We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

SVS Securities - shut down?

Comments

-

I just emailed X-O to check on the transfer progress. Received the below reply

“ We have not heard from ITI Capital since we sent them your transfer request. Please contact ITI Capital to make sure that you have completed all necessary forms to allow them to release your account for a transfer.”

How do we contact ITI. I have sent them several emails, initiated several tickets online but nothing so far!

3 -

So it goes on, 6 weeks now with no access to our shares, and it would seem nobody to complain to anymore, I really do not know what more we can all do, as nobody seems to take any notice of us. Totally shafted.

I see the Qort website is still unsecured, still it's alright the FCA is monitoring the situation. I now treat the Qort platform as a fruit machine, it seems that somebody at ITI pulls the handle everyday and three different figures appear in the three circles. Still waiting for three bars to show up to win the jackpot!

2 -

You should have a 1:1 Qort to PX accounts. Perhaps you created a Phoenix account yourself and then ITI automatically created one for you as well. However, ITI will eventually get round to loading one, and only one,Phoenix account with your shares.rugby7170 said:Update...just now.

I have 2 Phoenix and 1 Qort accounts. The status is open, in progress, on-boarding approved. What does it all mean and why 2 PH accounts ?

You won't see much sense if you just look in your on boarding account...logon to your ititi ( Phoenix) account if it is open. ITI might have started to populate it with your shares.

Note , you'll have to check both Phoenix accounts. Also, you might find that Phoenix only contains some of your shares and others are CURRENTLY missing. I wouldn't panic at that stage, ITI are gradually topping up shares to accounts .

Once again, I'd say, it is worth checking your Phoenix account ( and ignoring the on board accounts).

0 -

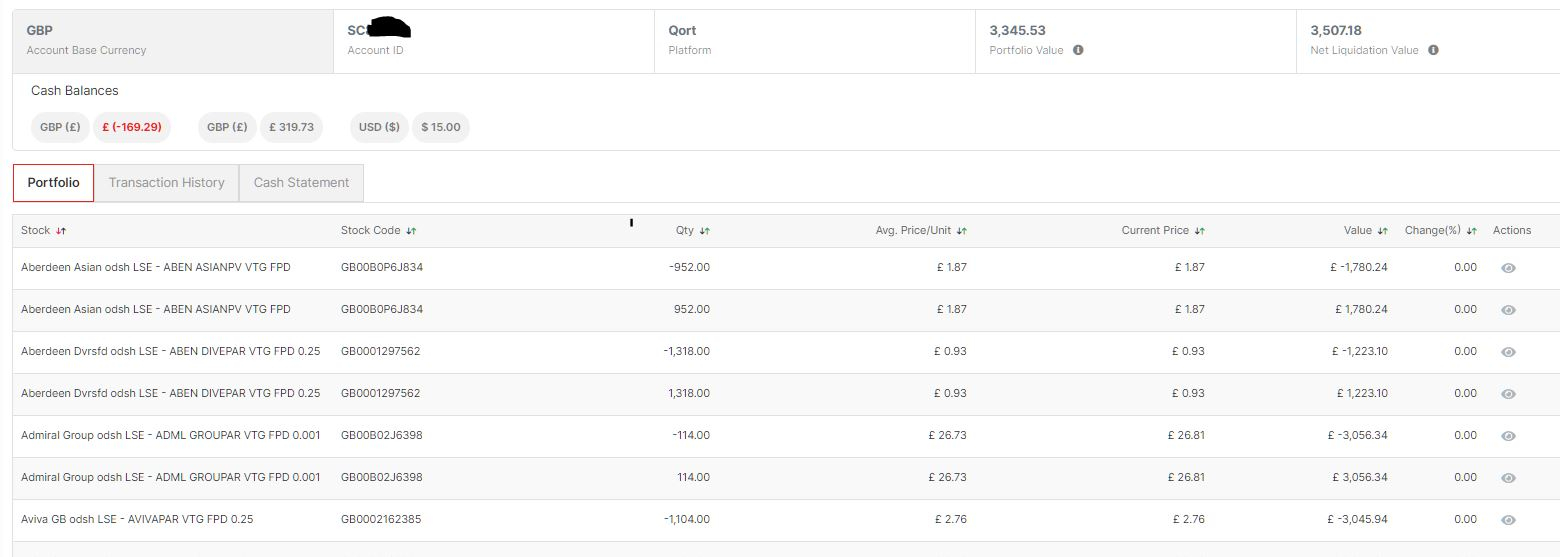

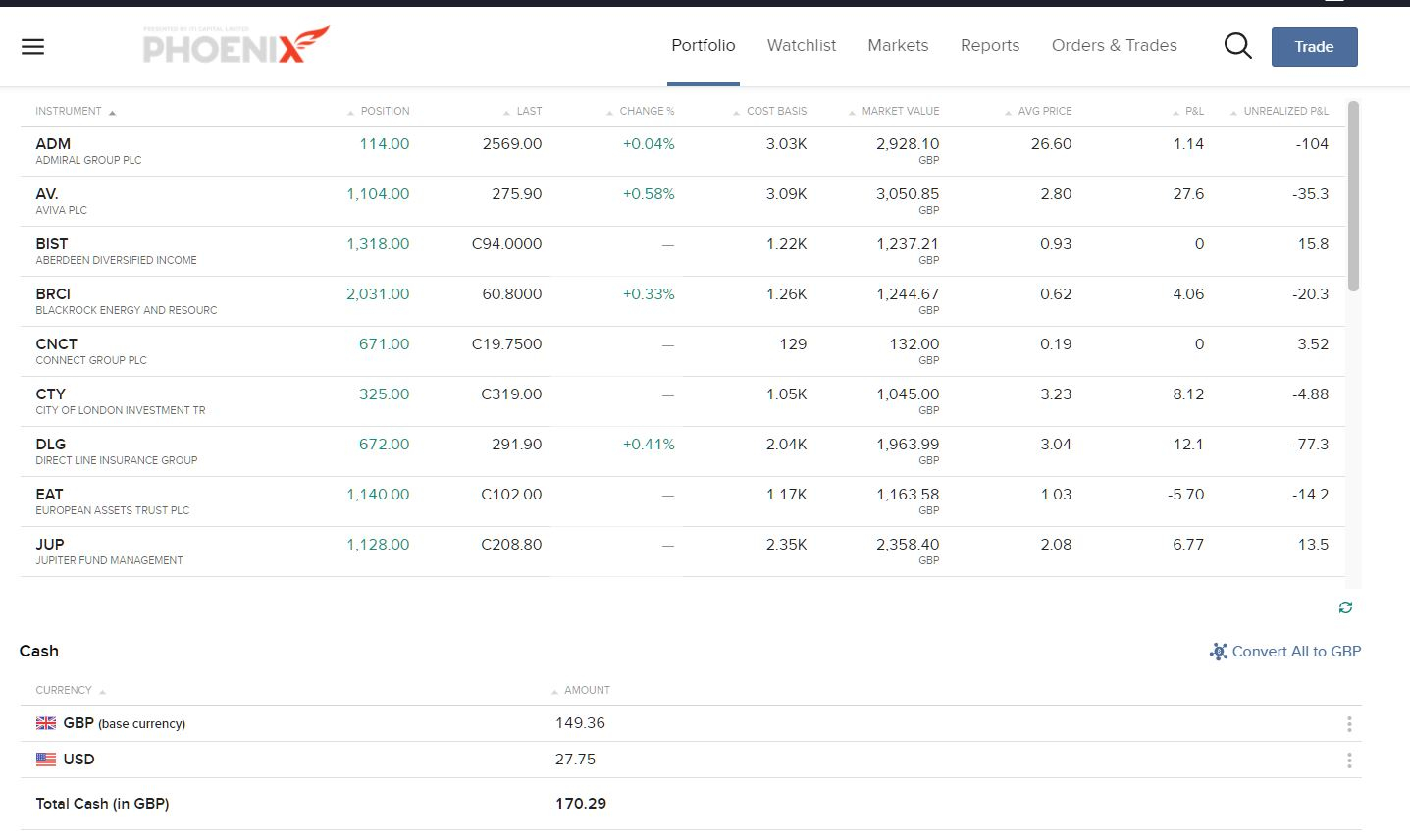

I thought I'd post comparative information for one of my accounts. This is a comparison of what I'm seeing in the on boarding account versus what is currently in Phoenix.

On Boarding (negatives cancelling positives and portfolio value is way incorrect..essentially nonsense)

Visible in Phoenix

By watching the cash balances on a daily basis one can see if dividends have been added - I still can't see how to get a statement of what dividend has been paid when and how much it is - so this is a temporary workaround for me and I can cross off dividends expected).

I reckon that if one originally opted to onboard into Phoenix, ITI Capital won't start the transfers out to another broker until your account is full (i.e all assets transferred over such that your Phoenix holdings match what is in the on boarding account).

There is a summary of the portfolio value which is correct for the shares CURRENTLY in the account. I reported previously that some accounts are still missing shares (mainly iShares/ SSGA GBDV and..surprising Centrica. LGEN and RDSB but the latter 2 have now been added).

Note the slider bar, I'm only listing assets alphabetically.

0 -

My2penneth said:

I reckon that if one originally opted to onboard into Phoenix, ITI Capital won't start the transfers out to another broker until your account is full (i.e all assets transferred over such that your Phoenix holdings match what is in the on boarding account).That may or may not be the case.ITIC are still not progressing transfers out, even when they are nowhere near Phoenix.How many weeks to go before those who agreed to the ITIC terms - but now want to leave - get clobbered by mammoth custody fees?ITIC are just running down the clock.

0 -

....and I, like many others i suspect, was a satisfied customer of SVS securities for over a decade

4

4 -

desertorchid123 said:....and I, like many others i suspect, was a satisfied customer of SVS securities for over a decade

and very likely - "..and so say all of us..."Unlike now.0

and very likely - "..and so say all of us..."Unlike now.0 -

Hi all. This is a lengthy exchange between Leonard Curtis and myself - boring to some so apologies but possibly of interest to the more pedantic reader! Anyway, it starts with my email to LC about their 21 August Client Update which makes absolutely no reference to the chaos unfolding at ITI Capital :

ME on 23 August: "Good day. Isn't it most extraordinary that your update has to make clear

1. That FSCS can entertain claims "other than for the return of client assets and client money" when it is exactly those issues which are affecting ex-SVS clients whose funds have been appropriated by ITI since 11 June, and

2. That you have to issue a warning that ITI's recommendation to use their associated claims management co. SJS Legal should be viewed with caution and that claims management is unlikely to be of benefit. This after SJS has been cold-calling ITI Capital clients in dubious circumstances as to how the list of clients has been passed to them.

I have attempted in previous emails and discussions with your colleagues to be restrained, patient and good natured, and Leonard Curtis staff have indeed reciprocated.But surely the time has now come when someone has to get a grip of this situation? Leonard Curtis bear a strong responsibility for the appointment of ITI Capital- SVS clients had no say.

It is just not acceptable for staff at LC to keep repeating that ITI hope to have this resolved in a few days, or for ITI to say that they are working on "technical problems".Surely SVS clients are entitled to a proper explanation as to exactly what has gone wrong and how it is proposed to put it right and an early deadline to do so, in default of which the FCA should step in to administer the urgent transfer out of all clients who have made the transfer request. Further, there should be an offer of compensation for anxiety and inconvenience caused- clients should not have to go to the FS Ombudsman to make a claim.

There seems to be a reluctance by the Administrator or the FCA or the FSCS to get to grips with the failings of ITI Capital and take decisive action.My complaint to ITI has received a response from David Moss Compliance Manager suggesting that I was unreasonable for complaining that a member of ITI staff who promised to phone me back in a few minutes had not done so (and has never done so)! My main complaint that I cannot access my stocks in ac SC 36112 has of course not been resolved. Neither can my partner Sharon B SC 69709. Nor my ex-wife Elizabeth R SC 72988 and, I assume many thousands more.

Please therefore inform me what steps are being taken by Leonard Curtis or any other organisation to ensure that this disgraceful situation is resolved immediately- either through ITI Capital or without them.

Regards James Ramage"

Reply: Leonard Curtis on 4 September

"Having reviewed your email, I understand that your complaint comprises of:

1. Complaint regarding our recent update stating that the FSCS will not be open to claims regarding the transfer of client assets and client money to ITI Capital Limited

2. Complaint regarding the transfer of your assets to ITI Capital Limited (“ITI”)

3. Failure of ITI to communicate to you in relation to your requests for access to the accounts you administer which have been transferred to them

I will deal with each of these issues in turn.

1. Complaint regarding our recent update stating that the FSCS will not be open to claims regarding the transfer of client assets and client money to ITI Capital Limited

As the FSCS only deals with claims in relation to failed FCA regulated firms, they will not consider claims against active firms. The update issued by the JSAs on 21 August 2020 was intended to alert the large number of SVS Securities clients, who had been waiting to submit mis-selling/negligence claims against SVS Securities since the firm was placed in special administration on 5 August 2019, that the FSCS was now open to receiving their claim submissions. Should any client wish to make a complaint against an active FCA regulated firm, they should first go through the firm’s own complaints procedure. Following that, should they still not be satisfied they can then take their complaint to the Financial Ombudsman Service (https://www.financial-ombudsman.org.uk/).

If you are displeased with the level of service you have receiving from ITI and you wish to raise your concerns then in the first instance please contact their compliance department at compliance@iticapital.com who will communicate directly with you regarding the issues that you have raised as part of your complaint. Further details of ITI’s Complaints Procedure can be found at https://iticapital.com/assets/pdf/Complaints-Procedure.pdf

2. Transfer of Client Assets to ITI

The JSAs concluded that the quickest and most cost-effective way for Client Assets and Client Money to be returned to clients was by way of a transfer to a single broker regulated by the Financial Conduct Authority (“FCA”). Following their appointment, the JSAs engaged a specialist marketing company with relevant experience to undertake an accelerated marketing process to identify an appropriate single broker to whom the Client Assets and Client Money held by the Company could be transferred. As part of the accelerated marketing process, a shortlist of over 100 potential bidders was created, with company information being made available to those parties that expressed an interest in participating in the transfer, subject to the receipt of a confidentiality undertaking. A deadline was subsequently set for indicative offers, of which the JSAs received eleven from FCA regulated firms. The JSAs considered those offers in conjunction with the overall strategy and allowed the eleven potential bidders to conduct further due diligence, setting a further deadline for best and final offers. Three parties submitted final offers, one of whom subsequently withdrew from the bidding process. Further due diligence was then undertaken by the remaining two brokers and negotiations undertaken with each party. The JSAs subsequently selected ITI as the preferred broker for the transfer and the terms of the proposed transfer were agreed between the parties (in the "Sale and Purchase Agreement"). The key factor in the JSAs' decision was the scope of the FCA permissions granted to ITI, which made ITI a suitable broker to receive, and deal with, the variety of Client Assets and Client Money held by the Company. Following the completion of this process, ITI was selected as the preferred broker by the JSAs without objection by the Financial Services Compensation Scheme (as member of the Creditors’ Committee) or the FCA. The Creditors' Committee were also consulted on the choice of ITI and raised no objection. The transfer to ITI was ultimately agreed by the High Court of Justice in England and Wales at a Court hearing on 7 May 2020.

3. Failure of ITI to communicate to you in relation to your requests for access to the accounts you administer which have been transferred to them

I am sorry to hear of your experience with ITI so far in regard to gaining access to the accounts which you administer which have been transferred to them. Please be advised that I have made a request to ITI’s Customer Services Manager to look into this matter as soon as practicable.

Leonard Curtis Complaints PolicyFinally, I would like to confirm that Leonard Curtis does have a Complaints Policy. It can be found via on our website under the title “Quality of Service” via the following link: http://www.leonardcurtis.co.uk/legals/. Please be advised that if you are not satisfied by the response provided to you, a complaint can be made to the Insolvency Service via the Insolvency Practitioner Complaints Gateway (“the Complaints Gateway”). The Insolvency Service is a government department. The web address for the Complaints Gateway is https://www.gov.uk/complain-about-insolvency-practitioner The JSAs regulatory body is The Institute of Chartered Accountants in England and Wales (“ICAEW”).Should you require any further information, please do not hesitate to contact me.

Yours sincerely for and on behalf of SVS SECURITIES PLC for the Joint Administrators Craig Harrison"

MY REPLY

"Hi Craig [We know each other, JR]

Thank you for that response. I can assure you that numerous complaints have been made to ITI through all available channels. Nothing has resulted in a satisfactory response with the notable and noble exception of work done by LC's Pras Kumpati who managed to get my "cash balance only" ISA transferred over to iWeb- thank you again Pras.

Otherwise my own trading account and the other 2 accounts referred to in my original message remain in chaos: mine and my partners accounts have not been transferred to iWeb. Mine is shown as "pending"- as regards Sharon's, despite her numerous requests, the account has not been even identified to be actioned for transfer yet. It exists now as a Phoenix account. However, she is too worried to even consider trading on it- the Phoenix sysyem is very unfriendly to use and there are numerous reports from people who are using the system that it is inaccurate and that charges are not being limited to the £7.95 trade agreed. Also she can't withdraw the large cash element as it would lose ISA status.

I am responding in particular to point out peoples' growing concerns that these accounts which are in "transfer limbo" will shortly start to incur the percentage custody charge (which incidentally was never pointed out to SVS clients- SVS X-O clients never had that charge). I do feel that ITI should confirm that no custody charge will be applied to any client who has requested an account Transfer out. Perhaps Leonard Curtis could assist in that respect?

Lastly, for an overview of continuing problems for account holders, the website at https://forums.moneysavingexpert.com/discussion/6032496/svs-securities-shut-down/p278 and continuing (up to p. 335 currently) sets out grapically all the problems that SVS clients are continuing to experience with ITI Capital- it really has been a nightmare for us.

Regards James Ramage"

9 -

I think we should ask ITI to get their monies back from LC rather than trying to block us from leaving. Given that most of us were really satisfied with SVS, ITI are a big step down in service no matter how good the trading platform might be. If customers cant access it, no use of it.rnf11 said:My2penneth said:

I reckon that if one originally opted to onboard into Phoenix, ITI Capital won't start the transfers out to another broker until your account is full (i.e all assets transferred over such that your Phoenix holdings match what is in the on boarding account).That may or may not be the case.ITIC are still not progressing transfers out, even when they are nowhere near Phoenix.How many weeks to go before those who agreed to the ITIC terms - but now want to leave - get clobbered by mammoth custody fees?ITIC are just running down the clock.1 -

There is a lot of truth that ITI are blocking those that wish to leave and the FCA are fully aware of the situation every day, but they have no control or power, L&C are now pointing the finger of blame at the FCA, very strange on goings.manted said:

I think we should ask ITI to get their monies back from LC rather than trying to block us from leaving. Given that most of us were really satisfied with SVS, ITI are a big step down in service no matter how good the trading platform might be. If customers cant access it, no use of it.rnf11 said:My2penneth said:

I reckon that if one originally opted to onboard into Phoenix, ITI Capital won't start the transfers out to another broker until your account is full (i.e all assets transferred over such that your Phoenix holdings match what is in the on boarding account).That may or may not be the case.ITIC are still not progressing transfers out, even when they are nowhere near Phoenix.How many weeks to go before those who agreed to the ITIC terms - but now want to leave - get clobbered by mammoth custody fees?ITIC are just running down the clock.

James, (Jamesram) excellent piece of truth in your emails, my thoughts all along.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards