We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Liquidate entire portfolio until virus is over?

Comments

-

It seems to me that over the course of these last few months you have moved from long term investing to short term gambling. I recognise that I don't know the direction or markets over the coming months (I could never have predicted I would be up 16% in the last month) but you seem so certain.7

-

Ed hasn't said this, but I assume he is living off guaranteed pensions, and doesn't really need the capital he's being so reckless with.Prism said:It seems to me that over the course of these last few months you have moved from long term investing to short term gambling.

0 -

Nothing is certain; the FED could prop markets up for some time. My view is markets are more likely to fall than not so I have positioned myself for that as far as possible. My view is that gold will be going much higher subject to a short pullback if stockmarkets drop. That's my view. Your's seems to be 'business as usual' which is also a view even if you haven't positively chosen it but just carried on doing what you always do, that is effectively what you are saying/doing. To me the economy does not look anything like 'business as usual' and so far the markets haven't fully caught up with that new reality.

1 -

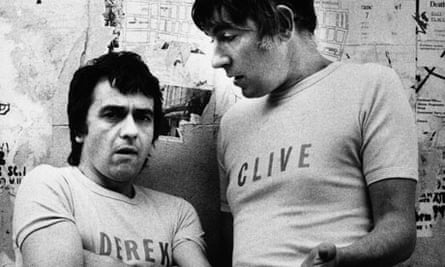

Ah, that was handy, one of the survivors had their cameraphone out! Good job their grandkids were later able to post the pic on Pinterest as a clickbait link for titanicwiki.com, a redirection URL for a chinese casino / sportsbook / lottery site.EdGasketTheSecond said:I wanted to post a pic of the Titanic but can't seem to make it work; only a link but here it is:0 -

The point is I don't have a short term view at all on the current markets, except for maybe the markets are always what they should be. My 'view' is the same as it was before all this which is over the long term being invested in companies is likely to be a good way of increasing wealth. I am a bit unsure why you think you know something that the rest of the combined market does not. You seem to be thinking very short term - this year and the next maybe?EdGasketTheSecond said:Nothing is certain; the FED could prop markets up for some time. My view is markets are more likely to fall than not so I have positioned myself for that as far as possible. My view is that gold will be going much higher subject to a short pullback if stockmarkets drop. That's my view. Your's seems to be 'business as usual' which is also a view even if you haven't positively chosen it but just carried on doing what you always do, that is effectively what you are saying/doing. To me the economy does not look anything like 'business as usual' and so far the markets haven't fully caught up with that new reality.2 -

"So" should go between two clauses where one follows from the previous. My view is that Man City is more likely to win the next Premier League season than anyone else but that isn't a reason to bet my life savings on it.EdGasketTheSecond said:Nothing is certain; the FED could prop markets up for some time. My view is markets are more likely to fall than not so I have positioned myself for that as far as possible.

0 -

That's not the titanic. That's SS Bogey.EdGasketTheSecond said:I wanted to post a pic of the Titanic but can't seem to make it work; only a link but here it is:

"Real knowledge is to know the extent of one's ignorance" - Confucius0 -

Gambling, or repositioning your portfolio? I've made huge changes to holdings. Though with a longer term emphasis in mind. Some individual holdings purchased have risen over 30% within a matter of weeks. There does seem to be a lot of misguided optimism still out there. As the company fundamentals haven't changed one iota in that timeframe. The tracker buying of the FTSE 100 does suggest that there's many people that view current prices as being cheap.Prism said:It seems to me that over the course of these last few months you have moved from long term investing to short term gambling. I recognise that I don't know the direction or markets over the coming months (I could never have predicted I would be up 16% in the last month) but you seem so certain.1 -

In your case repositioning for the long term with a defensive slant. I have done a bit of the same and in fact copied one of your ideas. However Ed selling all equities and throwing it all into gold, silver and daily FSTE short ETFs doesn't sound like investing to me. Not very diverse.Thrugelmir said:

Gambling, or repositioning your portfolio? I've made huge changes to holdings. Though with a longer term emphasis in mind. Some individual holdings purchased have risen over 30% within a matter of weeks. There does seem to be a lot of misguided optimism still out there. As the company fundamentals haven't changed one iota in that timeframe. The tracker buying of the FTSE 100 does suggest that there's many people that view current prices as being cheap.Prism said:It seems to me that over the course of these last few months you have moved from long term investing to short term gambling. I recognise that I don't know the direction or markets over the coming months (I could never have predicted I would be up 16% in the last month) but you seem so certain.3 -

Eggs in one basket is fine if it turns out to be the correct basket for the scenario faced. The best long-term returns will clearly come not from holding a bit of everything and periodically rebalancing, but from investing in particular types of equities when they are going to go up better (or fall less) than anything else, and then exiting to invest all the proceeds instead in other types of equities when *they* are going to go up better (or fall less) than anything else, and moving it all into certain types of bonds when *they* are going to be the best thing to invest in, ditto gold, leveraged property, etc etc. Goes without saying that this would be extremely difficult to do correctly and therefore could produce a much more volatile or unsuccessful result than an alternative approach where one had hedged their bets.Prism said:

In your case repositioning for the long term with a defensive slant. I have done a bit of the same and in fact copied one of your ideas. However Ed selling all equities and throwing it all into gold, silver and daily FSTE short ETFs doesn't sound like investing to me. Not very diverse.Thrugelmir said:

Gambling, or repositioning your portfolio? I've made huge changes to holdings. Though with a longer term emphasis in mind. Some individual holdings purchased have risen over 30% within a matter of weeks. There does seem to be a lot of misguided optimism still out there. As the company fundamentals haven't changed one iota in that timeframe. The tracker buying of the FTSE 100 does suggest that there's many people that view current prices as being cheap.Prism said:It seems to me that over the course of these last few months you have moved from long term investing to short term gambling. I recognise that I don't know the direction or markets over the coming months (I could never have predicted I would be up 16% in the last month) but you seem so certain.

Of course, having all the eggs in one basket can give you a poor result if you get it wrong. But the act of having a basket and filling it with 'stuff' that has the potential to give a return for whatever reason (even if merely speculative), is still investing. The people with the 100% equity tracker funds or gold ETFs or self selected equities have still 'invested' 'in those instruments, even though they face huge losses relative to other asset classes if equity trackers or gold ETFs or the self-selection of individual equities do a lot worse than the other asset classes.

You could say they are 'gambling' rather than 'investing', but they are still 'investing' in the traditional sense as distinct from, say, 'saving', because they are taking a non-zero market risk in pursuit of a return. As you get into the detail of what to hold, it becomes opinion rather than right and wrong.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards