We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Mechanics of Eligibility Checking.

reliquit

Posts: 69 Forumite

Most eligibility checkers give you an answer (yes/no/maybe) within about 30 seconds, which I suspect is one of the reasons why people tend to think that their credit score is being used - after all, what would be better for a computer to base a decision on than a straight-forward numeric value? However, knowing now that the credit score has no real value, leaves me wondering what DO they receive on which a likely decision can be based?

0

Comments

-

They do a soft search.

Look up what is looked at on a soft search Vs a hard search.

0 -

Yes I get that it's a soft search, and I apologise if my original query was not clear. But a lifetime of working with computer systems has taught me that computers are brilliant at evaluating numerics but less good at evaluating text. I would expect some sort of numeric test along the lines of:If {response} > 500thenprint "Yes"else if {response} > 350thenprint "Maybe"elseprint "No"which is why it is so tempting to think that your Credit Score is more important that it actually is, because a numeric score within known parameters would readily lend itself to this kind of evaluation. But if (as we are told here) that the credit score is not being used, then what else is available that can be instantly evaluated by a computer? Just curious.0

-

back in the day when it gave you a percentage of being accepted before you 'officially' applied, you could look at the source code by pressing f12. I remember the 3 categories being 'accept', decline' and 'defer'. Was useful because you knew whether you'd be accepted or not, and could ignore the 'likelihood' of acceptance.0

-

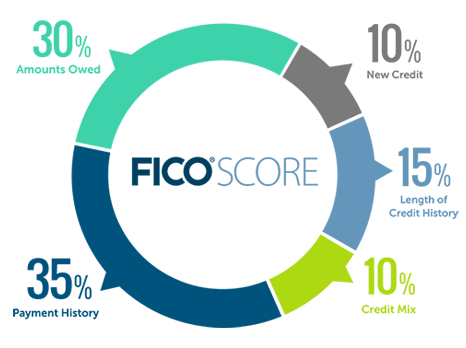

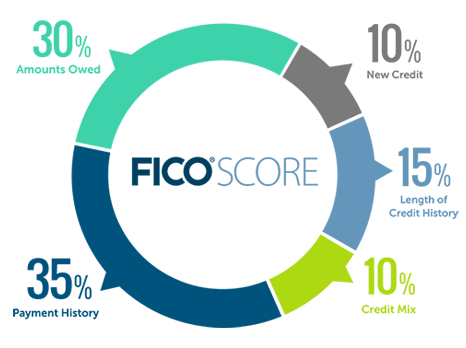

Of course they use a credit score, but it's their score, and it will (probably) be made up with criteria such as this.reliquit said:Yes I get that it's a soft search, and I apologise if my original query was not clear. But a lifetime of working with computer systems has taught me that computers are brilliant at evaluating numerics but less good at evaluating text. I would expect some sort of numeric test along the lines of:If {response} > 500thenprint "Yes"else if {response} > 350thenprint "Maybe"elseprint "No"which is why it is so tempting to think that your Credit Score is more important that it actually is, because a numeric score within known parameters would readily lend itself to this kind of evaluation. But if (as we are told here) that the credit score is not being used, then what else is available that can be instantly evaluated by a computer? Just curious.

But it is not the score that the credit reference agencies give you. As that is only their score. Each lender will score differently. So the credit score that Experian give you is their formula. Whereas "barclaycard" might use significantly different critera.0 -

This is useless as the U.K. doesn’t use the FICO score system, it’s only used in America. In America they do take into consideration the scores CRA’s give you.Malkytheheed said:

Of course they use a credit score, but it's their score, and it will (probably) be made up with criteria such as this.reliquit said:Yes I get that it's a soft search, and I apologise if my original query was not clear. But a lifetime of working with computer systems has taught me that computers are brilliant at evaluating numerics but less good at evaluating text. I would expect some sort of numeric test along the lines of:If {response} > 500thenprint "Yes"else if {response} > 350thenprint "Maybe"elseprint "No"which is why it is so tempting to think that your Credit Score is more important that it actually is, because a numeric score within known parameters would readily lend itself to this kind of evaluation. But if (as we are told here) that the credit score is not being used, then what else is available that can be instantly evaluated by a computer? Just curious.

But it is not the score that the credit reference agencies give you. As that is only their score. Each lender will score differently. So the credit score that Experian give you is their formula. Whereas "barclaycard" might use significantly different critera.Here each lender has there own unique scoring method, which a part of is data from the CRA’s the rest is down to whether you fit the type of customer they are looking for and if you will make them money.

Barclaycard don’t use Experian for there credit search they use Equifax. They do however report account conduct to Experian/Equifax/Trans-Union.Time is a path from the past to the future and back again. The present is the crossroads of both. :cool:2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.7K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.1K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards