We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Alternative Green Energy Thread

Comments

-

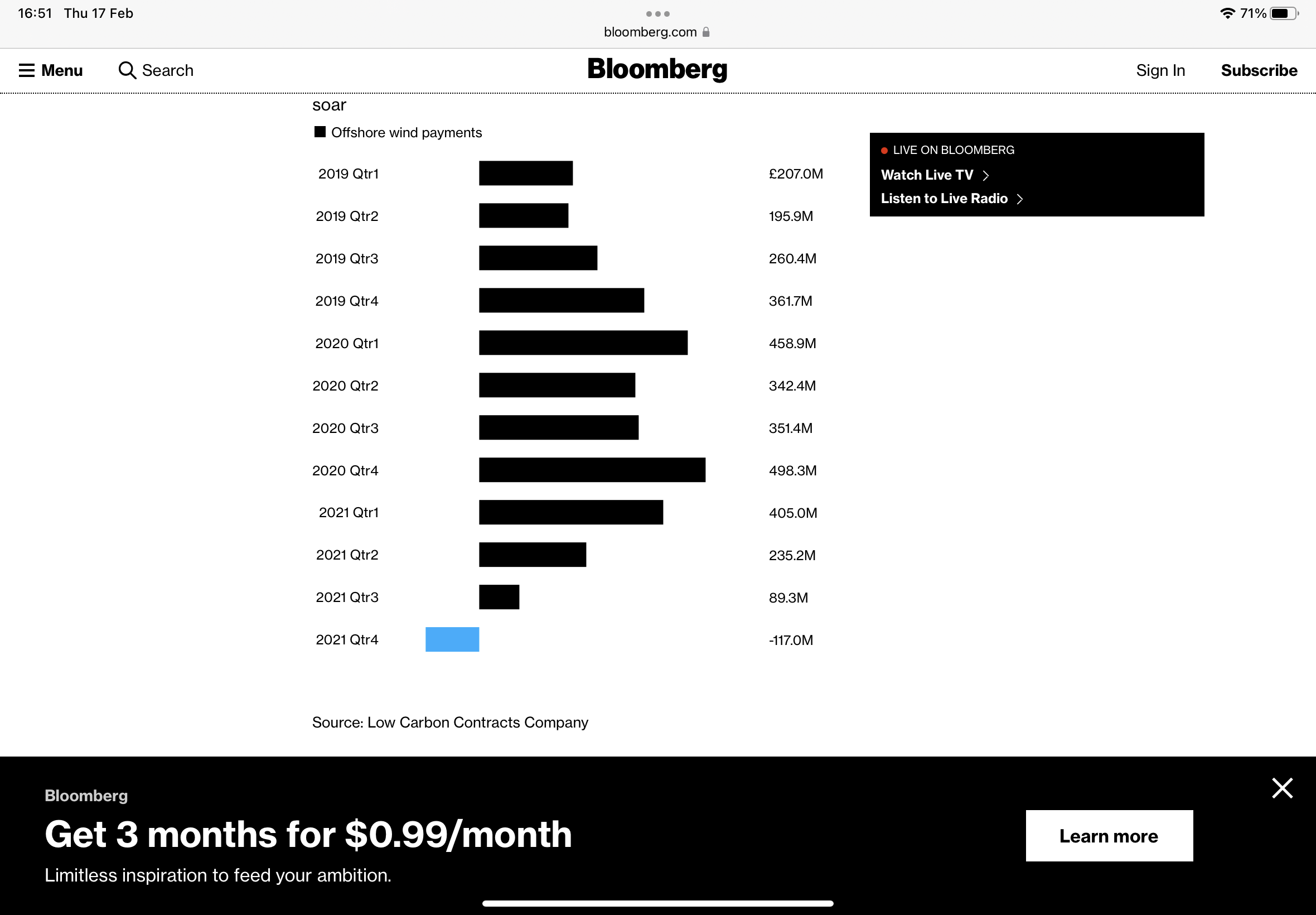

Thanks. Haven't we seen links recently showing that there is a big surplus in the 'CfD' pot so this component of the renewables levy has been set to zero and could even lead to bill reductions if the situation persists - and that with the historic much more expensive round 1 CfDs.JKenH said:

This report suggests a higher cost for current renewable wind and solar.ABrass said:How do they get £110 for Renewables? Those must all be 2012 money prices as well since that's the strike price for Hinckley.

Sound like the Telegraph continuing on its push against renewables.

The average-weighted strike price for wind and solar producers currently stands at GBP151/MWh as of July 2021, with over 6 GW of renewable capacity allocated under the scheme already installed.

https://www.spglobal.com/platts/en/market-insights/blogs/electric-power/082621-uk-renewables-power-price-rally

The link quotes round one at an average of £150 for 6GW and round 3 for about £40 for similar volume - does anyone know what the round 2 prices and volumes were - and also how long the CfDs remain operative for each tranche.

Also once the CfDs end presumably if the assets are still operational they become basically zero marginal cost production - I wonder what that might do to market prices...I think....0 -

Yes wind farms are paying back thanks to the high gas prices but the CfD pot has a long way to go before it balances.

Round 2 strike prices, around 3MW for 15 years

Round 2 strike prices, around 3MW for 15 years- three offshore wind projects

- a combined generating capacity of 860MW for delivery in 2021/22 (Triton Knoll) (strike price £74.75), and

- 2336MW for delivery in 2022/23 (Hornsea Project 2 and Moray Offshore Windfarm (East)) (strike price of £57.50 per MWh).

Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.2 - three offshore wind projects

-

JKenH said:

Like you, I am assuming it to be the current cost of the various forms of generation currently available to us (the Telegraph article says “has at its disposal”) not what they might be in 2023/4 when we start to see new generation come on line at the strike price of around £40/MWh (2012 figures, possibly nearer £50 by now). Someone recently enquired why we were still burning coal and the answer is in those figures.2nd_time_buyer said:

My thinking was that this is the current cost of production i.e. not the cost of adding increased capacity.ABrass said:How do they get £110 for Renewables? Those must all be 2012 money prices as well since that's the strike price for Hinckley.

Sound like the Telegraph continuing on its push against renewables.

Out of the context of the massive reductions that have occurred in renewables costs (but not other sources), it certainly looks like naughty reporting.I don’t consider it to be naughty reporting. It is factual but perhaps it is perceived to be so as it is contrary to the narrative we usually here about renewables being distinctly cheaper than other sources. They will be but they aren’t yet and there will still be the legacy renewable generators in the fleet that are still heavily subsidised.The g gas price is currently an anomaly but it is included at what it is now, not what it was 12 months ago or what it might be in a couple of years time. The nuclear price to me also looked suspiciously like the 2012 strike price for HPC so I was a little circumspect about that.

The only purpose of that table is to allow comparison of additional capacity to power those heat pumps they hate. In which case listing prices that no new systems will be able to get against is misleading.

There are no nuclear plants producing under CfD. They sell at whatever price the market allows.

You're a big fan of marginal load, in this context that's the current CfD strike prices of £50 odd.8kW (4kW WNW, 4kW SSE) 6kW inverter. 6.5kWh battery.0 -

Hornsea P2, 1400MW, which is coming on-stream now, has a strike price of £68.55/MWh, that was agreed/issued Sept 2017.

Moray East, 950MW, is the same strike price, that was operational 2021.

Triton Knoll, 860MW, coming on-stream now, £88.59/MWh

Earlier projects were more expensive, but they also have lower power outputs.

Maybe the Telegraph would like to rerun their numbers to take account of that.

Hornsea P1, 1200MW is £164.96/MWh, agreed 2014.

Walney Extension, 659MW, is £176.57/MWh, agreed 2014.

(I've used current pricing for all these)

1 -

JKenH said:Someone recently enquired why we were still burning coal and the answer is in those figures.By 'we' I assume they were referring to UK??Small wonder then that China/India/USA et al will be heavily reliant on coal for the next 50? years.However in another 28 years the UK will have reached net zero and we not only will have set an example to the above mentioned countries, but their emissions won't affect us! - well I hope they won't!

1 -

In reality it is current pricing we should be talking about not the 2012 based figures which usually get quoted, so thanks for working those out. They are higher than I was expecting.edgex said:Hornsea P2, 1400MW, which is coming on-stream now, has a strike price of £68.55/MWh, that was agreed/issued Sept 2017.

Moray East, 950MW, is the same strike price, that was operational 2021.

Triton Knoll, 860MW, coming on-stream now, £88.59/MWh

Earlier projects were more expensive, but they also have lower power outputs.

Maybe the Telegraph would like to rerun their numbers to take account of that.

Hornsea P1, 1200MW is £164.96/MWh, agreed 2014.

Walney Extension, 659MW, is £176.57/MWh, agreed 2014.

(I've used current pricing for all these)

Perhaps, the Telegraph has already adjusted for the recently commissioned wind farms as the figure quoted by S&P of £151/MWh for July 2021 has been scaled down to £110 by the Telegraph.I don’t doubt we will eventually see the benefit of the later CfD auctions in wholesale prices but the old contracts (ROCs and FiT) have to work their way through and will be with us for some time yet.Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.0 -

JKenH said:I wonder how many more of these we will see tomorrow.

Two lorries were tipped over, with one of them catching fire. Luckily zero major injuries.

https://www.newcivilengineer.com/latest/in-pictures-how-uk-infrastructure-struggled-to-cope-with-three-storms-this-past-week-21-02-2022/

That turbine in Cumbria is a decade old.

The New Scientist article is from 2013, about an event in 2011. It also points out that the most likely cause of the fire had been identified & changes made, even to existing turbines.0 -

Exiled_Tyke said:

I think this is actually alarmist. It is reasonable to assume that wind farm developers are aware of the issues and can weigh up investments accordingly. Subsidy free turbines will also be able to benefit from periods of high prices: although a major issue here will be that high wind periods will raise production and lower prices. So a reasonable conclusion is that we need a portfolio of RE sources as well of course as storage. Currently too much of our electricity is produced from gas and so the link between electricity prices and FF is far too close. Constant push for innovation in RE must be the solution. As for Orsted, there is the argument that the shares simply became overpriced and whilst the industry continues to face challenges, there are reasons to be optimistic. See: https://seekingalpha.com/article/4473683-rsted-go-against-the-wind-and-buy-this-dip for more on this.JKenH said:Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

michaels said:

A safe real return somewhere between 3.6% and 4.4% sounds pretty good to me, I would buy some of that in my pension for sure. What the piece did not say was what the CFD strike price was as this should give some indication of where bids might be in the current round.Exiled_Tyke said:

So the conclusion must be that the system is working in providing the best possible value for money for the consumer? But obviously at a price that investors are (or were at the time of their decision) willing to accept. In these times of escalating energy prices, a solid foundation for consumers with a relatively safe and stable return for investors sounds like the best balance has been achieved?JKenH said:World's largest offshore wind farm 'unprofitable' for Equinor, say government-funded researchers

We see considerable enthusiasm for renewable energy and the hope that it will solve our energy problems. However not everything in the garden is rosey as a recent report for the Norwegian government found.“In our estimate, Dogger Bank is unprofitable,” said University of Stavanger professor Petter Osmundsen. "The project has to compete with alternative investment opportunities."

Equinor has not disputed the study's conclusions, but emphasised that it had benefited from selling stakes in the project.

Costs have indeed come down for the bottom-fixed Dogger Bank and other offshore wind projects, but not at the same pace as strike prices have fallen in UK offshore wind auctions, according to the study.

The researchers calculated the Dogger Bank project's expected net present value (NPV) at minus £970 million (minus $1.3 billion). A negative NPV indicates that the value of the investment is below the rate of return which the company should require from its investments.

Equinor's bigger wind turbines, low prices for raw materials and limited competition helped the company generate solid profit from its larger early offshore wind projects.

That climate has since changed, as the world's largest player in the segment, Orsted of Denmark, has warned about supply-chain blockages and higher raw material prices. Increased competition for new licences also has significantly reduced strike prices in auctions.

It is actually working very well for the consumer with the current level of wind penetration, or rather it was prior to last year’s stilling. If wind speeds don’t pick up it will be disastrous for consumers and the industry alike as the current returns of 3-4% will disappear altogether and with less generation alternative sources will be required. The rise in gas prices to some extent concealed the underlying problem that more wind generation, while cheaper in itself leads to higher average prices. Doubling wind generation will only reduce the back up capacity we need by around 5- 10%. Back up plant is paid enormous sums of money to sit there doing nothing much of the year. When the wind stalls as we saw last autumn and in January this year prices go through the roof. Thes peaks are a feature of the market and will increase with the higher penetration of wind.

Anyway that’s another discussion (albeit an important one) and the article I posted was looking at the investment argument for wind (renewables) rather than consumer pricing (or indeed the CO2 benefits which we all accept.)

So going back to the returns of 3-4%, that might be attractive in a low interest market but interest rates are rising and putting pressure on margins. Also the costs of operating/maintaining the turbines are increasing. The present wind turbines will no doubt keep their heads above the water financially if wind speeds hold up but if wind speeds fall they could quickly be in trouble.

Wind power increases with the cube of the wind speed so a doubling of generation gives 8 times the power. Imagine what might happen if wind speeds fell a further 5%, that would produce around a 15% fall in generation. As wind farm operators on CfDs get a fixed rate per MWh generated that is going to translate directly into a 15% fall in revenue. Costs are essentially fixed (although there might be a small saving in maintenance).

This isn’t just me being alarmist - see Europe’s electricity generation from wind blown off course | Financial Times

It wouldn’t take much for the that 3-4% profit margin to turn into a 10% loss. If you hold an asset that generates a 10% loss for the remainder of its fixed price contract with no prospect of renegotiating the selling price then that business is in serious trouble and its shares would be virtually worthless.

Shares in wind energy companies have already started to fall.

Vestas and Orsted warn of tough times for renewable energy | Financial Times

Just have a look at Orsted’s share price over the last year. Orsted AS Share Price DKK10

"You are quite right that we need much more storage but what I have been arguing for some time is that the roll out of renewables and storage needs to be coordinated. At the moment we have new wind farm being commissioned without anything like the storage we require to balance them. We celebrate on here every new wind farm that is announced but without storage it is only making the electricity supply problem worse"

We aren't yet at the stage of needing to balance wind power since at it's best it can only currently provide around 40% of UK electricity needs. It's no surprise that more interconnections have been brought into use, which also help with the balancing. So I don't think we are yet 'making the problem worse' but I think we can all agree that storage rollout is too slow. (It does slightly amuse me that we talk about 'storage' of electricity when in fact we mean turning electricity into potential energy, or rather 'energy storage').

Incidentally a few year's back I was talking to the chief electricity engineer at the National Grid, who's view was the Dinorwig was far too expensive for what it did and was unlikely to be repeated. That of course was before the current price crisis and before we had such a roll-out of wind energy but I assume he saw at least the latter coming. So yet again we need innovation!Siemens Energy Shares Slump After Inflation Hits Wind-Power Unit

“We are increasing prices. The whole industry is increasing prices,” Siemens Gamesa Chief Executive Officer Andreas Nauen said during a call with analysts on Friday. “That brings business cases for customers to the limit or over the cliff.”

“Siemens Energy is trapped in a narrative it cannot control, and this makes it uninvestible.”

https://www.bloombergquint.com/technology/wind-giant-siemens-gamesa-cuts-profit-outlook-as-inflation-bitesEdit: it will be interesting to see if this has any impact on the CfD auction that is currently under way.Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.1 -

michaels said:The link quotes round one at an average of £150 for 6GW and round 3 for about £40 for similar volume - does anyone know what the round 2 prices and volumes were - and also how long the CfDs remain operative for each tranche.

Also once the CfDs end presumably if the assets are still operational they become basically zero marginal cost production - I wonder what that might do to market prices...There's a treasure trove of CfD info at https://www.lowcarboncontracts.uk/The "Dashboards" (link under "Resources") are a quick way to get a view of what's going on.

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

Energy crisis bursts green shares bubble

Surging gas prices brings an end to the green market bubble as private equity hugely increased investment into oil and gas firms last year

Shares in renewable energy companies have tumbled to their lowest level in 16 months, almost completely unwinding gains made during a stampede into companies aiding the shift away from fossil fuels.

It comes as new figures revealed that private equity snapped up oil and gas firms worth almost £12bn last year, a huge increase from £232m in 2020 as the sector ploughs investment into renewable energy.

https://www.telegraph.co.uk/business/2022/01/22/energy-crisis-bursts-green-shares-bubble/

Northern Lincolnshire. 7.8 kWp system, (4.2 kw west facing panels , 3.6 kw east facing), Solis inverters installed 2018, 5kWp S facing system (shaded in afternoon) added in 2025 with Tesla PW3 battery, Mitsubishi SRK35ZS-S and SRK20ZS-S Wall Mounted A2A Heat Pumps, ex Nissan Leaf owner.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards