We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SVS Securities - shut down?

Comments

-

SVS had no "custody" fee.

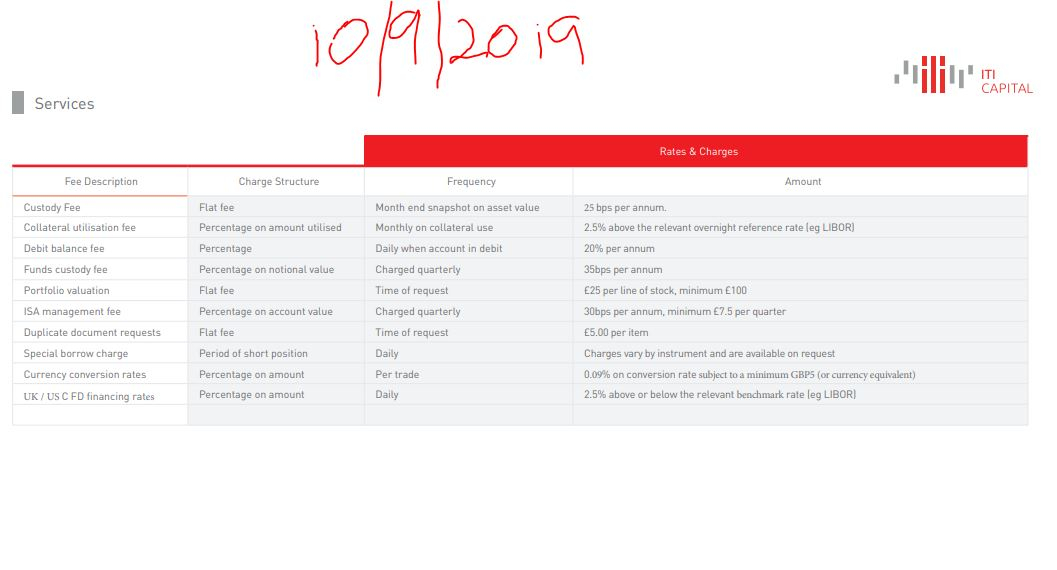

I believe (though not 100% sure) that ITI Capital charge 2 separate custody fees for ISA and non ISA accounts. The rate card is not very clear IMHO and I thought my account would be long gone by then. The rate card (10/9/2019 - latest on their website)

indicates a "Custody Fee" but does not say what for other than asset value - so I assume that is everything in the non ISA account. The ISA mgt fee is itemised separately.

However, I'd watch this space regarding custody charges - I believe LC are going to bring this to ITI's attention. IF we have initiated a transfer request (even by email) via a new broker, I reckon that that and an email to accountmanagement@iticapital.com would be sufficient information such that the Financial Ombudsman would instruct ITI to reimburse any charges. Note, these charges might be accompanied by a £650 per client fine for EACH client who complained to the Financial Ombudsman.

In fact, I'd go as far as to say, I'd be surprised that ITI would risk such a fine per client - hence I'd expect them to drop the proposed custody charges for anyone who has issued a transfer request.

The trading fee of £12.50 per shares was agreed to be reduced to £7.95 for 3 months. However, despite telling LC that the software had been modified to charge the lower fee, it hadn't as of 4th September (on the Phoenix trading accounts). This is an overcharge and ITI capital are legally obliged to pay the overcharge back (or that will be another complaint to the F.O.S. 0800 023 4567 Mon-Fri 8:00am to 5:00pm.).

If only 50% of the ex SVS clients complained to the Financial Ombudsman Service, that would initate a charge to ITI of £6.5 MILLION...which would essentially close them down.

The FCA and the FOS initially are "fluffy bunnies" but if you don't do what they tell you to they turn pretty nasty (and they can close you down as SVS found out when they ignored the FCA's instructions to stop flogging dodgy bonds).0 -

Thought I'd just comment my two cents worth as I've been dealing, like everyone else with no avail in this situation. People I know have taken absolutely ages to be succesfully onboarded, then when they get on their account have found their portfolios are empty when they should not be. I managed to get a lot of people to call the ITI Dealing Desk to sell shares that were in profit and then withdraw money to me. I'm waiting on around 75 transfers of which I've heard nothing back. Initially people were able to sell shares and withdraw 2 days later, now they've stopped replying to emails and have basically added later on that you need to send a Bank Statement. No one replies to emails or phone calls unless you're lucky.

So no one can see their shares or trade, no one can transfer out - I've had one successful transfer to me and that's basically because my client threatened ITI to the point he forced a transfer out a few weeks back. Everyone else is still waiting.

A disgrace.1 -

Still no progress from ITI on any of my accounts and no reply from David Moss or anyone else for that matter to my numerous emails and tickets!

Just heard from my new broker, HL, that they are being ignored by ITI who are not replying to their formal requests to action my transfer requests and apparently they have not managed to transfer any ex SXS clients yet. Surely this is in clear breach of all FCA regulations as we cannot access our assets or transfer them out so we are completely stuck!

Is this how the FCA is supposed to regulate the market?1 -

Pafpcg said: What do we want the oversight regulators, FCA, FOS, FSCS, LSE or whoever, to actually do?There is a nightmare scenario: ITI Capital itself goes into administration. Imagine what might happen if LSE considers the claims that ITI has breached LSE rules and imposes sanctions. ITI now has difficulties running its primary business. ITI's funder decides that ITI is going to be a cash drain in the short-term and the adverse publicity makes it unlikely to be successful in the long-term - the funder pulls the plug and puts ITI into administration. The FCA steps in and appoints another Special Administrator (but probably not LC). But this time the administration process will take much longer than for SVS, because SVS failed in its advice to its advisory clients, despite its execution-only service being relatively problem-free: the systems running SVS were effective and the data-base of client holdings matched the assets held in the SVS nominee accounts (all bar a small number of incomplete transactions). Thus we, the clients of SVS, were able to have confidence in LC's administration being able to preserve our holdings as soon as LC gave us access to the 'Client Portal' to check our holdings in preparation for a smooth transfer to another platform.

But I have serious doubts that a smooth administration of a failed ITI would be possible. It seems that many of us have opened trading accounts with ITI and have traded the transferred assets. If ITI's internal operations are as chaotic as has been claimed in posts in this forum, then it will be a much more arduous process to unravel all our holdings and successfully complete another administration process - it's unlikely to be as quick as twelve months! Even those of us who opted to transfer-out without 'on-boarding' will be trapped in this lengthy administration process because ITI still holds our assets.

So what's our best scenario? If ITI were to accept some friendly advice from FCA to expand its resources to improve the processing of ex-SVS assets and allow those clients who wish to opt-out or leave would eventually have their assets transferred to another platform; those clients who wish to stay with ITI would do so. ITI could then develop successfully or slide back into oblivion.

How can we achieve the best scenario and avoid the worst? My suggestions are:

- treat ITI with respect and consideration for ITI's position but not to overload them with repetitive demands & complaints and certainly not to abuse the staff;

- encourage the regulators to monitor the situation but not to force a shut-down of ITI;

- patience.

There is another suggestion but it's one which others may have perfectly valid reasons to disagree: don't trade! As someone who wanted not to do business with ITI and went straight to the option to transfer-out immediately, it's simple self-interest to see ITI concentrate on the transfer-out workload rather than setting-up Phoenix accounts and processing trades, especially if those trades might cause subsequent difficulties!

Thank you pafpcg. Your question is one that I have been asking myself. I think that virtually all exSVS XO clients will want OUT- what is the incentive to stay? So the 2 areas ITI need to deal with are1) PROMPT Transfers out of almost all ISA accounts and most Trading accounts to a new broker2. PROMPT Closure and sale off of ACCURATE positions for other accounts and prompt return of cash realised together with accurate dividends, for those people who prefer this route of exitNOTE :The Special Administrators retain responsibility: "The Administrators will continue to work constructively with ITI, the FSCS and the FCA to ensure that Clients can access their Client Money and Custody Assets with ITI as efficiently and effectively as possible, and will continueto provide Clients with updates in the period following this report." From LC Progress Report 26 August (download from their website)LC have already "embedded" at least one staff member to my knowlege at ITI, to assist in resolving the problems.So rather than a new Special Administrator, my view is that LC can and should secure that sufficient staff are taken on to deal PROMPTLY with 1) and 2) above. If they need 100 staff, then thats what should be arranged. I can't say how the cost of these staff would be dealt with- I don't know for instance what the Sale Agreement to ITI provides for in the event of defaults for instance. But I do believe it is something the FCA and possible the FSCS could put pressure on for. After all, it would be the FSCS who would have to cover the cost of a SECOND Administration.There seems to be a lot of cheap sympathy knocking about these agencies, and I have to say LC as well, but there is toomuch !!!!!!-footing around. Maybe we could derive help from Sharesoc who know about these Special Administrations and are not happy with the procedure anyway, to encourage FCO, FSCS and LC and try and bang heads together for a plan of ACTION to assist ITI. After all, Transfers between brokers happen all the time - the process should not be that difficult . Its the sheer numbers that ITI face that I can see is the trouble- they just need more staff who can tackle this. Do people agree, and if so, what next- I confess not to having any concrete plan formulated as yet.

0 -

Well well well - ITI can eff you around as much as they like, but you can't say poossy- footing on here!!!!! Live and learn.

0 -

Jamesram talks sense, although he is a bit soft on ITI. I have closed my accounts with ITI and requested transfers 7 weeks ago (very late July)

I am concerned wiht trading wiht ITI anyway as (to repeat) my one trade had an incorrect contract Note and the second trade produced no Notes at all.

I note tha tLC say:

The Special Administrators retain responsibility: "The Administrators will continue to work constructively with ITI, the FSCS and the FCA to ensure that Clients can access their Client Money and Custody Assets with ITI as efficiently and effectively as possible, and will continueto provide Clients with updates in the period following this report." From LC Progress Report 26 August (download from their website)

but for how long.

You are right that the FCA and possible the FSCS could put pressure on ITI to get loads more staff. Essentially they need KPMG or PwC in to sort out the mess, and that costs money.

My view is that ITI have written off the XO clients - not enough profit for them and they will go after the more profitable FX clients. Anyways you and shawdon have complaind to the FCA haven't you? And the LSE?0 -

Thanks for the reply My2penneth. I also just emailed ITI customer services & account management my questions but I don't expect a reply for 2 weeks if at all.

I hope they are forced or goodwill gesture to extend matching SVS costs past October 23..

In the meantime I will first attempt to extract the cash from the trading account and then request to have status reset/request a transfer.

0 -

Johnburman said I have just spoken to my new broker They have 70 clients requesting transfers to them from ITI with no action on anyone's account by ITI despite repeated remindersThey are regulated by the FCA and there is a systemic fault with ITI Capital. Don't they have a duty - an obligation as a regulated entity - to report defaults of other regulated entities to the FCA? If so why have they not done so? We should all ask - demand - our new brokers on behalf of all their clients requesting transfers to them, as some of the earlier ones are now 8 weeks old, to report ITI to the FCA.

Absolutely agree John. Will request my transferee broker iWeb to report ITI. Are you willing to diclose who your new broker is, out of interest?

0 -

Johnburman Yes John I have complained to both, and the FSO although not ABOUT FCA yet. Thanks for your response. Tell me how to be tougher on ITI and I will do so- there are only so many emails and Support Centre complaints I can make ( not that I think many are read, or I would have expected a solicitor's letter from some of the things I have said to higher management- Moss and that Russian Director bloke Rahul someone). I don't actually think they give a flying fairy about us XO people- why would they, they have no professionality or concept of client care- and they know we are all trying to escape anyway.

0 -

Complain to the LSE

And I still woinder why the press have not picked upon this?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards