We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Nationwide FlexDirect

Comments

-

Deleted_User said:

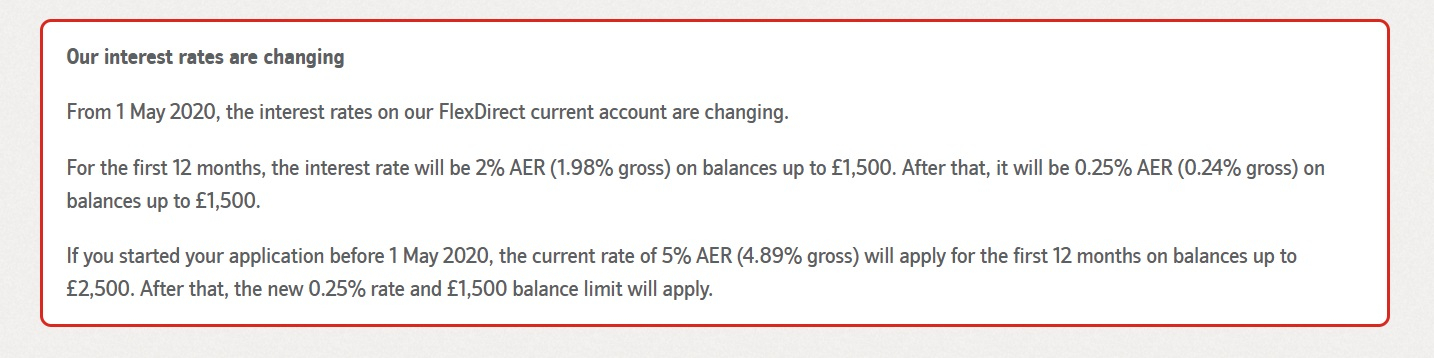

............. I have listed below the changes to take effect on new account openings wef 1st May 20 and existing accounts wef 1st July 20:-

At a glance, we are:

- reducing the interest rate for the first 12 months from 5% to 2%

- reducing the interest rate after 12 months from 1% to 0.25%

- reducing the balance cap from £2,500 to £1,500

It's the first time that I have seen anything about 1st July 2020 for existing accounts. This appears to contradict what they have published on their website. Perhaps what they mean is that existing accounts will move to the new terms on the earlier of July 1 2020 or when they are 12 months old? It's clear as mud. I won't be clarifying it with them since I haven't had a 5% FlexDirect in years but may be someone who has a current one, or is hoping to apply for one before May 1 2020 can follow up on this and post their conclusions?

Perhaps what they mean is that existing accounts will move to the new terms on the earlier of July 1 2020 or when they are 12 months old? It's clear as mud. I won't be clarifying it with them since I haven't had a 5% FlexDirect in years but may be someone who has a current one, or is hoping to apply for one before May 1 2020 can follow up on this and post their conclusions?

0 -

the 5% is fixed for 12 months......

Our online FlexDirect account pays 5% AER interest fixed for the first 12 months. That’s on every penny in your account up to £2,500 – 4.89% gross a year. After that, you’ll get 1% AER/gross a year (variable). All you need to do is pay in £1,000 a month, not counting transfers from other Nationwide accounts or Visa credits.

0 -

Does anyone know if I open a FlexDirect account will a hard search be carried out on my credit file? I am in the process of moving house so don't want to cause any issues with the mortgage0

-

Yes, applications for current accounts that could become overdrawn (even if you don't apply for an arranged overdraft) will entail a hard search.HarryDavies01 said:Does anyone know if I open a FlexDirect account will a hard search be carried out on my credit file? I am in the process of moving house so don't want to cause any issues with the mortgage0 -

No need to leave the extra £1000 in for 1 day. Mine lasts about 5 seconds, I still meet the funding requirement0

-

Mrs Phil and myself are long term members of Nationwide but have only as of today opened FlexDirect accounts in our own individual names and one further account in our joint names, so I have a question that I hope someone may be able to help with.

I'm fairly sure that we've never had a FlexDirect account before (either individually or joint), but there is always the chance during our long association with Nationwide that we may have previously opened one, so how do Nationwide let you know if that is the case? I'd hope that Nationwide would do something like show the interest rate at 1% when we went into the account on logging in, but wondered what the actual position was.

Hopefully we'll get the 5% on all three accounts, we just have to wait for them to appear in our account lists when we log in and then I can get started on moving the money in.

0 -

My Flex Direct account doesn't display the interest rate, at least not in the app. In fact I don't know of any current account which does so. However, as interest is credited monthly it should be easy to calculate the interest rate. Fingers crossed.Notepad_Phil said:Mrs Phil and myself are long term members of Nationwide but have only as of today opened FlexDirect accounts in our own individual names and one further account in our joint names, so I have a question that I hope someone may be able to help with.

I'm fairly sure that we've never had a FlexDirect account before (either individually or joint), but there is always the chance during our long association with Nationwide that we may have previously opened one, so how do Nationwide let you know if that is the case? I'd hope that Nationwide would do something like show the interest rate at 1% when we went into the account on logging in, but wondered what the actual position was.

Hopefully we'll get the 5% on all three accounts, we just have to wait for them to appear in our account lists when we log in and then I can get started on moving the money in.1 -

Yes, very annoyingly, applicable interest rates are usually not shown for current accounts. Santander online banking being the notable exception, at least for Select accounts. That's where it stops, though. They couldn't bring themselves to also displaying it in their app....badger09 said:My Flex Direct account doesn't display the interest rate, at least not in the app. In fact I don't know of any current account which does so. However, as interest is credited monthly it should be easy to calculate the interest rate. Fingers crossed.0 -

Just applied for a FlexDirect and they said they'll send a letter telling me which documents I'll need to send in. I've never had to send in anything for a current account so is that just going to be a signature? Not gonna go into branch currently for obvious reasons if I can avoid it.0

-

afis1904 said:Just applied for a FlexDirect and they said they'll send a letter telling me which documents I'll need to send in. I've never had to send in anything for a current account so is that just going to be a signature? Not gonna go into branch currently for obvious reasons if I can avoid it.Long time Nationwide member here. It will probably just be for a signature. I opened several FlexAccounts with them last year (for immediate transfer to Santander). Sometimes they were opened immediately and other times they required their letter to be signed before a/c opening.If you are a new Nationwide customer then other proof of id/address may be required if they were not able to verify this electronically.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards