We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Regular Savings Accounts: The Best Currently Available List!

Comments

-

It makes a good direct debit I find.chris_the_bee said:

Surprised you still have an Ecology RS. At 2.85% it must be nearly rock bottom and is easily surpassed by most other BS regulars and a number of short dated bonds.and even EA accounts.Bridlington1 said:It's manual transfers and a spreadsheet for me, the only exceptions being HSBC's regular saver and the Ecology regular saver (DD). I paid manually into 27 regular savers yesterday afternoon, and will be paying into another regular saver later in the month by manual transfer.

I personally would rather do things manually myself largely because I do not want to have to faff around with setting up SOs then needing to cancel them when the regular savers mature/get closed. I would also rather avoid having money sat in a current account earning no interest overnight as I do not have anywhere near a big enough OD limit to cover all the regular savers.

Plus if I am unfortunate enough to end up with a payment from my EA account held up for whatever reason I do not want to find myself having to take money out of the regular savers I've just paid into to avoid paying 40% on an arranged OD. At least with manual transfers if an EA payment is held up by a few days the worst that'll happen is I'll be paying into my regular savers a few days late, with SOs it could become a real pain as some will take me into unarranged ODs, others will bounce etc

That said, it’s disappointing they haven’t increased it since November (?)If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

It makes a good direct debit I find.

Let's be grateful for small mercies.

Nothing wrong with that!

3 -

HiBridlington1 said:

Whilst we're on the topic of spreadsheets I have one sheet of my spreadsheet in which I list all my regular savers, with minimum/max monthly deposit limits and day of month that they need to be deposited.pookey said:

That's a very good idea thanksflaneurs_lobster said:

A spreadsheet is definitely your friend.pookey said:

Wow, that's very good dedication. I need to be more stricter and get in on this method 😊flaneurs_lobster said:

I've got a dozen regular savings a/cs, plus some reward accounts that need funds flushed through them. Tried for a couple of months to get SOs in place to auto fund them all.ForumUser7 said:

I hold the Lloyds MS, BoS MS, NatWest DRS and RBS DRS (among others). I pay into all manually with no SOs set up. IIRC, I had to cancel the NatWest and RBS SOs as these were automatically set upliamcov said:Re regular savers like Lloyds, BOS, NatWest, RBS - do you have a SO set up for 1st of the month (which when it falls on a weekend doesn’t transfer until the Monday) or is it possible to do a manual transfer into them so you know the money goes in on the 1st?

All went to ratpoop over xmas/new year. Given up and now do everything manually, took about an hour this morning. Quite cathartic.

I copy this list at the start of each month and highlight in red the ones I am only paying the minimum deposits into. Once that has been done I highlight in green each monthly saver that I am paying the full amount into as and highlight in orange those that I've paid the minimum amount into.

Just wondering why you have so many and pay the minium in some please?

Is it because your income varies from month to month? Sorry I'm just wondering as I thought it would be better/ easier to have less and pay the full amount 😊0 -

According to Moneyfacts, Melton Building Society are launching a new account, Regular Saver (issue 3), paying 5.00%.

The minimum opening amount is £10. Pay in up to £200 per month. The maximum investment is £3,000.

The account matures on 31/05/2024. It is available to locals residing in Leicestershire, Lincolnshire, Nottinghamshire or Rutland only.

It is available to open in branch only, but once opened it can be managed via branch or post.

Moneyfacts states that unlimited withdrawals are permitted.

Once it has launched, it should appear on the Melton BS website:

https://www.themelton.co.uk/our_savings/regular-savings/Please call me 'Kazza'.5 -

A lot of regular savers have a variable rate of interest and/or have minimum monthly deposit limits. As a result a regular saver that offered a competitive rate of interest when I opened it may not have a competitive rate of interest now, but as it is variable it could become competitive again in the future.pookey said:

HiBridlington1 said:

Whilst we're on the topic of spreadsheets I have one sheet of my spreadsheet in which I list all my regular savers, with minimum/max monthly deposit limits and day of month that they need to be deposited.pookey said:

That's a very good idea thanksflaneurs_lobster said:

A spreadsheet is definitely your friend.pookey said:

Wow, that's very good dedication. I need to be more stricter and get in on this method 😊flaneurs_lobster said:

I've got a dozen regular savings a/cs, plus some reward accounts that need funds flushed through them. Tried for a couple of months to get SOs in place to auto fund them all.ForumUser7 said:

I hold the Lloyds MS, BoS MS, NatWest DRS and RBS DRS (among others). I pay into all manually with no SOs set up. IIRC, I had to cancel the NatWest and RBS SOs as these were automatically set upliamcov said:Re regular savers like Lloyds, BOS, NatWest, RBS - do you have a SO set up for 1st of the month (which when it falls on a weekend doesn’t transfer until the Monday) or is it possible to do a manual transfer into them so you know the money goes in on the 1st?

All went to ratpoop over xmas/new year. Given up and now do everything manually, took about an hour this morning. Quite cathartic.

I copy this list at the start of each month and highlight in red the ones I am only paying the minimum deposits into. Once that has been done I highlight in green each monthly saver that I am paying the full amount into as and highlight in orange those that I've paid the minimum amount into.

Just wondering why you have so many and pay the minium in some please?

Is it because your income varies from month to month? Sorry I'm just wondering as I thought it would be better/ easier to have less and pay the full amount 😊

E.g. I opened a regular saver with Stafford Railway BS last year at 2.5%. At the time it paid more than my EA accounts so I paid the full amount into it. The interest rate remained at 2.5% so when my EA savings accounts were paying more than 2.5% I reduced the balance to the minimum and went to paying in the minimum deposit. A few months later the rate was increased to 3.75% before rising again to 4.15% so I began paying the maximum deposit in again.

For Ecology as @ForumUser7 correctly mentioned I pay into it by DD so it is currently sat on one of my donor accounts (for getting bank switching bonuses).

My income doesn't vary from month to month but I do have a fair amount of EA savings which I drip-feed into my regular savers as they pay more interest than my EA accounts. I have recently paid pretty much all of my EA saving into regular savers so from next month I will be emptying lower paying regular savers into higher paying ones so as a result some of my lower paying regular savers will be made redundant.3 -

Thanks for explaining, that's a brilliant way to do it. I only have one RS at the moment but I'm going to open up some more soon so I'll try to apply your method.Bridlington1 said:

A lot of regular savers have a variable rate of interest and/or have minimum monthly deposit limits. As a result a regular saver that offered a competitive rate of interest when I opened it may not have a competitive rate of interest now, but as it is variable it could become competitive again in the future.pookey said:

HiBridlington1 said:

Whilst we're on the topic of spreadsheets I have one sheet of my spreadsheet in which I list all my regular savers, with minimum/max monthly deposit limits and day of month that they need to be deposited.pookey said:

That's a very good idea thanksflaneurs_lobster said:

A spreadsheet is definitely your friend.pookey said:

Wow, that's very good dedication. I need to be more stricter and get in on this method 😊flaneurs_lobster said:

I've got a dozen regular savings a/cs, plus some reward accounts that need funds flushed through them. Tried for a couple of months to get SOs in place to auto fund them all.ForumUser7 said:

I hold the Lloyds MS, BoS MS, NatWest DRS and RBS DRS (among others). I pay into all manually with no SOs set up. IIRC, I had to cancel the NatWest and RBS SOs as these were automatically set upliamcov said:Re regular savers like Lloyds, BOS, NatWest, RBS - do you have a SO set up for 1st of the month (which when it falls on a weekend doesn’t transfer until the Monday) or is it possible to do a manual transfer into them so you know the money goes in on the 1st?

All went to ratpoop over xmas/new year. Given up and now do everything manually, took about an hour this morning. Quite cathartic.

I copy this list at the start of each month and highlight in red the ones I am only paying the minimum deposits into. Once that has been done I highlight in green each monthly saver that I am paying the full amount into as and highlight in orange those that I've paid the minimum amount into.

Just wondering why you have so many and pay the minium in some please?

Is it because your income varies from month to month? Sorry I'm just wondering as I thought it would be better/ easier to have less and pay the full amount 😊

E.g. I opened a regular saver with Stafford Railway BS last year at 2.5%. At the time it paid more than my EA accounts so I paid the full amount into it. The interest rate remained at 2.5% so when my EA savings accounts were paying more than 2.5% I reduced the balance to the minimum and went to paying in the minimum deposit. A few months later the rate was increased to 3.75% before rising again to 4.15% so I began paying the maximum deposit in again.

For Ecology as @ForumUser7 correctly mentioned I pay into it by DD so it is currently sat on one of my donor accounts (for getting bank switching bonuses).

My income doesn't vary from month to month but I do have a fair amount of EA savings which I drip-feed into my regular savers as they pay more interest than my EA accounts. I have recently paid pretty much all of my EA saving into regular savers so from next month I will be emptying lower paying regular savers into higher paying ones so as a result some of my lower paying regular savers will be made redundant.

One bad habbit I have is leaving money in my Halifax account which pays no interest, I wait for it to build up a bit before moving it to my EA when I should do more consistently. Since interest rates dropped I've gotten lazy with it all and need to get back on it 😅1 -

I have several accounts where I pay the minimum, but for different reasons:-pookey said:

HiBridlington1 said:

Whilst we're on the topic of spreadsheets I have one sheet of my spreadsheet in which I list all my regular savers, with minimum/max monthly deposit limits and day of month that they need to be deposited.pookey said:

That's a very good idea thanksflaneurs_lobster said:

A spreadsheet is definitely your friend.pookey said:

Wow, that's very good dedication. I need to be more stricter and get in on this method 😊flaneurs_lobster said:

I've got a dozen regular savings a/cs, plus some reward accounts that need funds flushed through them. Tried for a couple of months to get SOs in place to auto fund them all.ForumUser7 said:

I hold the Lloyds MS, BoS MS, NatWest DRS and RBS DRS (among others). I pay into all manually with no SOs set up. IIRC, I had to cancel the NatWest and RBS SOs as these were automatically set upliamcov said:Re regular savers like Lloyds, BOS, NatWest, RBS - do you have a SO set up for 1st of the month (which when it falls on a weekend doesn’t transfer until the Monday) or is it possible to do a manual transfer into them so you know the money goes in on the 1st?

All went to ratpoop over xmas/new year. Given up and now do everything manually, took about an hour this morning. Quite cathartic.

I copy this list at the start of each month and highlight in red the ones I am only paying the minimum deposits into. Once that has been done I highlight in green each monthly saver that I am paying the full amount into as and highlight in orange those that I've paid the minimum amount into.

Just wondering why you have so many and pay the minium in some please?

Is it because your income varies from month to month? Sorry I'm just wondering as I thought it would be better/ easier to have less and pay the full amount 😊- Where I want to stop paying but don't want to receive the interest until the following tax year.

- To keep the account open in case they improve the interest rate.

2 -

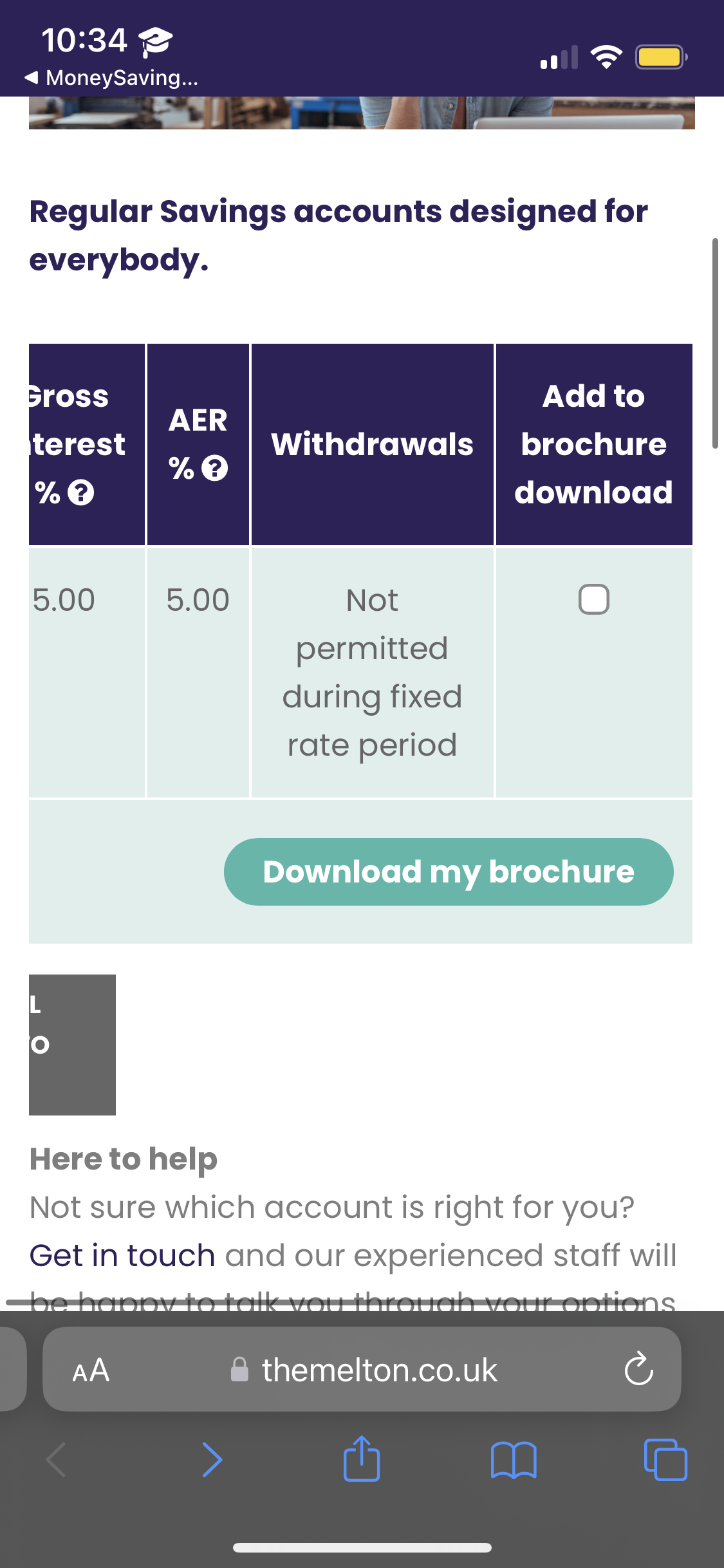

Interesting, their webpage summary says no withdrawals in fixed rate period, but the brochure says easy access:Kazza242 said:According to Moneyfacts, Melton Building Society are launching a new account, Regular Saver (issue 3), paying 5.00%.

The minimum opening amount is £10. Pay in up to £200 per month. The maximum investment is £3,000.

The account matures on 31/05/2024. It is available to locals residing in Leicestershire, Lincolnshire, Nottinghamshire or Rutland only.

It is available to open in branch only, but once opened it can be managed via branch or post.

Moneyfacts states that unlimited withdrawals are permitted.

Once it has launched, it should appear on the Melton BS website:

https://www.themelton.co.uk/our_savings/regular-savings/

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.2 -

As others have said, its a direct debit. It was also a little bit of a faff to open and set up, so its already in existence should its rate increasechris_the_bee said:

Surprised you still have an Ecology RS. At 2.85% it must be nearly rock bottom and is easily surpassed by most other BS regulars and a number of short dated bonds.and even EA accounts.Bridlington1 said:It's manual transfers and a spreadsheet for me, the only exceptions being HSBC's regular saver and the Ecology regular saver (DD). I paid manually into 27 regular savers yesterday afternoon, and will be paying into another regular saver later in the month by manual transfer.

I personally would rather do things manually myself largely because I do not want to have to faff around with setting up SOs then needing to cancel them when the regular savers mature/get closed. I would also rather avoid having money sat in a current account earning no interest overnight as I do not have anywhere near a big enough OD limit to cover all the regular savers.

Plus if I am unfortunate enough to end up with a payment from my EA account held up for whatever reason I do not want to find myself having to take money out of the regular savers I've just paid into to avoid paying 40% on an arranged OD. At least with manual transfers if an EA payment is held up by a few days the worst that'll happen is I'll be paying into my regular savers a few days late, with SOs it could become a real pain as some will take me into unarranged ODs, others will bounce etcI consider myself to be a male feminist. Is that allowed?4 -

I suppose also there is the fact that if we close it, we cannot open another for 12 months (and its rate may increase in that timeframe)surreysaver said:

As others have said, its a direct debit. It was also a little bit of a faff to open and set up, so its already in existence should its rate increasechris_the_bee said:

Surprised you still have an Ecology RS. At 2.85% it must be nearly rock bottom and is easily surpassed by most other BS regulars and a number of short dated bonds.and even EA accounts.Bridlington1 said:It's manual transfers and a spreadsheet for me, the only exceptions being HSBC's regular saver and the Ecology regular saver (DD). I paid manually into 27 regular savers yesterday afternoon, and will be paying into another regular saver later in the month by manual transfer.

I personally would rather do things manually myself largely because I do not want to have to faff around with setting up SOs then needing to cancel them when the regular savers mature/get closed. I would also rather avoid having money sat in a current account earning no interest overnight as I do not have anywhere near a big enough OD limit to cover all the regular savers.

Plus if I am unfortunate enough to end up with a payment from my EA account held up for whatever reason I do not want to find myself having to take money out of the regular savers I've just paid into to avoid paying 40% on an arranged OD. At least with manual transfers if an EA payment is held up by a few days the worst that'll happen is I'll be paying into my regular savers a few days late, with SOs it could become a real pain as some will take me into unarranged ODs, others will bounce etcIf you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards