We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SVS Securities - shut down?

Comments

-

How many pages of complaints have we got now...well over 200!0

-

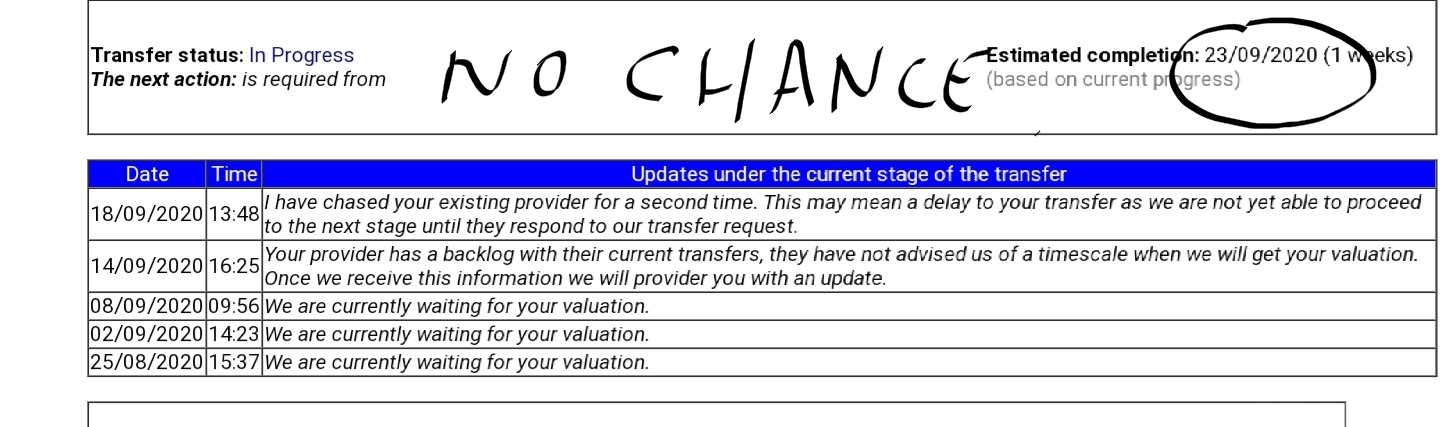

Update on my wife's accounts received from ii today.

0 -

The first hint of problems started at page 154.

Pafpcg reported

"And so the schedule for getting access begins to slide!"

Here we are at Page 406!

1 -

Some Shout Outs:

1 Geeba - you have a Trade and more importantly a SETTLEMENT DATE. You are my hero.

Now we all know such a thing exists we can all ask our new brokers "When is my settlement date...what do mean you have not yet got one. Why ever not?"; and

2 Shawdon. What I thought was interesting about the letter was the below:

"I have not had a meaningful response to my email to ITI, other than an acknowledgement, promise to revert with a proper response and a request not to copy the FCA in!"

Why ever not? That request from ITI must of itself be a breach of the FCA rules - how is it being open, fairt and fran with the Regulator?

PLUS why did ITI not want the letter copied? Do they actually fear/are worried about the FCA? Even more reason for each of us to tell the FCA of all the continuing defaults of ITI.2 -

The only reason i can think of it they don't want the FCA to get a true picture of the extent of the problem .. lets be honest .. FCA have been fast asleep during all of this.johnburman said:Some Shout Outs:

1 Geeba - you have a Trade and more importantly a SETTLEMENT DATE. You are my hero.

Now we all know such a thing exists we can all ask our new brokers "When is my settlement date...what do mean you have not yet got one. Why ever not?"; and

2 Shawdon. What I thought was interesting about the letter was the below:

"I have not had a meaningful response to my email to ITI, other than an acknowledgement, promise to revert with a proper response and a request not to copy the FCA in!"

Why ever not? That request from ITI must of itself be a breach of the FCA rules - how is it being open, fairt and fran with the Regulator?

PLUS why did ITI not want the letter copied? Do they actually fear/are worried about the FCA? Even more reason for each of us to tell the FCA of all the continuing defaults of ITI.0 -

Agreed and we all need to wake them up1

-

Some more feedback just given to Mark Bentley (ShareSoc) who is conversing with ITI who are trying to make excuses for their very poor service:

Mark,

I have finally managed to get some communication from Chris Smith (head of London Operation) and Rahul Agarwal (Head of Private Clients) with some apologies and some of the missing dividend information. They also promise that my 8 account transfers to HL are being processed and this is now confirmed by HL although when this will happen is unclear. Worryingly they have transposed one of my son’s ISA and non-ISA accounts so they are incorrect and getting them to acknowledge this is very difficult. The MSE forum is now up to 406 pages with more than 200 pages of complaints about ITI so they need to walk the talk and actually get their act together. So far not one ex-SVS customer has managed to escape from ITI with their shares and there is a growing feeling that this business is so corrupt and inefficient it is only a matter of time before it fails as they cannot make any money with such an awful reputation on Google and Trustpilot.

Hope this feedback helps.

xxxxxxx6 -

ITI is the most top-heavy organisation I have met...nobody who one actually speaks to actually makes or can make any decisions about anything r knows anything. EVERYTHING has to be relayed to management, a director, my manager, my supervisor etc. Nobody can make a decision. As for the Director of Compliance, nice Mr David Moss, anybody knows what he actually does? [answering my complaints/queries/questions he doe snot do that I know for certain] .1

-

On my joint account, stocks/cash are in SC account and showing on the closure download form, I have managed to upload what were JPG 3MB file documents by converting them to pdf, this must have compressed them as they are now smaller at 970KB, closure submitted, hurrah, 3 cheers for sh ITI, NOT!

.........................................................

Now for the other two SC accounts which have nowt in them, cash/assets are all in the Phoenix accounts, the Closure download cash/assets form needs a signature, I'm not signing those. Going to put another complaint in to have the assets moved back to SC accounts. This really is tiresome.

0 -

I have received exactly the same, but it does not refer to which complaint I made, I've made several.[Edited by Forum Team]1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards