We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

lifestrategy 80

dd95

Posts: 213 Forumite

please correct me if I'm wrong.

I am investing in the above fund's accumulation version. Past annual returns have been 6%, 13% etc etc.

As the returns are from dividend reinvested and capital growth, the only real return i will be getting each year is the dividends reinvested as i want to leave my funds there be over 10 years.

Eg (hypothetically) if last years return was 12% (and 3% was from dividends) i would only be benefitting from the 3% growth as if i wanted to sell a year later the return could be lower?

I am investing in the above fund's accumulation version. Past annual returns have been 6%, 13% etc etc.

As the returns are from dividend reinvested and capital growth, the only real return i will be getting each year is the dividends reinvested as i want to leave my funds there be over 10 years.

Eg (hypothetically) if last years return was 12% (and 3% was from dividends) i would only be benefitting from the 3% growth as if i wanted to sell a year later the return could be lower?

0

Comments

-

Start £100k

+12% year 1 inc dividend = £112k

-12% year 2 inc dividend = £98.56k (your dividend gain is gone and you are in a worse place than you started)

So stay invested and hope for the best.Unless, that is, that you didn’t understand the potential for loss and now realise you’ve not got the appetite for it.0 -

what im trying to say is the only part that you are benefitting from is the reinvested dividend compounding - it's not therefore accurate to say you get an average of 8% increase year from year (i think the dividend yield is 1.64%?)

You are only getting the 1.64% dividend being compounded year on year not the capital growth0 -

dd95 said:what im trying to say is the only part that you are benefitting from is the reinvested dividend compounding - it's not therefore accurate to say you get an average of 8% increase year from year (i think the dividend yield is 1.64%?)

You are only getting the 1.64% dividend being compounded year on year not the capital growth??? The capital growth compounds as well. If you have a capital gain of 5% in a year a £100 initial investment would rise to £105, and another 5% return in the following year would make that £110.25Over the past 5 years VLS80 has returned 57.1% which is an average of 9.5%/year. If you simply threw away the dividends it would have returned 44.9%, an average of 7.7%/year. So capital growth represents most of the total return.0 -

I don't understand what you're asking.

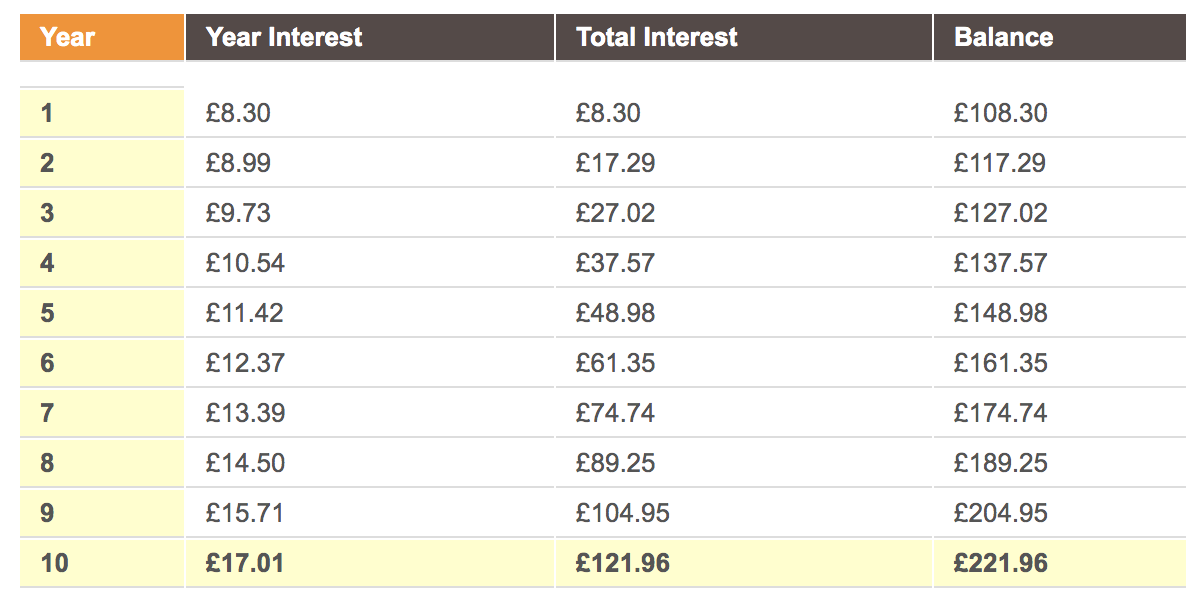

If we assume 8% a year and you put in £100 then after and simply do nothing for 10 years this is how your initial investment compounds courtesy of this calculator.

https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

0 -

Some people missed their maths at school obviously

As previous posters have said, capital growth and dividends on ACC funds don't matter really (especially when in ISA wrapper). Just look at sterling value of your total gains, that's the number you want to monitor closely when in ACC fund, you don't need to look at dividend yield as it's being automatically reinvested anyway.

As previous posters have said, capital growth and dividends on ACC funds don't matter really (especially when in ISA wrapper). Just look at sterling value of your total gains, that's the number you want to monitor closely when in ACC fund, you don't need to look at dividend yield as it's being automatically reinvested anyway.

0 -

i think im overcomplicating it. I didn't think the capital growth would compound as it may gain 7% one year and then the next it may lose 12%. At least with the dividend you are getting a set amount of increase every year into the fund that compounds over time.

And Pioruns - bit of an unnecessary comment. I must have done ok at school to become a corporate lawyer. I apologise for not understanding something - perhaps you can produce me a 200 page share purchase agreement for me to critique?0 -

Why so salty? you asked (a very simple and weird question to be honest) and got answers, just get on with it. People are offended so easily these days don't you think?

2 -

I think that's why you have to work off a long term average return when working out compounding though.dd95 said:i think im overcomplicating it. I didn't think the capital growth would compound as it may gain 7% one year and then the next it may lose 12%. At least with the dividend you are getting a set amount of increase every year into the fund that compounds over time.

I don't think it's possible to account for the scenario where one year you're up 8% and the next year down 4% and the next year up 20%.

That's where the long term average return makes most sense to use, to me at least.0 -

The dividend is not truly 'set' - in the last 8 years, it has varied between 1.3% and 1.8% of the unit price. That is, however, a lot less variation than the annual increase, or decrease, of the unit price itself.dd95 said:i think im overcomplicating it. I didn't think the capital growth would compound as it may gain 7% one year and then the next it may lose 12%. At least with the dividend you are getting a set amount of increase every year into the fund that compounds over time.

The change in unit price is compounded as well. If they tell you the accumulation unit price went up 10% in year 1, and up 10% in year 2, then it would have increased from a nominal start of 100p to 110p, and then to 121p. Or if they said it went up 10% in year 1, and down 10% in year 2, from 100p to 110p then down to 99p. The increase or decrease for a year is measured relative to the price at the start of the year.0 -

think i had a massive mind blank yesterday posting this :')

100 invested with 5% cap growth after a year = 105 (year 1)

105 at 5% in year 2 = 110.25

etc

etc

plus all compounding dividends

sorry folks!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards