We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Advice and suggestions: investing for kids

Doneby55

Posts: 24 Forumite

Evening all

I've been reading the excellent advice dished out on this board for a while now, so thought I'd join in properly...

My own (admittedly very first-world) problem is that I have c. £200k to invest for my children and not entirely sure of the best thing to do. The money is held in trust and is currently sitting as cash earning no interest. My two children aged six and eight are the beneficiaries. I am one of two trustees.

It's a discretionary trust and the earliest I will consider major disbursements to the kids is from age 18 - so investment timescale is at least 10 years.

However, I would like to generate some income - say £4-5k pa. to pay for extra curricular stuff while they are at school, as per the letter of wishes from the settlors.

Other relevent info - kids are very fortunate to have fully funded JISAs from birth. With Fundsmith returning over 300% over this period, their two JISAs are worth c. £130k between them. They are now invested 50% in Fundsmith and 50% in Alliance Trust. As they will gain control of this at aged 18, this is another reason why we may not need to call on the trust for capital.

They also have small JSIPPs to ehich we will continue to contribute if we can.

Any surplus income from the trust could be used to top up the JISAs, although given the current value and the fact they will assume full control at 18, further contributions aren't a massive priority.

I consider myself reasonably knowledgeable regarding investments and have a high risk tolerance for my own money.

Current thoughts are along the lines of splitting the £200k across 2-3 investment trusts. I like ITs for long term performance and closed ended nature. But what would people recommend? Perhaps one with a good yield and something more defensive? Or some in a lower cost tracker too? Ethical is also good. I've got a fair bit of BG positive change, which I like. But open to other suggestions I could explore.

Oh, and happy new investing year - let's hope it's a good one :beer:

I've been reading the excellent advice dished out on this board for a while now, so thought I'd join in properly...

My own (admittedly very first-world) problem is that I have c. £200k to invest for my children and not entirely sure of the best thing to do. The money is held in trust and is currently sitting as cash earning no interest. My two children aged six and eight are the beneficiaries. I am one of two trustees.

It's a discretionary trust and the earliest I will consider major disbursements to the kids is from age 18 - so investment timescale is at least 10 years.

However, I would like to generate some income - say £4-5k pa. to pay for extra curricular stuff while they are at school, as per the letter of wishes from the settlors.

Other relevent info - kids are very fortunate to have fully funded JISAs from birth. With Fundsmith returning over 300% over this period, their two JISAs are worth c. £130k between them. They are now invested 50% in Fundsmith and 50% in Alliance Trust. As they will gain control of this at aged 18, this is another reason why we may not need to call on the trust for capital.

They also have small JSIPPs to ehich we will continue to contribute if we can.

Any surplus income from the trust could be used to top up the JISAs, although given the current value and the fact they will assume full control at 18, further contributions aren't a massive priority.

I consider myself reasonably knowledgeable regarding investments and have a high risk tolerance for my own money.

Current thoughts are along the lines of splitting the £200k across 2-3 investment trusts. I like ITs for long term performance and closed ended nature. But what would people recommend? Perhaps one with a good yield and something more defensive? Or some in a lower cost tracker too? Ethical is also good. I've got a fair bit of BG positive change, which I like. But open to other suggestions I could explore.

Oh, and happy new investing year - let's hope it's a good one :beer:

0

Comments

-

I would agree than ITs could be a good strategy for income, but I'm less convinced about them for growth.

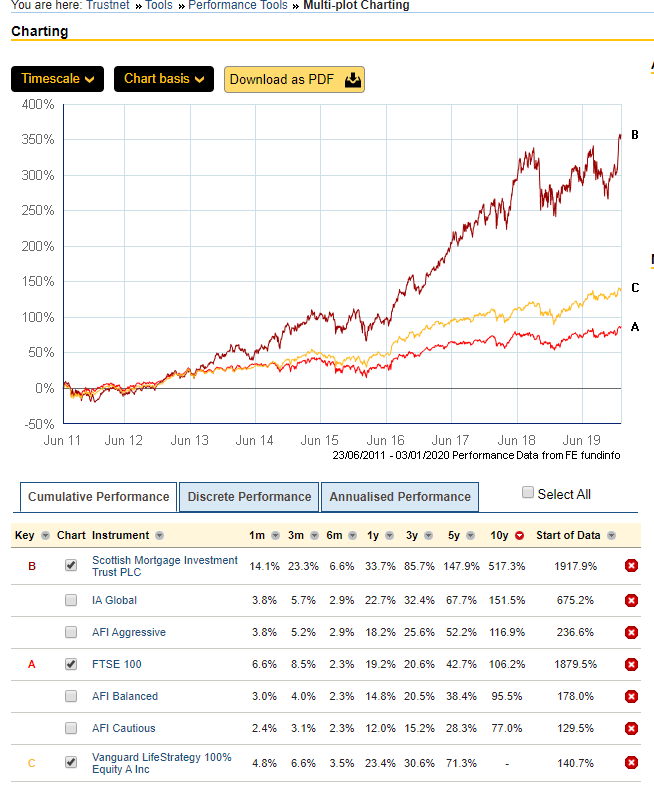

I think I would recommend that you invest about half the £200K in an IT for income, and the other half in a Unit Trust Fund for growth. Have a look at JP Morgan Global Growth & Income and JP Morgan Claverhouse as options for the IT (I hold both in my SIPP), and VLS 100 for a UT growth fund.

You might need to put a little more than half into those particular ITs to get £5000 in income - yields are currently 3.8 & 3.65%.The comments I post are my personal opinion. While I try to check everything is correct before posting, I can and do make mistakes, so always try to check official information sources before relying on my posts.0 -

-

I would agree than ITs could be a good strategy for income, but I'm less convinced about them for growth.

Scottish Mortgage is the largest Investment Trust (?), so not just a random "outlier" picked to prove a point. It is a member of the footsie 100 as a company in its own right...

It should certainly be considered risky, but not fair to eliminate IT's on account of lack of growth.... It also provides .5% dividend 0

0 -

It would be highly advisable to see an FCA-registered Independent Financial Adviser.

Discretionary trusts are subject to penal rates of tax and you need to ensure the impact of this is minimised, both now and in the future.

As you mention "the earliest I will consider major disbursements is 18", it is worth noting that unless there are other potential beneficiaries, they will be able to wind up the trust when both are 18. (Whether the eldest can do anything alone at 18 depends on the exact nature of the trustees' discretion.)0 -

Thanks for the replies and sorry for not replying sooner - appreciate all the suggestions and views.

Re. Tax - yes we have a tax adviser and I'm confident we know the position here.

So far I've put about half in a couple of ITs for income and a further chunk in BG Positive Change.

Still pondering what to do with the rest. Does anyone have a view on RIT Capital Partners IT?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards