, was offered another job in another area of the country. We looked at renting it out, whilst we rented locally to the new job.

We decided against it for a lot of the reasons outlined. We spent the first month in rental returning each weekend to give the house the best clean it has probably ever had, and sorted out all those little DIY job's that were always on the to do list. Is so much easier to do this whilst you're not living in the house, esp with a small child. We rented the cheapest house we could fit in so we could continue to pay for the two places prior to our house selling. Not ideal, but it was never going to be a long term arrangement.

When the house went on the market, the estate agents had a key, so viewings were easy to arrange for the buyers, and it was a no chain sale. In the end we sold to the first viewer the day before it officially went on the market. A couple of months later the money was in our bank account and that was that. We then could look for another house locally, and were no chain buyers - which the estate agents loved us for being. And let us put in a cheeky offer to the house we have now.

We've now purchased another house, and have about 5 to 6 weeks left on the rent here. Which we're using to decorate the new house, and sort things out as we slowly move our belongings over.

Yes it's cost us money to do it this way (was able to claim some back from the new job as relocation), but for the lack of stress of not knowing what tenants were doing in our house, the not having to have the house spotless on moving day, being able to do things at our leisure, being able to decorate our new house within living in it, selling and buying with no chain, not having complex tax arrangements etc, that has been worth alot to us.

We stepped off the house market ladder for about 11 months in total, has it really changed that much in that time?

1 -

I must admit I am baffled by the reluctance to "step off the ladder". I can understand if property prices were booming and you stood to gain a lot on the house value therefore making it easier to buy on/meaning you have to find less money to buy on. However as others have said house prices look like they will be flat for a while and added to that you're proposing to make a loss on renting your property. It just doesn't make sense to me.You say you have £40k equity. If you lose £2k renting the property you will effectively have £38k to put towards the next property. Whereas if you sell and save the £2k instead you would then have £42k to put towards a new property.0

-

That, in itself, is a massive warning bell that running a lettings business is not for you.AlwaysPondering said:

...but for the lack of stress of not knowing what tenants were doing in our house...

It's their home. They can do what they like in it while they live there. Absolutely none of your business what they might be doing or not doing.0 -

I do. I didn't used to. In Holland, where I'm from, renting is seen as a perfectly good step in between. But Brits are so focused on buying, it has scared me into thinking I'm stupid to leave.AdrianC said:

So you move out. You make the property ready to let. You advertise for a tenant. You finally find somebody willing to move in on a six month AST. They give notice at their old place, and move in.dutchcloggie said:All of that is true. But, I am talking about a period of a year. Max.

There's three of your 12 months before you get a penny of income.

Then you give them notice for the end of the fixed period. That's month nine. Miss that by a day, you're up to month eleven at the earliest. IF they then move out on the expiry of the notice...

Potentially, you've got just £7,200 income in the year. Before expenses, advertising costs, referencing, CtL, etc etc. Oh, yes - and £12k of mortgage payments... You're five-six grand down IF everything goes smoothly...I am security driven,money driven.

Let's put it simply: You're betting on one-year property price increases being higher than your losses on the let, and you're betting on the tenancy being zero-hassle. That doesn't seem particularly "money-driven" and definitely not "security-driven".

You've just got this "MUST NOT GET OFF LADDER" trope sellotaped front and centre in your consciousness.

I am security driven, risk averse. When I say money driven, I mean I want what will lose me the least money in the end, not what will make me the most. I was just looking for what would give me the most security. And it seems that is selling, rather than renting it out.

I'd prefer to sell. That's my gut instinct and I am going to stick with it after all your advice :-) Sometimes gut instinct is best. I don't think renting it out is for me. I'm too much of a worrier.

Thank you.3 -

Phew! Good job done, if we've save the UK from another accidental landlord. OP: sell up, bank your £40K equity at 1.16% in NS&I Income Bonds for a year, and relax.No free lunch, and no free laptop

1

1 -

One more question though.

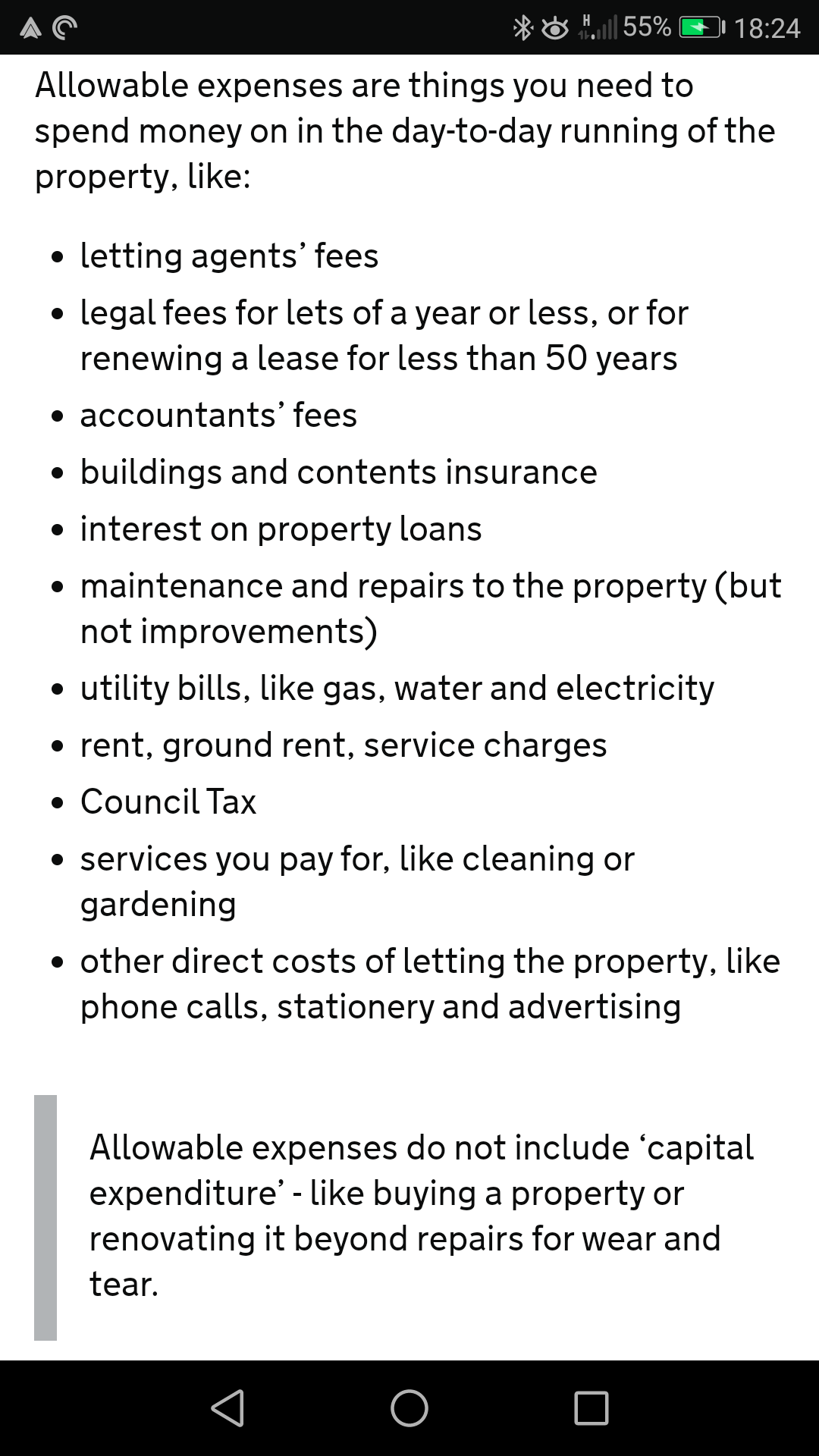

I would pay tax on the rental income minus costs. Don't costs include the actual mortgage? So if rent is £750 and mortgage is £550 and agency fee is £100 and insurance is £50, I would only pay income tax on £50?

Literally asking for a friend who is now worried she's misunderstood the law when she rented her house out.

Edit: I think I found the answer. Mortgage is not a deductable cost. Only the running costs, right? 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards