Current debt-free wannabe stats:

We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Welcome to the UK

Comments

-

The title is a bit misleading, it should read "Welcome to SE England". Plenty of areas in the UK with cheaper properties.

Unless you work in finance (and some other minor areas), there really isn't much of a reason to stick to London/SE other than personal choice. If you decide to live there - be prepared to pay the associated cost.

There is plenty the Government can do to mitigate the effects or outright combat the price inflation. They lack the political will do do any of it.1 -

The salary element of the graph looks too linear to me, in the mid-70's with inflation rampant, annual wage increases were commonly in the teens, percentage wise. It's only in the last 20 years or so inflation and so wages have been in low to cause a gentle linear increase.0

-

It's not too difficult to buy if there is two of you.

But as soon as you're a sole buyer, it's all uphill.

I think everyone needs to remember that everyone has different levels of privilege.

I have a friend who's parents helped with her deposit, mine did not.

But then I got relatively low rent whilst I stayed at home, so I was able to save more for my deposit.

Then my other friend had to pay for his mum's rent whilst he lived there as she was so ill, so he can't buy yet.

& all of us are lucky to earn a decent wage, compared to the minimum (not above 35k or so).

It's very easy to say that if you give up some luxuries & move areas you can do it, but if your job is in the South East & your support system, you're not going to move to Manchester (for example) to find a cheaper property. It's not realistic.

It's tough & I know I've been extremely lucky with my circumstances to be able to buy at 24 and some have had to rent since they were 18 and that's far harder.

My dad likes to use me as an example of 'what can happen when you are careful with your money' and it annoys me to no end because I've been lucky, I'm good with my money but that isn't why I managed to buy. It's a hell of a lot easier when you start about 10 steps ahead of someone else.2 -

And let's not forget that a very large percentage of those who work in London do not live there. They commute.sst1234 said:if you if you can’t afford to live in London, don’t live London. The rest of the country gets by not living in one of the largest international hubs in the world. If you want to live there, pay for the privilege and stop moaning. And before anyone comes along with the argument, “but who will make the coffees”, “where will the teachers and the nurses come from”, if no one chose to do it then everyone in London would be paid more.

Living in London is a lifestyle choice that comes with a high pricetag.2 -

I didnt have to make too many tough choices.

I think i was largely fortunate in the geographical location i chose to buy my house. Im in the north west and bought my hosue at 24. Never really had to struggle that hard, partial to Chateaubriand and fine rums, several holidays a year, a few expensive bad habits. My income isnt much above min wage, OHs is a bit better at about national average. Me getting a house was easy and require practically no sacrifice.

I dont think its as simple as saying you need to make tough choices. Or more to the point, some people have much tougher choices to make. If i was born in london, the choice would be to move out of london to afford a house or reject the idea of home ownership. Here in Preston, the choice is buy a nice house locally or pay more than you would on a mortgage renting an inferior property. Theres clearly different levels of making 'tough' choices.3 -

It's entirely realistic. People even move to other countries and continents, not just couple of 100s miles away.Deleted_User said:It's very easy to say that if you give up some luxuries & move areas you can do it, but if your job is in the South East & your support system, you're not going to move to Manchester (for example) to find a cheaper property. It's not realistic.

If you choose to stay in the SE on a low paid job and can't afford to buy a property, you have no one to blame but you.

Of course there are some exceptions for individual circumstances, like family members to care for etc. But your current job being in the SE is not an excuse not to relocate. If you are half decent at what you do and it's not a niche area you can get a job elsewhere in the country relatively easy. some employers will even pay for/towards your relocation.2 -

I guess the caveat is that the SE needs people doing those low-paid jobs as much as anywhere. If everyone relocates, who will collect your bins or clean your office?sal_III said:

It's entirely realistic. People even move to other countries and continents, not just couple of 100s miles away.Deleted_User said:It's very easy to say that if you give up some luxuries & move areas you can do it, but if your job is in the South East & your support system, you're not going to move to Manchester (for example) to find a cheaper property. It's not realistic.

If you choose to stay in the SE on a low paid job and can't afford to buy a property, you have no one to blame but you.

Of course there are some exceptions for individual circumstances, like family members to care for etc. But your current job being in the SE is not an excuse not to relocate. If you are half decent at what you do and it's not a niche area you can get a job elsewhere in the country relatively easy. some employers will even pay for/towards your relocation.0 -

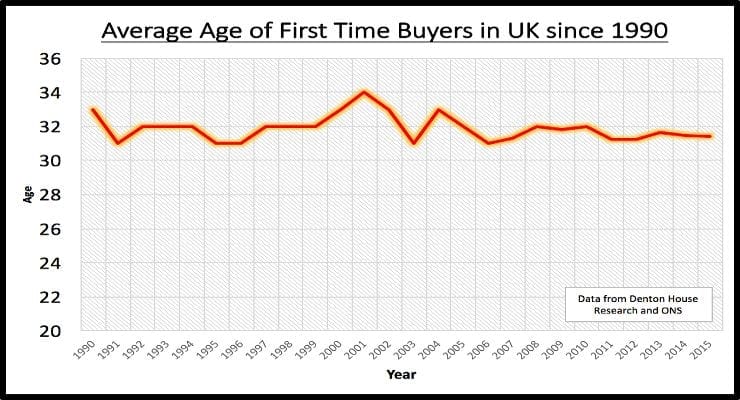

I am almost at the average age 30 going on 31 and in the process of buying. But it's about affordability and it's only getting worse.AdrianC said:Minor detail...

My dad paid off his mortgage by the time he was in his early 40s, having bought in his late 20s. That will NEVER happen to this generation. Most will be paying it off into their 60s.

To OP's point, I have no idea what would make it better but I have a very strong feeling that post-Brexit, this will only get worse. We know we are going to be poorer. Even my mortgage advisor told me yesterday that in 2 years I'd be hitting the post-Brexit crunch so I so I should think about that when choosing between 2 or 5 year fixed term.

Edit to add for those using the same generationalist lazy stereotypes:

-I don't have a gym membership

-my dad pays for my phone contract(!)

-I don't go out (cinema, bar, club, nothing - entertainment is movie at mine)

-I don't eat out

-I work bang in central London and am buying far out; 30 miles out, and my train ticket costs will feel it. I don't "feel I have the right to live there" - wouldn't want to to be honest it's a mess.Credit card: £8,524.31 | Loan: £3,224.80 | Student Loan (Plan 1): £5,768.55 | Total: £17,517.66Debt-free target: 21-Mar-2027

Debt-free diary0 -

The caveat is that people dont live their life solely on property prices and jobs.seradane said:

I guess the caveat is that the SE needs people doing those low-paid jobs as much as anywhere. If everyone relocates, who will collect your bins or clean your office?sal_III said:

It's entirely realistic. People even move to other countries and continents, not just couple of 100s miles away.Deleted_User said:It's very easy to say that if you give up some luxuries & move areas you can do it, but if your job is in the South East & your support system, you're not going to move to Manchester (for example) to find a cheaper property. It's not realistic.

If you choose to stay in the SE on a low paid job and can't afford to buy a property, you have no one to blame but you.

Of course there are some exceptions for individual circumstances, like family members to care for etc. But your current job being in the SE is not an excuse not to relocate. If you are half decent at what you do and it's not a niche area you can get a job elsewhere in the country relatively easy. some employers will even pay for/towards your relocation.

If i did what i want to, i would be living on a large chunk of land in the middle of nowhere in france rearing animals and growing fruits and vegetable. Theres an issue with that though, im married, i love my wife, i want her. She likes the sound of my idea however she ahs her own idead that are conflicting with it. She has a mother, her mother needs a certain degree of care. She also needs a certain amount of companionship etc. Then theres the issue of moving to a remote part of france, ive done it to a degree, my linguo is pretty good and i feel comfortable in france. My wife does not. So you might be thining should her mother die, im in with my chacne of living in france. The reality is i suspect i wont be. I cant imagine isolating myother half from her friends. Whilst we live in the 21st century and people have moved around, shes never that far away from a good ear, a hand ot hold or a mate to get hammered with.

My friend moved to london for the job, house and status. He was loving life down there. Then they planned to have a kid as most people do. Issue being london is very professional, his mates wherent having kids (i was back home). So his wifes frinds quickly dried up, she had no family nearby either. It was inevitable they would move back. He could because he could afford it. If him and I where born in london though hed be happy staying and i wouldnt be able to afford to yet my wife and her mum would still want/need to be there.3 -

Don't forget that interest rate has a lot to do with affordability! Late 80s 14% and more was what we had to pay. But we didn't spend on what todays first time buyers seem to class as essential.

Plus there are still plenty of really nice affordable houses in this area including new 2 and 3 bed houses for £155k to £200k older houses, 2 bed semi in reasonable condition, for example start at under £60k.

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards