We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Purchasing a property with a relative

Comments

-

The property he is looking to buy is £200k and lenders are willing to borrow him only £120k. He will be putting down a deposit of 25% including the extra SDLT charge, however there is still a shortfall of £30k. If i put my name on the mortgage then he can purchase. On his salary he can afford to make the monthly payments esp if he gets the mortgage for 30years as the payments will be lower. It's just a case of being able to get a mortgage in the first place! Lenders may not think he can afford it but I know he can (his parents will be moving in with him so if need be will contribute to the payments).AdrianC said:

But why?Lover_of_Lycra said:

The OP says the nephew is unable to get a mortgage on his own.gettingtheresometime said:Stupid question but if he can afford the mortgage without you contributing why can't he just get the mortgage in his own name?

The lenders don't agree he "can afford it"?

No equity?

Unacceptable credit history?

0 -

sounds like you are becoming a guarantor, what happens if he cannot make the payments for whatever reason?Rubi87 said:

The property he is looking to buy is £200k and lenders are willing to borrow him only £120k. He will be putting down a deposit of 25% including the extra SDLT charge, however there is still a shortfall of £30k. If i put my name on the mortgage then he can purchase. On his salary he can afford to make the monthly payments esp if he gets the mortgage for 30years as the payments will be lower. It's just a case of being able to get a mortgage in the first place! Lenders may not think he can afford it but I know he can (his parents will be moving in with him so if need be will contribute to the payments).AdrianC said:

But why?Lover_of_Lycra said:

The OP says the nephew is unable to get a mortgage on his own.gettingtheresometime said:Stupid question but if he can afford the mortgage without you contributing why can't he just get the mortgage in his own name?

The lenders don't agree he "can afford it"?

No equity?

Unacceptable credit history?

30 years is a long time after all. Sounds like you will be liable for mortgage payments for that property. Shouldn't you talk to a solicitor so you get a real view of what you are about to do?0 -

I am happy to make the payments if he cannot and have been in touch with a solicitor. I was just initially enquiring whether the purchase of the property without me residing in it was 'illegal' as it was being purchased as a residential property. The idea is once my nephew does his pre-reg and is on a higher salary, i will take out my name as he will be able to get the mortgage on his own. We're talking about 2 years top.eidand said:

sounds like you are becoming a guarantor, what happens if he cannot make the payments for whatever reason?Rubi87 said:

The property he is looking to buy is £200k and lenders are willing to borrow him only £120k. He will be putting down a deposit of 25% including the extra SDLT charge, however there is still a shortfall of £30k. If i put my name on the mortgage then he can purchase. On his salary he can afford to make the monthly payments esp if he gets the mortgage for 30years as the payments will be lower. It's just a case of being able to get a mortgage in the first place! Lenders may not think he can afford it but I know he can (his parents will be moving in with him so if need be will contribute to the payments).AdrianC said:

But why?Lover_of_Lycra said:

The OP says the nephew is unable to get a mortgage on his own.gettingtheresometime said:Stupid question but if he can afford the mortgage without you contributing why can't he just get the mortgage in his own name?

The lenders don't agree he "can afford it"?

No equity?

Unacceptable credit history?

30 years is a long time after all. Sounds like you will be liable for mortgage payments for that property. Shouldn't you talk to a solicitor so you get a real view of what you are about to do?0 -

So, yes, the lenders don't agree that he "can afford" a £150k mortgage, even at 75% LtV.Rubi87 said:

The property he is looking to buy is £200k and lenders are willing to borrow him only £120k. He will be putting down a deposit of 25% including the extra SDLT charge, however there is still a shortfall of £30k. If i put my name on the mortgage then he can purchase. On his salary he can afford to make the monthly payments esp if he gets the mortgage for 30years as the payments will be lower. It's just a case of being able to get a mortgage in the first place! Lenders may not think he can afford it but I know he can (his parents will be moving in with him so if need be will contribute to the payments).AdrianC said:

But why?Lover_of_Lycra said:

The OP says the nephew is unable to get a mortgage on his own.gettingtheresometime said:Stupid question but if he can afford the mortgage without you contributing why can't he just get the mortgage in his own name?

The lenders don't agree he "can afford it"?

No equity?

Unacceptable credit history?

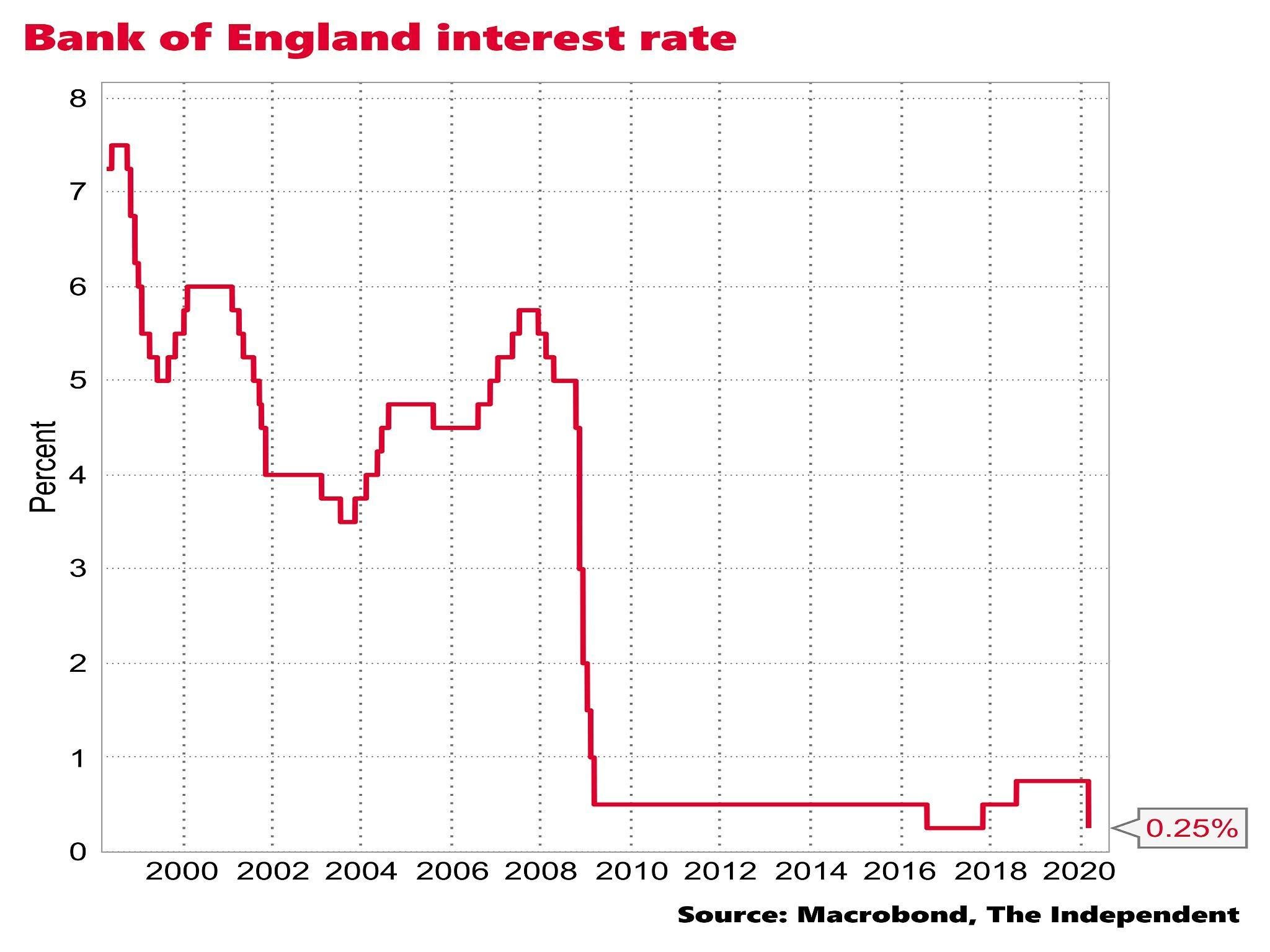

There's a reason for the strength of the affordability checks... the potential for future interest rate rises!

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards