We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

IFA or DIY - any thoughts appreciated

Comments

-

I got my FTSE figures from a trustnet.com chart and S&P 500 from dqydj.com. What TC93 is doing (I think) is removing price changes from the equation that don't reflect the actual growth of the company to try to get to the bottom of the strength of the companies as far as earnings are concerned. However I don't think its that simple as earnings or company profits are not equal. Earnings are also fiddled with at the corporate level using buybacks, which isn't a bad thing but makes the numbers harder to read. Amazon for example which has a pretty big impact on the S&P and arguably deserves to trade on a very high price and might never return to a mean.AlanP_2 said:TC93 - I have no idea whether your way of calculating and your maths is right but just cannot see how your calculations map on to the total return figures Prism posted.

What is the reason for the dramatic difference in Prism's overall return figures over 25 years and your annual rates?

The fundamental question is difficult to answer. Are the US companies better than the UK companies and do they deserve their premium price? If not then over the coming years they should continue to do well but their stock price will level off or drop (probably the best example being the Nifty 50). Meanwhile the UK companies will also do well and people will realise they are just as good (and a bargain) and their stock price will recover. Its a classic value investor concept which personally I am not sure works anymore.

The facts are though, if you invested globally 25 years ago (btw, I picked that date as roughly when I invested in my first pension fund) you would be considerably better off now than if you invested more into the UK, regardless of the reasons. At other time points that would not have been true.0 -

/Prism said:

I got my FTSE figures from a trustnet.com chart and S&P 500 from dqydj.com. What TC93 is doing (I think) is removing price changes from the equation that don't reflect the actual growth of the company to try to get to the bottom of the strength of the companies as far as earnings are concerned. However I don't think its that simple as earnings or company profits are not equal. Earnings are also fiddled with at the corporate level using buybacks, which isn't a bad thing but makes the numbers harder to read. Amazon for example which has a pretty big impact on the S&P and arguably deserves to trade on a very high price and might never return to a mean.AlanP_2 said:TC93 - I have no idea whether your way of calculating and your maths is right but just cannot see how your calculations map on to the total return figures Prism posted.

What is the reason for the dramatic difference in Prism's overall return figures over 25 years and your annual rates?

The fundamental question is difficult to answer. Are the US companies better than the UK companies and do they deserve their premium price? If not then over the coming years they should continue to do well but their stock price will level off or drop (probably the best example being the Nifty 50). Meanwhile the UK companies will also do well and people will realise they are just as good (and a bargain) and their stock price will recover. Its a classic value investor concept which personally I am not sure works anymore.

The facts are though, if you invested globally 25 years ago (btw, I picked that date as roughly when I invested in my first pension fund) you would be considerably better off now than if you invested more into the UK, regardless of the reasons. At other time points that would not have been true.

Your last point is obviously unarguable, but I think it's relevant to the future. I.e. someone could say "I have £1m of tech stocks" in 2000 or bank stocks in 2007, yes you have it on paper, but if you're intending to hold then the future is relevant to that. £1m in stocks in 1975 or 1933 is worth a lot more than £1m in stocks in 1973 or 1929 (it's easy to say this in hindsight).

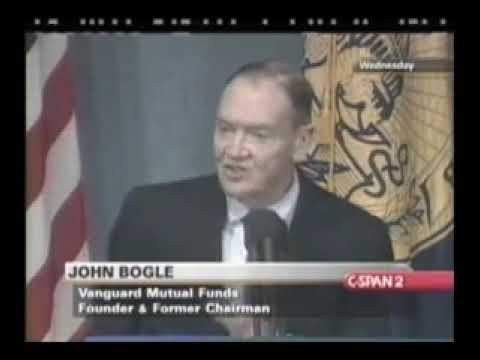

This video explains it better than I can: https://youtu.be/tobJH2QBruk

https://youtu.be/tobJH2QBruk

Your point about earnings is interesting, at least with dividends you can't dispute the data but you can question where they come from and how sustainable they are. And on the level of national indices I don't think there's any reason to think either the US or UK arematerially more or less fraudulent than the other, both have had plenty of scandals.

Also the price index can be affected as you say buy share buybacks, M&A/FDI, listings, delistings, fraud, dilution etc.

The US's competitive advantages are, I think, their global dominance alongside global insulation (most powerful and wealthy country ever, lowest trade as a % of GDP among advanced economies, mostly with allies via secureable trade routes, energy independence, ocean moats on both sides, militarily incomparable allies to the North and South, biggest single chunk of arable land in the world, best natural infrastructure in the world in the Mississippi River network and intracoastal waterways) and having the best demographics in the developed world, even before you get into the diverse economy, the can do attitude and enterprise etc. In spite of all those advantages: the history, the data, the valuations and the pessimism I see and read and hear about the UK is I think significant enough to justify me upweighting the UK in my own portfolio above what people may consider standard, whether you think the standard is the global market weight of ~5%, or half of each, is up to you.

2 -

For what its worth I am around 20% UK (more if you include property, infrastructure and cash), although that is incidental as I only hold a small allocation to a couple of microcap UK funds, preferring global ones in general. No oil, mining or banks though.tcallaghan93 said:In spite of all those advantages: the history, the data, the valuations and the pessimism I see and read and hear about the UK is I think significant enough to justify me upweighting the UK in my own portfolio above what people may consider standard, whether you think the standard is the global market weight of ~5%, or half of each, is up to you.0 -

I'm not sure this will ever be read, seeing as the thread has slipped pages and pages down the list, but I OP'd back in early July, and got some very useful thoughts and advice back - and one or two posters asked that I let them know how I got on.

Thanks again for all the thoughts. Here's what's happened and what I'm doing:

Someone suggested I read John Edwards' book "DIY Pensions" - I did, it's a very readable and clear book. I'd recommend it. The cover picture's not particularly inspiring, but, well, you shouldn't judge a book... And I read his "DIY Simple Investing", which compliments the other well (and arguably is needed to get the most from DIY Pensions).

I also read about a quarter of "Saving and Investing for Retirement" by Yoram Lusting. All very dry, and I didn't think it was an efficient use of time (the cover's pretty good though!). And I'm about halfway through Monkey with a Pin, although that's ~8 years old now.. Then there were a few hours lost to monevator, and other bits dotted around the internet.

Anyway, my plan:

On the charges front -

i'm not going with the IFA I'd chatted to and who had put together a portfolio. So I've dodged 0.5% pa...

Platforms-wise (what a can of worms) I'm walking away from Hargreaves Lansdown (for ISAs as well as the SIPP) - that was costing me ~0.4% pa, and moving to Interactive Investor for the SIPP (and my ISA). That's effectively £240 pa, (given my hyper low trading plan), which works out at 0.07% pa for me. (the Funds Network platform that the IFA was going with would've been 0.20%). Comparefundplatforms.com was very useful.

I did briefly look at Vanguard (the platform) for the majority of the SIPP, but incredibly they don't accept regular direct debits from UK companies, so my monthly employer amounts couldn't go in (bizarre, though I'm sure they have a reason..)

I may well move my wife's ISA over to Vanguard though - limited to Vanguard funds admittedly, but 0.15% pa on £30k makes for £45 a year (not really got into that decision though, yet)

On the investments front -

I'll probably get pulled apart for this, but I'm swayed (utterly swayed) by the passive over active argument, and have decided that the vast majority of my SIPP will be in passive funds. With that decision made it was fairly inevitable I'd end up looking at Vanguard's Life Strategy funds, which happily deal with asset allocation for me (in a binary, equity vs bonds way). I'm not going entirely into Vanguard's LS funds, but the vast majority will go there. They charge 0.22% pa. I'll be honest, I don't actually know what the weighted average charge is on the multitudinous funds I've got with HL but I suspect it's around 0.60% pa.

I think I'm right in the following comparison of what the IFA suggested vs my plan, on the charges front:IFA Vang / II OCFs 0.51% 0.22% trans costs 0.04% 0.04% Platform 0.20% 0.07% IFA fee 0.50% 0.00% TOTAL 1.25% 0.33% (that's a weighted average for the OCFs on the IFA suggested funds, and I don't know about the transaction costs on the IFAs portfolio, but Vanguard seem to think 0.04% on their LS funds)

So a saving of 0.92% pa (which should increase slightly as the portfolio does, what with the platform fee being fixed)

I've compounded (assuming 5% growth) that annual 0.92% out on the principal I start with and the (hefty, admittedly) annual contributions I expect - looks like a £25k difference after 5 years.

There we have it - that's the plan. Fire at will... !4 -

Just looking at the charges is a bit like comparing apples and pears and having invested with VLS60 for about 6 years I moved to an IFA last year and was under no illusion that the charges would be higher. The performance of the VLS60 though over the last 12 months is 4.4% whereas the portfolio under my IFA has returned almost 10% with a similar asset allocation of 60% equities and 40% fixed term. A few of the funds he chose have performed very well over the last few months though so that has skewed the results. The charges are higher but the return is too so overall it has performed better than in a passive multi asset fund. I am only speaking from a personal point of view though and of course you could get investors with other IFAs producing completely different results. You cannot really only look at charges in isolation.I’m a Forum Ambassador and I support the Forum Team on the Debt free Wannabe, Budgeting and Banking and Savings and Investment boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

The 365 Day 1p Challenge 2025 #1 £667.95/£500

Save £12k in 2025 #1 £12000/£124503 -

I do agree with you regarding the level of pessimism that persists. Herd mentality of investing is a researched fact. There's some great UK companies that have performed extremely well.83705628 said:

In spite of all those advantages: the history, the data, the valuations and the pessimism I see and read and hear about the UK is I think significant enough to justify me upweighting the UK in my own portfolioPrism said:

I got my FTSE figures from a trustnet.com chart and S&P 500 from dqydj.com. What TC93 is doing (I think) is removing price changes from the equation that don't reflect the actual growth of the company to try to get to the bottom of the strength of the companies as far as earnings are concerned. However I don't think its that simple as earnings or company profits are not equal. Earnings are also fiddled with at the corporate level using buybacks, which isn't a bad thing but makes the numbers harder to read. Amazon for example which has a pretty big impact on the S&P and arguably deserves to trade on a very high price and might never return to a mean.AlanP_2 said:TC93 - I have no idea whether your way of calculating and your maths is right but just cannot see how your calculations map on to the total return figures Prism posted.

What is the reason for the dramatic difference in Prism's overall return figures over 25 years and your annual rates?

The fundamental question is difficult to answer. Are the US companies better than the UK companies and do they deserve their premium price? If not then over the coming years they should continue to do well but their stock price will level off or drop (probably the best example being the Nifty 50). Meanwhile the UK companies will also do well and people will realise they are just as good (and a bargain) and their stock price will recover. Its a classic value investor concept which personally I am not sure works anymore.

The facts are though, if you invested globally 25 years ago (btw, I picked that date as roughly when I invested in my first pension fund) you would be considerably better off now than if you invested more into the UK, regardless of the reasons. At other time points that would not have been true.1 -

Similar asset allocation? Well, I guess the percentages sound the same....enthusiasticsaver said:Just looking at the charges is a bit like comparing apples and pears and having invested with VLS60 for about 6 years I moved to an IFA last year and was under no illusion that the charges would be higher. The performance of the VLS60 though over the last 12 months is 4.4% whereas the portfolio under my IFA has returned almost 10% with a similar asset allocation of 60% equities and 40% fixed term. A few of the funds he chose have performed very well over the last few months though so that has skewed the results. The charges are higher but the return is too so overall it has performed better than in a passive multi asset fund. I am only speaking from a personal point of view though and of course you could get investors with other IFAs producing completely different results. You cannot really only look at charges in isolation.

....but which equity funds & fixed term funds did your IFA suggest?

Plan for tomorrow, enjoy today!0 -

An IFA (or anyone else for that matter) is unlikely to significantly outperform something like the LS range (or similar multi-asset low cost offerings) over the long term.enthusiasticsaver said:Just looking at the charges is a bit like comparing apples and pears and having invested with VLS60 for about 6 years I moved to an IFA last year and was under no illusion that the charges would be higher. The performance of the VLS60 though over the last 12 months is 4.4% whereas the portfolio under my IFA has returned almost 10% with a similar asset allocation of 60% equities and 40% fixed term. A few of the funds he chose have performed very well over the last few months though so that has skewed the results. The charges are higher but the return is too so overall it has performed better than in a passive multi asset fund. I am only speaking from a personal point of view though and of course you could get investors with other IFAs producing completely different results. You cannot really only look at charges in isolation.1 -

Depends on the funds chosen.BritishInvestor said:

An IFA (or anyone else for that matter) is unlikely to significantly outperform something like the LS range (or similar multi-asset low cost offerings) over the long term.enthusiasticsaver said:Just looking at the charges is a bit like comparing apples and pears and having invested with VLS60 for about 6 years I moved to an IFA last year and was under no illusion that the charges would be higher. The performance of the VLS60 though over the last 12 months is 4.4% whereas the portfolio under my IFA has returned almost 10% with a similar asset allocation of 60% equities and 40% fixed term. A few of the funds he chose have performed very well over the last few months though so that has skewed the results. The charges are higher but the return is too so overall it has performed better than in a passive multi asset fund. I am only speaking from a personal point of view though and of course you could get investors with other IFAs producing completely different results. You cannot really only look at charges in isolation.

Terry Smith has significantly outperformed for years.

As did Neil Woodford, until he didn't. 0

0 -

1. You sure Fundsmith has outperformed if benchmarked appropriately?garmeg said:

Depends on the funds chosen.BritishInvestor said:

An IFA (or anyone else for that matter) is unlikely to significantly outperform something like the LS range (or similar multi-asset low cost offerings) over the long term.enthusiasticsaver said:Just looking at the charges is a bit like comparing apples and pears and having invested with VLS60 for about 6 years I moved to an IFA last year and was under no illusion that the charges would be higher. The performance of the VLS60 though over the last 12 months is 4.4% whereas the portfolio under my IFA has returned almost 10% with a similar asset allocation of 60% equities and 40% fixed term. A few of the funds he chose have performed very well over the last few months though so that has skewed the results. The charges are higher but the return is too so overall it has performed better than in a passive multi asset fund. I am only speaking from a personal point of view though and of course you could get investors with other IFAs producing completely different results. You cannot really only look at charges in isolation.

Terry Smith has significantly outperformed for years.

As did Neil Woodford, until he didn't.

Ditto Woodford

https://finalytiq.co.uk/woodford-vs-ftse-uk-equity-income-lets-set-the-record-straight/

You have to remember the (active) investment management industry makes money from selling the dream of outperformance.

2. If anyone has the ability to pick these future "outperforming" funds/sectors I'm all ears.

This has just been released and is a good read

https://www.amazon.co.uk/Incredible-Shrinking-Alpha-2nd-successful-ebook/dp/B08BX5HRLJ/ref=sr_1_1?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards