Current debt-free wannabe stats:

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Help me understand why house prices and rent won't rise faster than wages forever.

CreditCardChris

Posts: 344 Forumite

This isn't about London.

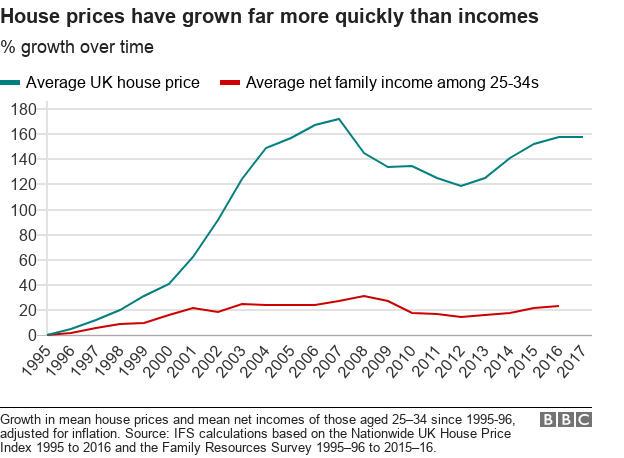

We all know that the housing market rises significantly faster than wages and there's no sign of that changing any time soon. I don't understand enough about economics to know why the trend won't continue essentially for the foreseeable future. If Tesco increased the price of their groceries significantly, nobody would shop there, we'd all go to Sainbury's or Asda or any of the many choice we have.

However we don't have the same luxury to do that with housing as there are no competing companies so we're basically forced to accept whatever price the market gives us or live on the street... So can someone explain to me why this trend won't continue for the foreseeable future?

It's easy to say "if home owners charge too much for rent / to sell then people won't rent / buy and the prices will come down" but this would be true for mobile phones or cars as there are always other companies to shop at and of course a phone or a car isn't anywhere near as important as having a home with running water, warmth, electricity etc so from where I'm sitting it seems people will just have to suck it up until they're paying like 50% - 75% of their salary towards rent? And banks typically won't lend more than 4 - 5 times your annual salary which makes getting a mortgage of your own impossible until you're earning £100,000 a year or something, because you can be sure in 30 years time the average house price outside London will probably be £500,000 and the average wage will probably be ~£40,000 as wage growth is always the slowest thing to rise (funnily enough).

We all know that the housing market rises significantly faster than wages and there's no sign of that changing any time soon. I don't understand enough about economics to know why the trend won't continue essentially for the foreseeable future. If Tesco increased the price of their groceries significantly, nobody would shop there, we'd all go to Sainbury's or Asda or any of the many choice we have.

However we don't have the same luxury to do that with housing as there are no competing companies so we're basically forced to accept whatever price the market gives us or live on the street... So can someone explain to me why this trend won't continue for the foreseeable future?

It's easy to say "if home owners charge too much for rent / to sell then people won't rent / buy and the prices will come down" but this would be true for mobile phones or cars as there are always other companies to shop at and of course a phone or a car isn't anywhere near as important as having a home with running water, warmth, electricity etc so from where I'm sitting it seems people will just have to suck it up until they're paying like 50% - 75% of their salary towards rent? And banks typically won't lend more than 4 - 5 times your annual salary which makes getting a mortgage of your own impossible until you're earning £100,000 a year or something, because you can be sure in 30 years time the average house price outside London will probably be £500,000 and the average wage will probably be ~£40,000 as wage growth is always the slowest thing to rise (funnily enough).

0

Comments

-

I bought my first house in 2003 for £63000 at the time I earned £18000 basic, I had just turned 23.

Today I earn a basic of £35000 and the same house is worth about £110,000. I haven’t had any major pay rises or promotions just regular cost of living rises and a few band increases but nothing spectacular. I would argue the multiple has stayed roughly the same over those 17 years but interest rates are lower so its cheaper at the moment because of that.

0 -

You earned £18,000 in 2003 as a 23 year old. 23 year old's today are basically earning the same wage 14 years later. Except this time they cannot buy a house for £63,000 and must now pay £110,000 (in your case) but in most of the UK that price is actually more along the lines of £180k - £200k.Markneath said:I bought my first house in 2003 for £63000 at the time I earned £18000 basic, I had just turned 23.

Today I earn a basic of £35000 and the same house is worth about £110,000.

1 -

No answer to your question just my pondering over tired mind.

Theres not enough social housing to home average wage earners so a lot of their disposable income goes on rent instead of saving deposits at a quicker rate. Which makes it hard to save a deposit before inflation chips away. Does it mean prices are too high? If you can pay rent you can pay a mortgage so maybe not?

If everyone currently private renting woke up to news that miraculously there's enough council houses for all at cheaper rent, would this cause house prices to drop? Possibly, as there would be few BTL not earning rent but I bet a lot of people would still want to buy. End if the day its credit availability that plays a significant role in house prices and who wants to lend on a deprecating security. So in a way rising prices is good for buyers as long as you have access to a sizable deposit which is hard.

0 -

Two incomes and benefits top ups are where the secret money's coming from for a lot of people. It's singles that are hit hardest as they've one income and no top ups. Rental values underpin the cost of houses. Rents come from families with top ups or HMOs. When you discover the level of benefits some people get you'll start to realise why many are priced out; it's hard/impossible to compete.

There will always be people, especially couples, who have well paid jobs and those with well paid jobs are more likely to come from wealthier backgrounds where they have access to a BOMAD and can buy somewhere. For the rest it's about getting top ups, or living in shared houses.

While somebody can afford to buy the houses it won't stop. There will always be somebody who can afford to buy them (owners or landlords). Then it's about occupancy.... which can be increased by a variety of methods. I had a neighbour who had 24 in his house in bunkbeds, plus 2-3 chaps living in the shed and running an extension lead out there. Where there's money to be made, somebody will always be able to pay more than a regular owner/buyer is limited to.

0 -

Nope, because banks will only lend a certain multiple of your income. So if the average house price in 30 years is £500,000 and the average wage is £40,000, the max a bank will lend you is probably £200,000 which is less than half the cos of the average home.Getting_greyer said:Does it mean prices are too high? If you can pay rent you can pay a mortgage so maybe not?

Right now I earn £40,000 a year which is considerably above average and the most a bank will lend me is £190,000. This just about buys me a run down terraced house where I live (and no I don't live in London).1 -

Banks change their lending criteria, who knows what it will be in 30 years.0

-

Would anyone be able to explain in short why removing the need for a deposit of 5-10% would be a bad idea if this wage:house price trend carries on?

Sort of akin to the 100% mortgages of old - if you cannot afford to make your repayments, the bank will still be able to repossess your home and sell it to recoup their losses, so as a measure to help people get on the ladder, could that be a viable option?

If I didn't need a deposit, only needed to meet affordability criteria and show a history of responsible management of my finances/credit, I would have been able to buy years ago, even when my salary was far lower at about 4x less than the average 1-bed price in my area.

Please explain like I'm 5. I work in pharma not finance.Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0 -

It's a start. We all started somewhere. Houses can be refurbished.CreditCardChris said:Getting_greyer said:Does it mean prices are too high? If you can pay rent you can pay a mortgage so maybe not?

Right now I earn £40,000 a year which is considerably above average and the most a bank will lend me is £190,000. This just about buys me a run down terraced house where I live (and no I don't live in London).0 -

I suspect post GFC regulation plays a part.annetheman said:Would anyone be able to explain in short why removing the need for a deposit of 5-10% would be a bad idea if this wage:house price trend carries on?

Sort of akin to the 100% mortgages of old - if you cannot afford to make your repayments, the bank will still be able to repossess your home and sell it to recoup their losses, so as a measure to help people get on the ladder, could that be a viable option?

If I didn't need a deposit, only needed to meet affordability criteria and show a history of responsible management of my finances/credit, I would have been able to buy years ago, even when my salary was far lower at about 4x less than the average 1-bed price in my area.

Please explain like I'm 5. I work in pharma not finance.0 -

The problem is if you cant afford a deposit of some description it means you are either living pay check to pay check, poor with your finances and have little control over them or just in a low paid job. Its understandable that the bank arent going to lend to someone in this position just because they have made their last 36 months rent payments.annetheman said:Would anyone be able to explain in short why removing the need for a deposit of 5-10% would be a bad idea if this wage:house price trend carries on?

Sort of akin to the 100% mortgages of old - if you cannot afford to make your repayments, the bank will still be able to repossess your home and sell it to recoup their losses, so as a measure to help people get on the ladder, could that be a viable option?

If I didn't need a deposit, only needed to meet affordability criteria and show a history of responsible management of my finances/credit, I would have been able to buy years ago, even when my salary was far lower at about 4x less than the average 1-bed price in my area.

Please explain like I'm 5. I work in pharma not finance.

It's all about sacrifice for some people they genuinely will never be able to buy a house. For the majority they just dont want to make the sacrifices required to buy one.

They say I cant afford to save a deposit yet smoke, drink, have Netflix, do their weekly football bet, have a mobile phone contract at 50 quid a month. They also dont want to get a 2nd job because "the taxman" will take it all which is completely untrue.

It is really hard for a singleton to get on the property ladder but it's not impossible. Many people have to move citys to be able to buy a house. If people are on 18k a year in one part of the country for sure they could find a similar job in another with the same conditions.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards