We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

NS&I Income Bonds

Comments

-

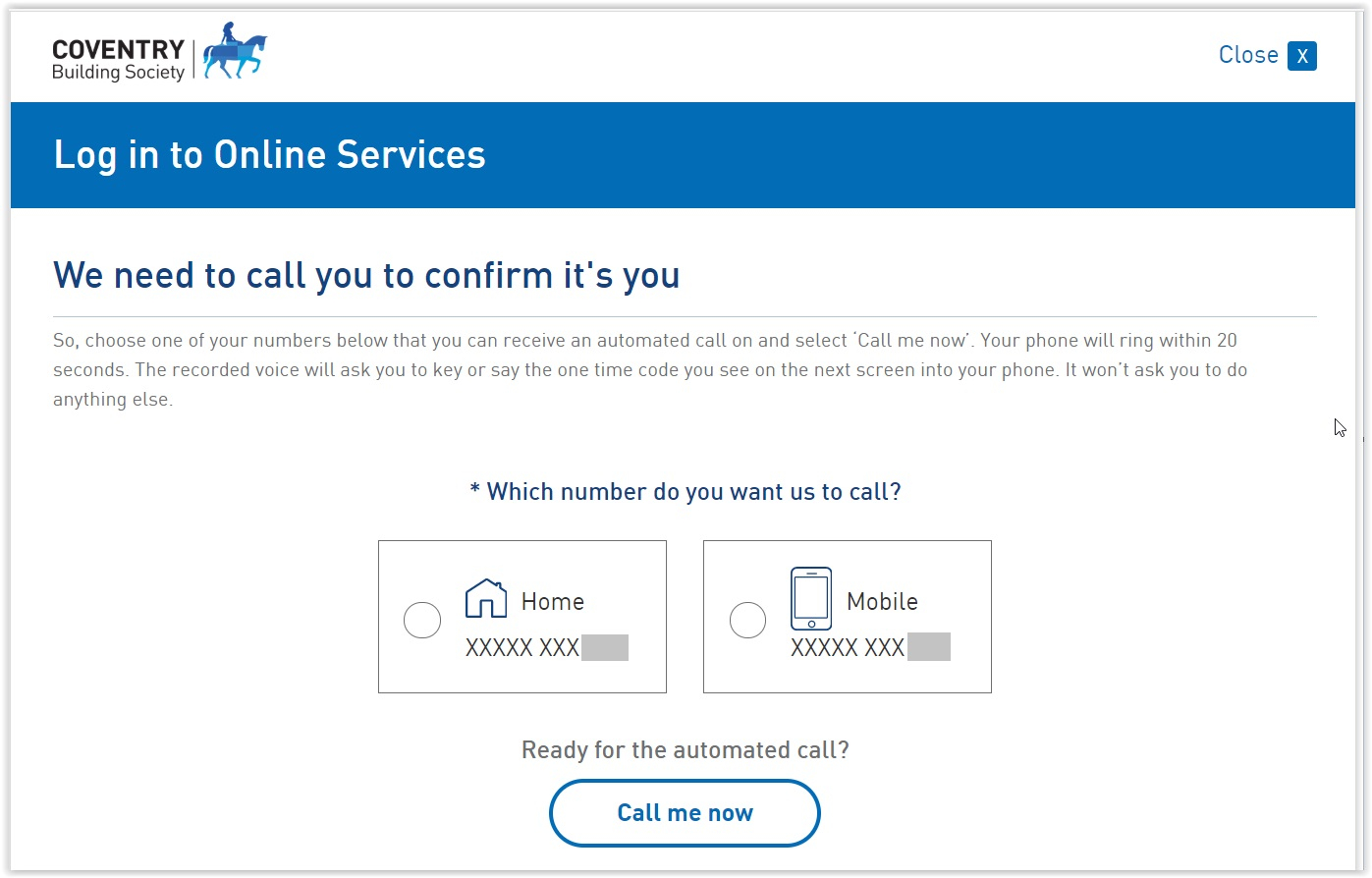

Thanks @Archi_Bald , Never had accounts with HBOS or Lloyds Group but do have a Coventry saver so this is a useful heads up for me.Archi_Bald said:

Lloyds, BoS, Halifax have had this for years for confirmation of transactions. Coventry BS are about to implement it, too.RG2015 said:Just logged into NS&I and they needed to phone me to do an automated security check. A code appeared on the screen which I had to enter on the phone. I have not seen this type of security check anywhere before.

All of my ten banks/building societies have texted me a confirmation code to enter on my device.

That said, I have had an NS&I account for 3 or 4 years and never had this type of confirmation request before.0 -

Not met it yet on NS&I but if it is like the LBG one and you are given the option of either keying in or speaking the security data, before you try the speech option, turn down anything making a noise. I find that even a fan running confuses the heck out of LBG's voice recognition software ...RG2015 said:Just logged into NS&I and they needed to phone me to do an automated security check. A code appeared on the screen which I had to enter on the phone. I have not seen this type of security check anywhere before. 1

1 -

I think it's all to do with strong customer authentication that all financial institutions have to implement this year.RG2015 said:

I have had an NS&I account for 3 or 4 years and never had this type of confirmation request before.

It gets rid of the grid card, which I think is a great improvement. Like the LBG banks, Coventry will offer to call you on your home or your mobile number, and you then have to enter/say the code from your screen into the phone. I don't know when exactly this will go live, but reckon it might be soon. I think there are better solutions for the strong customer authentication but as it still is a great improvement over the grid card, I am not complaining.RG2015 said:.......have a Coventry saver so this is a useful heads up for me.

1 -

Grid card is fine for me but I must be weird because I have no problem with card readers either unlike everyone else on this site.

I am though quite a fan of the fingerprint 2FA.0 -

"My voice is my password" - The only HMRC helpline bod to do what I want.polymaff said:

Not met it yet on NS&I but if it is like the LBG one and you are given the option of either keying in or speaking the security data, before you try the speech option, turn down anything making a noise. I find that even a fan running confuses the heck out of LBG's voice recognition software ...RG2015 said:Just logged into NS&I and they needed to phone me to do an automated security check. A code appeared on the screen which I had to enter on the phone. I have not seen this type of security check anywhere before. 0

0 -

Wait until you get a phone that does face recognitionRG2015 said:I am though quite a fan of the fingerprint 2FA. . 1

. 1 -

Apparently so.Archi_Bald said:

It should come out of pending early next week, and earn interest from the day your money was debited from your current account, at the latest. NS&I do some peculiar stuff between the 22nd of a month and the 5th of the next month. Deposits can be pending for days on end in that period but you won't be losing any interest. It isn't the instant access account it's being 'sold' as by many.Jaspar100 said:I opened an ns and I income bond account recently and paid a deposit from my bank by debit card. My account shows my deposit as pending but as a minus figure. The amount shows as a debit on my bank account statement, I paid another amount earlier by the same debit card and this shows as a plus amount which is correct. Confused.

I opened an income bond 7 days ago Thursday 4th June ‘online’ (I was already an NS&I ‘online’ customer) and made a sizeable deposit online by Debit card.

The ‘debit’ transaction appeared in my NatWest current account almost immediately;...however, I was totally unaware of this 7- working-day clearing rule for debit-card deposits;....I foolishly didn't go through the full T's&C's but fully read the account ‘summary box’ and took it at face value. i.e.

“Can I withdraw money? : Yes, you can take out money online, by phone or by post with no notice or penalty.”

A full week later my NS&I income bond account balance shows the full amount I’ve transferred in,...however, it also shows “available funds £0”...not impressed.

7 days already since I paid them my funds, and counting,... and nothing I can do to get my hands on a single penny of it.

I’ve complained, by phone, to NS&I that their ‘summary box’ info is misleading and should at the very least make some sort of reference to this debit-card ‘delay’,...some sort of caveat at least, but I was told I’ll just have to wait and it will probably?? be Monday before I can access any of my funds and transfer any of it back to my NatWest current account;...in which case I should?? receive it on Tuesday,...a full 12 days after my initial investment;... again, not impressed.

I was also completely dumb-founded when the NS&I help-desk operator told me that any funds I transfer to my income bond account, after the 21st of each month, will not be accessible until the 5th day of the following month!

e.g. If I use bank transfer to send £10k to my income-bond account on the 21st, that £10k will be credited to my account upon receipt but will not show as ‘available’ until the 5th of the following month. The only funds ‘available’ between the 21st and the 5th are the funds that already show as ‘availble’ prior to the 21st.

I couldn’t believe my ears!, and I asked the operator to explain it again.,...which she did;...she said the reason was because NS&I run ‘interest calculations’ et al between 21st and 5th and that’s why recently deposited funds are unavailable to be transferred out!....surely she must be wrong???

This from NS&I Income bond brochure:

“Who are Income Bonds for? Suitable for savers who: want a monthly income at a variable rate and want easy access to their money”

....easy access eh?

0 -

I remember one NS&I staffer referring to it as being "their monthly purdah".Archi_Bald said:... NS&I do some peculiar stuff between the 22nd of a month and the 5th of the next month.

0 -

Well, this has all been covered on MSE. They're an institution unto themselves....Biggus_Dickus said:... I couldn’t believe my ears!, and I asked the operator to explain it again.,...which she did;...she said the reason was because NS&I run ‘interest calculations’ et al between 21st and 5th and that’s why recently deposited funds are unavailable to be transferred out!....surely she must be wrong???

0 -

The grid card is the worst 2FA I've ever encounteredRG2015 said:Grid card is fine for me but I must be weird because I have no problem with card readers either unlike everyone else on this site.

I am though quite a fan of the fingerprint 2FA. 1

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards