We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Who will accept a DB to SIPP transfer from "insistent client"

Comments

-

The IFA is educating you on the pros and cons of a transfer and giving you his opinion, that is all he is doing. As Dunstonh implies, the decision of whether to allow you to transfer against advice is made by the platforms. They make that decision on commercial grounds in that the benefit to them of your custom is outweighed by the risk that the regulator will make them pay for the foolish investment decisions you may make.NotaBene12 said:ZingPowZing said:Once financial advisers have authority over pension freedom, pension freedom is dead.Spot on.What about free will and informed consent?The role of the IFA should be about educating you on the pros and cons of the options and, maybe, giving his opinion on what he thinks is best for you - but he should not be able to stop you from proceeding as you wish. Yet, this is what happens here.Something has gone terribly wrong.0 -

ZingPowZing said:Once financial advisers have authority over pension freedom, pension freedom is dead.There is no chance whatsoever that the government will mandate taking advice of any kind on flexibly drawing benefits from defined contribution pensions.Financial advisers don't have any authority whatsoever over DB transfers. You do not need a positive recommendation to transfer. If people want to pay for negative recommendations and then run around shouting "tHeY wOnT lEt Me HaVe MuH mOnIeS" instead of exercising their right to take the CETV and transfer it into a stakeholder pension, it's a free country.0

-

It seems an open question of whether you can in practice use a stakeholder pension since few are available and where they are they seem to need access through advisors. It will be interesting to see if someone succeeds.Malthusian said:ZingPowZing said:Once financial advisers have authority over pension freedom, pension freedom is dead.There is no chance whatsoever that the government will mandate taking advice of any kind on flexibly drawing benefits from defined contribution pensions.Financial advisers don't have any authority whatsoever over DB transfers. You do not need a positive recommendation to transfer. If people want to pay for negative recommendations and then run around shouting "tHeY wOnT lEt Me HaVe MuH mOnIeS" instead of exercising their right to take the CETV and transfer it into a stakeholder pension, it's a free country.

However if they do I suspect the loop-hole wont last long. It will probably be closed before it is ruled a mis-sale and compensation awarded to a financially incompetent transferer.1 -

Linton said:It seems an open question of whether you can in practice use a stakeholder pension since few are available and where they are they seem to need access through advisors. It will be interesting to see if someone succeeds.You can open a stakeholder pension by paying in £20 gross, after which the provider will be obliged to accept the transfer in from the DB scheme by law.I don't believe that there isn't a single stakeholder pension which can be opened on a direct-to-consumer basis. They were after all designed (poorly) to be easily accessible to the man on the street. Or that stakeholder pension providers will break the law rather than accept a DB transfer. I might be wrong but both seem very unlikely.However if they do I suspect the loop-hole wont last long. It will probably be closed before it is ruled a mis-sale and compensation awarded to a financially incompetent transferer.Compensation from who? The adviser advised against it and the punter then went off and did his own thing. And the stakeholder pension provider isn't going to be made to pay compensation because they did something they were obliged to by stakeholder pension rules.I know that some advisers believe that giving advice against transferring makes you vulnerable to a complaint, even if the punter does their own thing, because the adviser giving negative advice allows the transfer to proceed. But I think it's a stretch.Remember we're talking about a punter going off and doing their own thing, creating a clear break in the chain of causality between the adviser giving the advice and the punter cashing in the DB pension, not a transaction intermediated by an adviser on an "insistent client" basis.It's not a loophole, it's how the system is supposed to work. The philosophy behind the system is 1) people must take regulated advice before they take the exceptionally high risk of transferring out of a DB scheme, 2) people who are advised against it should still be able to do so, but 3) it should be more difficult for them. All those things are still true.Anyway, if people really are going to be due compensation for proceeding with DB transfers off their own bat after being advised against it, closing the stakeholder pension "loophole" won't achieve much - the ship has sailed.

0 -

Can you name one?Malthusian said:I don't believe that there isn't a single stakeholder pension which can be opened on a direct-to-consumer basis.0 -

Financial advisers on this board don't share your glib assumption that insistent clients are able to transfer, Malthusian. And if they don't know, what chance has the ordinary "punter"?Malthusian said:ZingPowZing said:Once financial advisers have authority over pension freedom, pension freedom is dead.There is no chance whatsoever that the government will mandate taking advice of any kind on flexibly drawing benefits from defined contribution pensions.Financial advisers don't have any authority whatsoever over DB transfers. You do not need a positive recommendation to transfer. If people want to pay for negative recommendations and then run around shouting "tHeY wOnT lEt Me HaVe MuH mOnIeS" instead of exercising their right to take the CETV and transfer it into a stakeholder pension, it's a free country.2 -

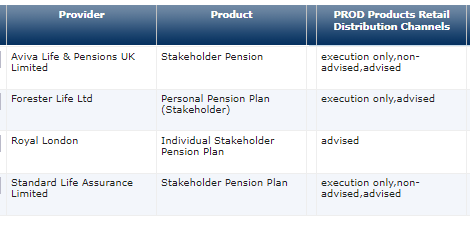

Aviva

Standard Life

Royal London

Forresters

They are the ones coming up on Defaqto as open for new business. All but Forresters are intermediary products. However, Forresters requires their in house FAs (so is effectively intermediary). Defaqto says Aviva and Std Life PROD Distribution channels are execution-only, non-advised and advised. Royal London is advised and Foresters is advised and execution only.

You can ignore execution-only and advised as they won't be of use. Non-advised would mean Aviva and standard life should take it. If both have stated on their PROD they do non-advised, then it is hard to see how they can refuse and still comply with the stakeholder pension rules on transfers. However, from other posts, SL does appear to be refusing.

The only thing I can think is that their non-advised distribution applies only to regular contributions, single premiums and non-safeguarded benefit transfers.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

eskbanker said:

Can you name one?Malthusian said:I don't believe that there isn't a single stakeholder pension which can be opened on a direct-to-consumer basis.I'm not going to name them, as that is too close to financial advice for my liking (specific recommendation).There are at least two providers who advertise stakeholder pensions on consumer-facing websites with no suggestion that you need an adviser to open one.So far no-one has told a convincing tale of "I went to X and Y and tried to open a Stakeholder Pension with a nominal £20 but neither would let me without an adviser", and until that happens my understanding is that you can open a Stakeholder Pension and take advantage of the legal requirement to accept transfers from any registered pension scheme.0 -

1) You may be right but it would be much clearer if we actually had an example of successful use of a stakeholder pension.Malthusian said:Linton said:It seems an open question of whether you can in practice use a stakeholder pension since few are available and where they are they seem to need access through advisors. It will be interesting to see if someone succeeds.1) You can open a stakeholder pension by paying in £20 gross, after which the provider will be obliged to accept the transfer in from the DB scheme by law.I don't believe that there isn't a single stakeholder pension which can be opened on a direct-to-consumer basis. They were after all designed (poorly) to be easily accessible to the man on the street. Or that stakeholder pension providers will break the law rather than accept a DB transfer. I might be wrong but both seem very unlikely.However if they do I suspect the loop-hole wont last long. It will probably be closed before it is ruled a mis-sale and compensation awarded to a financially incompetent transferer.2) Compensation from who? The adviser advised against it and the punter then went off and did his own thing. And the stakeholder pension provider isn't going to be made to pay compensation because they did something they were obliged to by stakeholder pension rules.I know that some advisers believe that giving advice against transferring makes you vulnerable to a complaint, even if the punter does their own thing, because the adviser giving negative advice allows the transfer to proceed. But I think it's a stretch.Remember we're talking about a punter going off and doing their own thing, creating a clear break in the chain of causality between the adviser giving the advice and the punter cashing in the DB pension, not a transaction intermediated by an adviser on an "insistent client" basis.It's not a loophole, it's how the system is supposed to work. The philosophy behind the system is 1) people must take regulated advice before they take the exceptionally high risk of transferring out of a DB scheme, 2) people who are advised against it should still be able to do so, but 3) it should be more difficult for them. All those things are still true.Anyway, if people really are going to be due compensation for proceeding with DB transfers off their own bat after being advised against it, closing the stakeholder pension "loophole" won't achieve much - the ship has sailed.

2) Compenstion from the advisor or conceivably the platform. I think that it is unreasonable that either an advisor or platform should be held responsible for the customer who does his own thing against advice. However I understand the FCA do not agree with us.

Possibly cynically I suspect that some of the rationale behind the current scheme is that MPs constituents want protection from losing their pensions. The state cannot underwrite investment decisions so the IFA is a convenient fall-guy to take the blame and pay the costs. It has the advantage of letting the DB trustees off the hook as well as they could otherwise be considered responsible for not acting in their members best interests in releasing the pension.0 -

For the avoidance of doubt, I certainly wasn't seeking a specific recommendation but simply some evidence that they do currently exist - as dunstonh mentions, other threads suggest that actual experience differs from the theory in the case of Standard Life, so I was/am curious about whether any providers are actually open for retail business....Malthusian said:eskbanker said:

Can you name one?Malthusian said:I don't believe that there isn't a single stakeholder pension which can be opened on a direct-to-consumer basis.I'm not going to name them, as that is too close to financial advice for my liking (specific recommendation).0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards