We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Wrong purchase price on mortgage offer!

scottmonkey1990

Posts: 2 Newbie

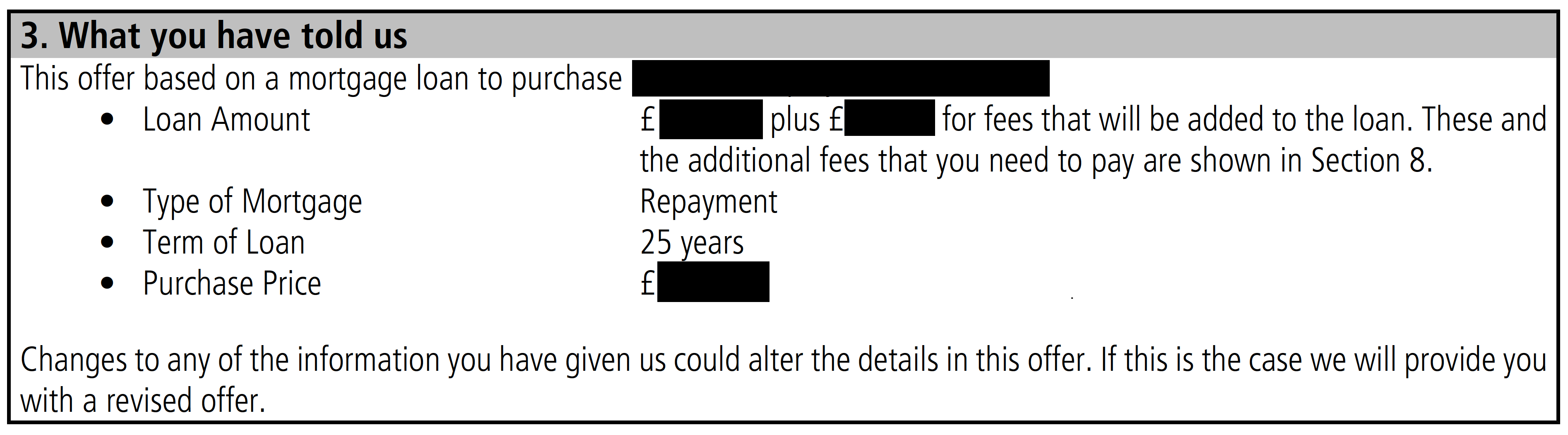

I recently got my Mortgage offer through the purchase price is wrong. We are buying a home at £112,500 and on the offer if states £110,000, this is what the home is valued at and we are adding the extra £2500 ourselves. The solicitor won’t accept the offer and says it needs amended, and will call bank for us. Is this something to worry about or is it an easy fix. Many thanks

0

Comments

-

I think that is correct, the mortgage offer will have the value of the property at whatever the bank has valued it at. Not sure why your solicitor thinks it's wrong?0

-

I think it’s because the purchase price says different, tried to call Nationwide today however I can only deal with my Mortgage specialist on the matter and she isn’t back until Tuesday0

-

They should have left the purchase price the same and decrease the amount that says Amount of Loan (This is from an original Nationwide offer).

0 -

Hi I was just wondering what happened with this? The same thing has just happened to us and we are concerned the whole thing may be reassessed we informed them of the purchase price and have proof but they have put the purchase price at home report value which is incorrect. 😕0

-

No problem then, just provide the extra £2,500 that you think it's worth.

0 -

The purchase price should accurately reflect just that - how much you are purchasing the property for. The amount you are purchasing for is not always going to be the value of the property. This is not an uncommon discrepancy and is easily resolved. Usually a new offer is sent out.0

-

Has there been any update on how long this took to amend? Same thing happened to me0

-

This has just happened to us with Nationwide. Solicitor says today the offer has to show the actual purchase price, not the valuation.Has this happened to anyone else and if so, did this get sorted quickly?0

-

This thread is quite old so probably better to create a new one. In a nutshell the purchase price has to be the purchase price, not the valuation. A solicitor will need to have this changed as they have a document from their other client, the lender, that is incorrect. How difficult this is depends on lender but generally if it's just an error this should be an easy fix. However, again depending on the lender, they may rerun you through their credit check process which in theory means you could fail and they withdraw their offer. Best to speak to your broker who should be able to get this sorted out, 99% chance they fix it and send a new offer within a couple days.0

-

It’s usually just an error at the mortgage lender’s end - I’d be very surprised if your solicitor doesn’t get it sorted out very quickly.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

Balance as at 31/08/25 = £ 95,450.00

£100k barrier broken 1/4/25SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards