We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Will interest rates ever go back up to 5% - 7%?

Comments

-

CreditCardChris said:I get why the governments put interest rates to 0%The BoE reduced it from 0.75% to 0.1%Of course this is a great strategy to make the billionaires even richerIdiotic commentWhy would they ever increase rates againInflationSnipped the restWhat would you rather have?

- 7% interest with 10% inflation

- 1% rates with 2% inflation

3 -

I see, so why hasn't the interest rate always been 0%? If 0% means it's cheaper to pay off debt, companies grow faster and the pound goes down making it better for our exporters then why did governments ever have high interest rates previously and why would interest rates ever go high again if it's just worse for the economy?Prism said:The BoE change the interest rates to try and balance UK inflation and growth, and to help with government and corporate debt.

If they put up interest rates too much then government struggles to pay back its debts and UK companies don't grow as quickly. Oh and the pound goes up which is worse for our exporters and some companies go bust. This is the sort of stuff they need to balance.

Stock market valuations and individual savings rates from banks are way out of their scope though obviously affected to some degree by their decisions.

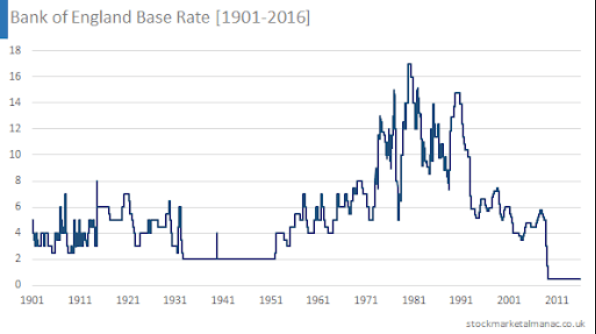

The thing I don't understand is the interest rate has essentially been 0% - 1% for Europe, Japan, UK and America since 2008 but also since 2008 we've had the greatest stock market bull run in history, unemployment was the lowest in decades, companies are reaching trillion dollar evaluations and the amount of startups has exploded. So why is the interest rate still so low like we're in the middle of a depression? Look at 1931, the interest rate is lower than the great depression!

I can't find a long enough history chart for the US but I'm confident it's similar.

So why are the interest rates no reflecting the health of the economy?! Is it just the case the governments owe SO much debt that they basically have no choice but to keep interest rates close to 0% so they can actually afford to repay it and hopefully reduce the value of the debt thanks to inflation?

For example if I owe £100,000 and pay of £100 a month, that will take me 83 years to pay off but in 50 years for example, £100,000 will be like £50,000 in today's money so it's cheaper to pay off the loan later than sooner when the interest rate is very low. (hope I'm making sense)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.8K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.8K Work, Benefits & Business

- 600.2K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards