We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

[The Economy] 6.2% living wage increase

Comments

-

You could argue it's against the interests of small business owners not to be able to pay £3 an hour and not to be use illegal immigrants and pay no national insurance. However we are a modern advanced country with a big economy and sensible rules including the minimum wage.Malthusian wrote: »

Why do they expect small business owners to act against their own interests but not other groups?

The minimum wage has been rising for years. Unemplyment is not. If the business is reliant on paying the absolute minimum then it's not a great business whether big or small.Making small business owners (or any business owner) annoyed is expected if you increase minimum wage, the question is whether it is worth the cost to society. (Higher unemployment, higher grey market employment, and boosting big business at the expense of small business.)0 -

25_Years_On wrote: »If the business is reliant on paying the absolute minimum then it's not a great business whether big or small.

*sigh*

What is with people and this attitude?

Some jobs are just low economic value - in businesses that serve a need to provide value products which meet consumer demand.

People want to buy cheap sausage rolls from Greggs, and drink cheap pints at Wetherspoons, and buy cheap consumer goods at Poundland or Aldi or Tesco.

As a result, net profit margins at such companies can be in single digit percentages, and a big rise in wages can have a seriously negative impact on their viability.

Only around 15% of employees are on minimum wage - the other 85% earn more already - but it's a simple fact of life that not everyone can earn £30K a year...

Some jobs are just not worth any more than minimum wage.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »I am the owner of several small to medium size businesses.

We pay our staff well over £1m a year. We pay over £2m a year in tax.

A 6% rise in our wage bill is more than I paid myself from the business last year...

What do you think the solution is?

I think if a business is generating enough profit to pay £2m in tax then it can probably afford an extra £60k in staff wages.0 -

SpiderLegs wrote: »I think if a business is generating enough profit to pay £2m in tax then it can probably afford an extra £60k in staff wages.

And that is the fundamental misunderstanding most people have of business.

The vast majority of taxes levied on business are not dependent on profit.

Corporation tax, which is dependent on profit, is of little relevance to us as we make very little profit after paying £2m in other taxes (and of course all the other operating costs of the business)...“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »*sigh*

What is with people and this attitude?

Some jobs are just low economic value - in businesses that serve a need to provide value products which meet consumer demand.

People want to buy cheap sausage rolls from Greggs, and drink cheap pints at Wetherspoons, and buy cheap consumer goods at Poundland or Aldi or Tesco.

As a result, net profit margins at such companies can be in single digit percentages, and a big rise in wages can have a seriously negative impact on their viability.

Only around 15% of employees are on minimum wage - the other 85% earn more already - but it's a simple fact of life that not everyone can earn £30K a year...

Some jobs are just not worth any more than minimum wage.

So you acknowledge these jobs are necessary and need to be done, but whoever does them has to live in poverty?

I'm failing to see where the free market prosperity comes from, if the free market won't provide anything above poverty pay for essential but low skill labour.

But, considering a large number of people on these low wages just voted in a government committed to ensuring low wages, low taxes, and low employment rights, I'm sure it's all very clever and will soon become apparent.0 -

HAMISH_MCTAVISH wrote: »And that is the fundamental misunderstanding most people have of business.

The vast majority of taxes levied on business are not dependent on profit.

Corporation tax, which is dependent on profit, is of little relevance to us as we make very little profit after paying £2m in other taxes (and of course all the other operating costs of the business)...

Go on then hamish. If you think your comment about how much tax your empire pays was relevant then let’s see the breakdown.

Bung a copy of last year accounts up here so we can decide if you’re really on the breadline or not.

Company large enough to pay £1m in staff wages and you’re making ‘very little’ profit. That sounds either like a very good accountant or a very bad CEO.0 -

So you acknowledge these jobs are necessary and need to be done, but whoever does them has to live in poverty?

Not at all.

I'm suggesting these jobs are necessary and need to be done, but as just 15% of the population work at them they are also in most cases considered 'entry level', or part time as a 2nd source of income for a family, or older people supplementing other income, or whatever.

Very few people work their whole careers in minimum wage jobs.I'm failing to see where the free market prosperity comes from, if the free market won't provide anything above poverty pay for essential but low skill labour. .

As already noted, around 85% of people earn more than the minimum.

And the small number on minimum wage are mostly young, single, students, part timers, etc.

It's not really 'poverty pay'. It's 'foot in the door' pay while they're young and carefree with low costs of living, or learn work skills and get experience to move onto something else.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

CreditCardChris wrote: »Not sure if this is the correct sub forum to put this in but here goes.

So the government just announced the "biggest cash increase ever" a 6.2% rise to the national living wage and immediately in the Federation of Small Businesses are basically saying they're doomed because they can't afford to pay people a living wage! Well I'm sorry but if your business is so fragile that you cannot afford to pay people a decent wage, then perhaps it's for the best you go bust now rather than later?

Small businesses are saying they're going to have to cut hiring rates, even let some people go, cancel investment plans, lower the quality of training and equipment etc...

So what's the solution here? To keep people on sub par wages forever and ever because your business isn't good enough to pay them what they need to survive?! Seriously I don't get it... What do these small business actually think the solution is here?

After a decade of sub par wages growth we're finally getting our head above water again and straight away you have the doomsdayers crying about being forced to pay people a living wage... Oh the horror, oh the injustice!

I get the impression you dont really do business.

lets do the basics.

I sell toilet roll. It costs me 50p to produce, half of that is staff costs. I want to make 10% profit on it for the stuff i do. So sell the goods for 55p.

Government come in and tell me to increase my wages by 10% because it better for my staff and the country. So now my wages are 27.5p. Assuming everything else is raw material and running costs, those have stayed the same (if you buy in youll be paying more for those costs). So new costs is 52.5p. I still want to make 10%. New sale price is 57.5p.

So all the workers got an extra 2.5p between them. They then went out to buy toilet roll and found out that it was 2.5p more expensive therefore nullifying any wage increase they had.

Now that weve done business 1.01, can you tell me what the point of that whole exercise was?

No one got richer, no one got poorer, you just have a government bod saying i got everyone a pay rise, which isnt actually a pay rise. This is something that the government do brilliantly well. Not to mention theyve just pushed a load of people in to a higher tax bracket/out of tax relief.

It doesnt matter if minimum wage is £1 per hour or £10million per hour. The only thing that matters is the spending power of your earnings.

I make a point all the time of picking on all the people who complain about high interest rates in the 80's and 90's when it came to mortgage costs. Its funny because you can only ever get away with charging that much in interest if poeple can pay it. The economy was booming, pay increases where vast, property price increase where vast and yet everyone whinges about double figure interest. Well if you didnt have them you wouldnt have had the pay rises and property price increases. Im here in 2019 wishing for interest rates to be near 20%, it would mean the economy was booming.

Ive had practically zero real wage increase in my working life (less than 1% annually iirc. Im 32, ive only ever worked with a minimum wage system in place. When i started working NMW was £5.05 per hour, its now £8.21. So there has been a 62% increase in the minim wage since ive been working. Where is the 62% increase ive had? The only thing thats increased over 62% in that time frame is my level of scepticism.

So a 62% increase in the minimum wage since ive been working has resulted in no real wage increase.

Going back to what i said earlier, what is the actual point?

O and it savages competition to boot. Causing further stagnation in the wider economy.0 -

SpiderLegs wrote: »Go on then hamish. If you think your comment about how much tax your empire pays was relevant then let’s see the breakdown.

Bung a copy of last year accounts up here so we can decide if you’re really on the breadline or not.

Company large enough to pay £1m in staff wages and you’re making ‘very little’ profit. That sounds either like a very good accountant or a very bad CEO.

Or a company operating in a sector that has low profit margins, not every sector is high wage, high profit. We operate in a low margin, low wage sector, with wage cost around £40m a year, and we make c2% pre tax profit margin. The increase in minimum wage will mean our profit drops to zero, unless we pass it on to our clients, which is what we will do. Clients will push back, and some will want to reduce the service they want, which will mean having less people employed, as employment costs are 85% of our total costs. That's the reality of the sector we operate in, it's our choice, but for people to say we pay poverty wages, or we should be paying more, what planet do they live on? We would love to pay £10 an hour, but clients won't pay what that would cost them. The sector has very few barriers to entry, so any cowboy can set up, and try to undercut their competitors, but it's not sustainable long term.

At the end of the day, our clients will pay for the increase, which will then mean they pass that on to their clients, and eventually we see higher inflation, to some degree. As long as people understand this, and are happy to pay more, by way of higher council tax, or higher prices for goods and services, then the actual size of the increase is irrelevant. Those people who think that companies can just pay this and not pass the this on, do not understand the reality of low wage, low margin companies. There are lots of sectors like this, and they will always be like that.0 -

SpiderLegs wrote: »Go on then hamish. If you think your comment about how much tax your empire pays was relevant then let’s see the breakdown.

Bung a copy of last year accounts up here so we can decide if you’re really on the breadline or not.

Company large enough to pay £1m in staff wages and you’re making ‘very little’ profit. That sounds either like a very good accountant or a very bad CEO.

LOL, as if I'm going to post that level of personal data on here...:rotfl:

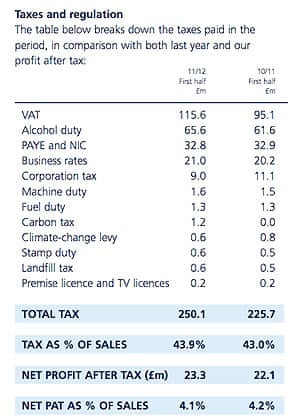

But just to prove the point I'll happily post the accounts summary from a national company illustrating exactly my argument, and showing a net profit of just 4.1% of turnover after paying 43% of turnover in tax.

Here's the analysis for JD Wetherspoons, the high street food and drink chain....

43% of their sales revenue is paid in various taxes before a penny can be contributed via additional taxation on profits.

And net profit after tax is just 4.1% of sales revenue.

Scale that down to a smaller company like ours and it's pretty easy to see how we can pay well over £1m in wages and £2m in tax yet make very little in overall net profit, and certainly not enough to afford a 6% wage bill rise without markedly increasing prices.

As I said, most taxes paid by business have nothing to do with profitability, the government takes a huge cut of turnover first, and then you're left with the crumbs, and then the government taxes the crumbs again.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards