We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Advise with my current savings 52k

Bucki

Posts: 214 Forumite

Hello All,

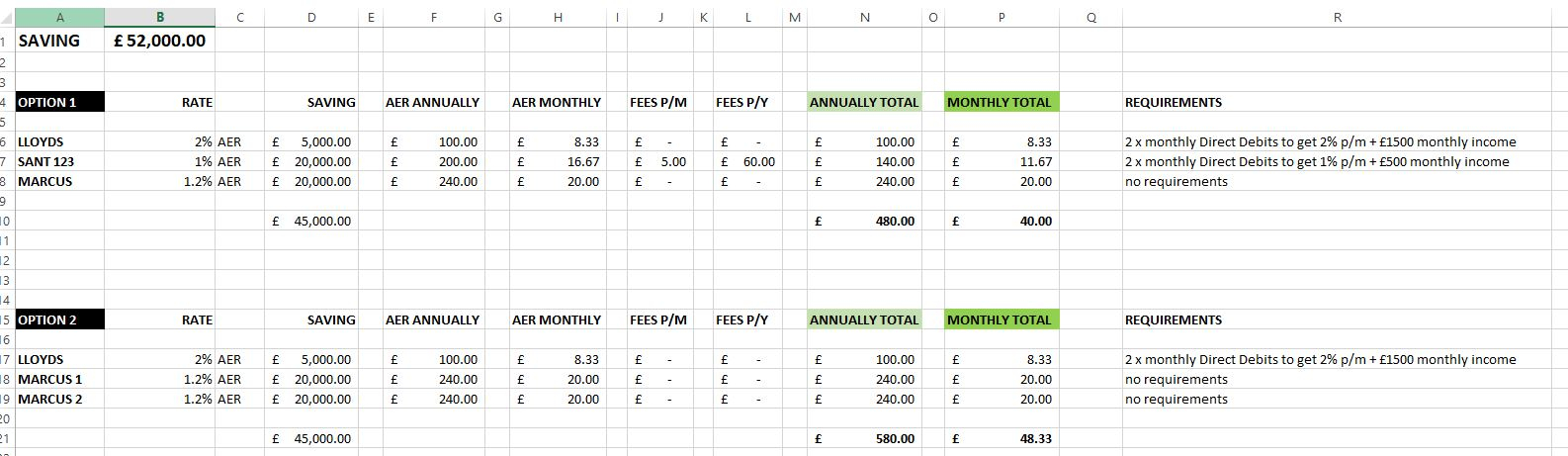

I have a total of 52k savings and need some advise....

Until recent, I been using Santander 123 Current Account but its rate droped from 1.5% to 1% where I deposited 20k. I also had an account with OakNorth Bank where I deposited some money but not very keen in "fixing" the money away just in case I need it badly (who knows). Besides that, my first and forerver lasting current account is with Lloyds - they offer 2% between 4-5k provided I have 2 x DD and an incomeof 1500 p/m.

I have done some research and this is what I can come up with best:

Until recent, I been using Santander 123 Current Account but its rate droped from 1.5% to 1% where I deposited 20k. I also had an account with OakNorth Bank where I deposited some money but not very keen in "fixing" the money away just in case I need it badly (who knows). Besides that, my first and forerver lasting current account is with Lloyds - they offer 2% between 4-5k provided I have 2 x DD and an incomeof 1500 p/m.

I have done some research and this is what I can come up with best:

Note

Note- I am guessing I could have 2 x Marcus accounts: single and one joing account?

- Llouds has £3 fee but it balances it if you have 1500 income per month.

- I am not keen in locking money away.... I have done it via OakNorth and felt strange lol (maybe just the thought of it).

- I am not keen in locking money away.... I have done it via OakNorth and felt strange lol (maybe just the thought of it).

Question:

What would you change and why? Should I best close the Santander 123 account? Most importantly, if I depost 22k and then go down to 20k after few months: will the AER depend on the 22 or 20k? Does it have to remain 22k for all 12months and if it goes down or up > will it also benefit or reduce the overall interest payment at the end?

0

Comments

-

You have the rate on the Lloyds Club account incorrect: it's 1% up tp £4k and then 2% on £4k to £5k, giving an overall 1.2% on the whole amount. This works out to £60 p.a., not £100 p.a. as per your spreadsheet.

You can deposit a lot more than £20k in a sole Marcus account.

0 -

Under what circumstance would you suddenly need all the 52k pounds badly? Buying a house isn't one of them, because you can plan for it and ensure you have enough cash before you commit to buy.

If you don't need all 52k in short notice, can you put some in a fixed savings account? Or even invest some if you think you wouldn't need it in the next 5-10 years.

0 -

Hmmm but on lloyds website it states 2% for savings between 4-5k , so does it not make 100per year on 5k with 2%?wmb194 said:You have the rate on the Lloyds Club account incorrect: it's 1% up tp £4k and then 2% on £4k to £5k, giving an overall 1.2% on the whole amount. This works out to £60 p.a., not £100 p.a. as per your spreadsheet.

You can deposit a lot more than £20k in a sole Marcus account.source: see the linkOh yeh, I won't need to have 2 Marcus accounts (silly of me). Could just deposit doulbe the amount...0 -

I'm in a similar position and have been using three Santander 123 accounts with £20k in each. I've just opened a Marcus account and am in the process of closing two of the 123 accounts, transferring it all to the Marcus account and just keeping the one I use for bills. I did consider looking at other options but to be honest I can't really be bothered spending time chasing fractions of a percent - law of diminishing returns and all that.

1 -

Mr.Saver said:Under what circumstance would you suddenly need all the 52k pounds badly? Buying a house isn't one of them, because you can plan for it and ensure you have enough cash before you commit to buy.

If you don't need all 52k in short notice, can you put some in a fixed savings account? Or even invest some if you think you wouldn't need it in the next 5-10 years.

Under what circumstances... good question

I just feel somehow "stranggled" if I fix it away ... maybe it it's just that uncertainty.

From what I noticed, even when fixing away for 1 year, there is no huge margine?

I will purchase a house within next 2 years anyway but will not deposit everything.

Probably 10-15k and the rest to have as a backup.

0 -

You can often take a fix and withdraw if you really need access to it. You'd lose your interest in up to 6mths and 6mths interest after. So, not too horrendous if you have something you need it for.0

-

Thanks for your inputblue_max_3 said:You can often take a fix and withdraw if you really need access to it. You'd lose your interest in up to 6mths and 6mths interest after. So, not too horrendous if you have something you need it for. I usually use the moneysavingexpert page for best interest rates

I usually use the moneysavingexpert page for best interest rates

0 -

The 2% is only for the final £1000 in the account, the one between £4000 and £5000, not on the full amount if you have £4000 - £5000 in the account. It is a tiered interest accountBucki said:

Hmmm but on lloyds website it states 2% for savings between 4-5k , so does it not make 100per year on 5k with 2%?wmb194 said:You have the rate on the Lloyds Club account incorrect: it's 1% up tp £4k and then 2% on £4k to £5k, giving an overall 1.2% on the whole amount. This works out to £60 p.a., not £100 p.a. as per your spreadsheet.

You can deposit a lot more than £20k in a sole Marcus account.source: see the link

Not Rachmaninov

But Nyman

The heart asks for pleasure first

SPC 8 £1567.31 SPC 9 £1014.64 SPC 10 # £1164.13 SPC 11 £1598.15 SPC 12 # £994.67 SPC 13 £962.54 SPC 14 £1154.79 SPC15 £715.38 SPC16 £1071.81⭐⭐⭐⭐⭐⭐⭐⭐⭐Declutter thread - ⭐⭐🏅1 -

Hey MickeyMickey666 said:I'm in a similar position and have been using three Santander 123 accounts with £20k in each. I've just opened a Marcus account and am in the process of closing two of the 123 accounts, transferring it all to the Marcus account and just keeping the one I use for bills. I did consider looking at other options but to be honest I can't really be bothered spending time chasing fractions of a percent - law of diminishing returns and all that.

Thanks for sharing your experience. So what what I understood, you had 2 x Santander (one single and one joint acc) and now you are closing both down and migrating over to Marcus with 40k ?

Instead you are then converting Santander 123 over to 123 lite for cashback and bills, right?

0 -

Frogletina said:The 2% is only for the final £1000 in the account, the one between £4000 and £5000, not on the full amount if you have £4000 - £5000 in the account. It is a tiered interest account

Sorry, I am not into figures and maths ... but I could swear down that when I spoke to Lloyds agents and asked to why I never got the interest paid (as I did once 8.xx per month) their reply was "because you no longer meet the 2 x DD's requirements".

Unless it has changed. but even then it was 2% for 4-5k in the account.

Btw. I have this account for many years and have had over 5k since.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards