We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

bank deposit asked before new account details

cisko65

Posts: 359 Forumite

My application for a saving online account has been accepted. It's one of the top payers in the MSE one-year fixed list (Habib Bank Zurig). I received an email from them asking to pay the deposit in an account but no details at all about it (interest rate, maturity date etc.). I opened other online accounts and, when asking for the deposit, details of the just accepted account were provided.

Is it me or does anyone find it unusual? Thanks so much.

0

Comments

-

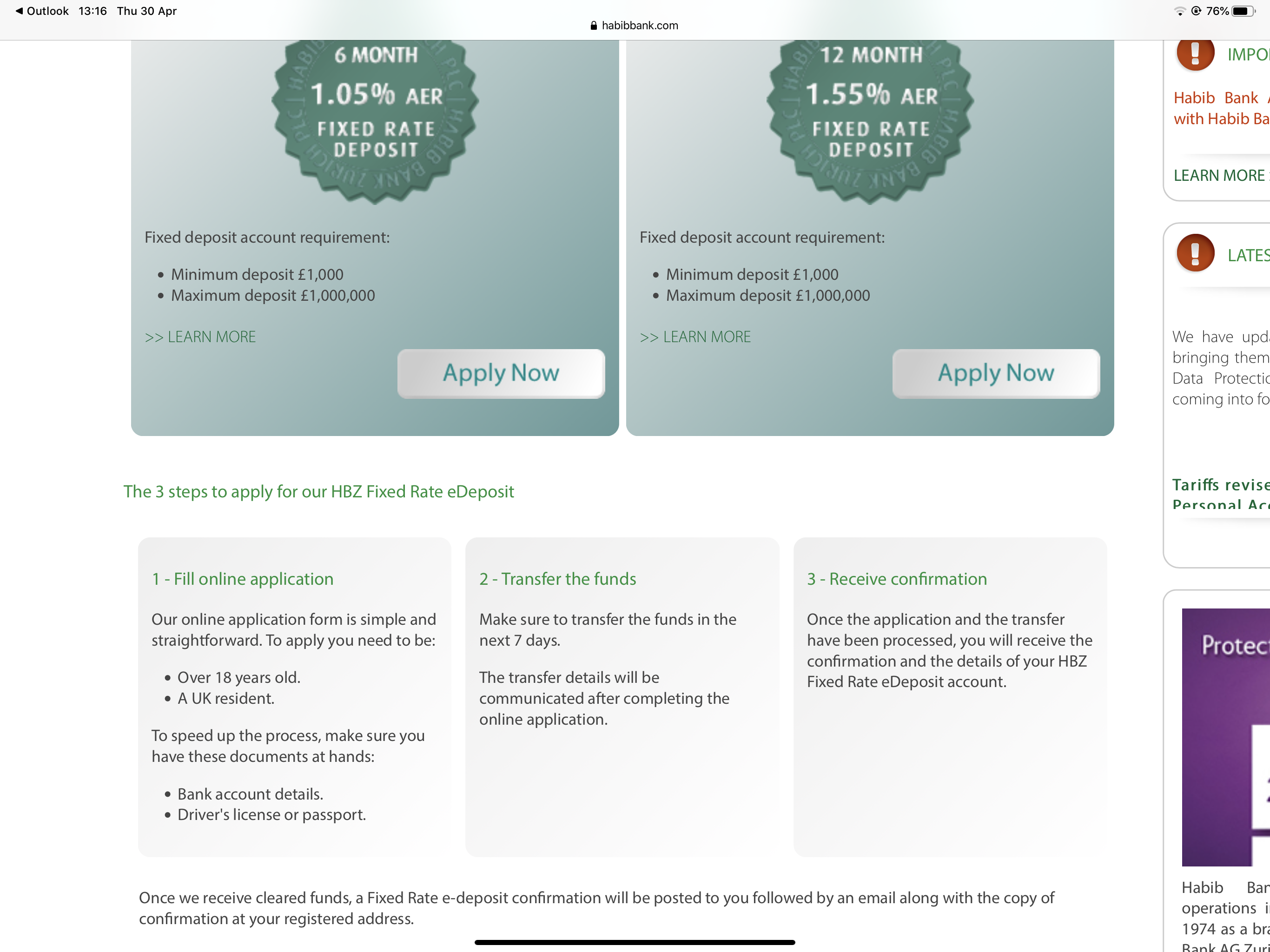

It looks like it's the process:

1 -

Thanks, I saw it, but I thought details usually come before transfer.0

-

You're right, they usually do. This looks like a Mikey Mouse operation and its website looks like something from 1999; if you click on 'learn more' IIRC it just says there's no access during the term.

0 -

Also warning - "Zurig" - is it the HBZ group, in which case based in Switzerland - and so probably not under FSCS scheme?Peter

Debt free - finally finished paying off £20k + Interest.0 -

FSCS status already discussed at https://forums.moneysavingexpert.com/discussion/6135499/habib-bank-zurich-and-fscsnyermen said:Also warning - "Zurig" - is it the HBZ group, in which case based in Switzerland - and so probably not under FSCS scheme?1 -

cisko65 said:It's one of the top payers in the MSE one-year fixed list (Habib Bank Zurig).

Perhaps worth mentioning that https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/ specifically highlights that they only list FSCS-protected accounts:nyermen said:Also warning - "Zurig" - is it the HBZ group, in which case based in Switzerland - and so probably not under FSCS scheme?Every bank we mention in this guide is fully UK-regulated, which means you get £85,000 per person protection in the event it goes bust (£170,000 for joint accounts).No harm in doing additional research over and above what MSE articles say but they'd rightly be lambasted for misleadingly directing savers to non-UK-protected products in one of their most popular guides, so in this case I think I'd be inclined to take their comments at face value!0 -

Thanks. We agree, it is unusual to be asked for a deposit before the details of the account are provided, but they could send fake details. The look of the website is not always important as there could be a fake good one. Also found out that for this online bank account you can't register to access it online... However interest rate and deposit will not vary. I'll go ahead. Fingers crossed.wmb194 said:You're right, they usually do. This looks like a Mikey Mouse operation and its website looks like something from 1999; if you click on 'learn more' IIRC it just says there's no access during the term.1 -

Great. What you say, eskbanker, reassures me. Thanks.eskbanker said:cisko65 said:It's one of the top payers in the MSE one-year fixed list (Habib Bank Zurig).

Perhaps worth mentioning that https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/ specifically highlights that they only list FSCS-protected accounts:nyermen said:Also warning - "Zurig" - is it the HBZ group, in which case based in Switzerland - and so probably not under FSCS scheme?Every bank we mention in this guide is fully UK-regulated, which means you get £85,000 per person protection in the event it goes bust (£170,000 for joint accounts).No harm in doing additional research over and above what MSE articles say but they'd rightly be lambasted for misleadingly directing savers to non-UK-protected products in one of their most popular guides, so in this case I think I'd be inclined to take their comments at face value!0 -

cisko65 said:

Thanks. We agree, it is unusual to be asked for a deposit before the details of the account are provided, but they could send fake details. The look of the website is not always important as there could be a fake good one. Also found out that for this online bank account you can't register to access it online... However interest rate and deposit will not vary. I'll go ahead. Fingers crossed.wmb194 said:You're right, they usually do. This looks like a Mikey Mouse operation and its website looks like something from 1999; if you click on 'learn more' IIRC it just says there's no access during the term.Hello I posted the same question as yourself but missed your post, how did it go in the end ?You mention you do not get any online bank account access with this account ?Very worrying you can not see your money or details surely.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards