We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Should we reduce our offer due to flood risk?

Comments

-

OP will not know what such an in-joke means, nor is it fair IMO to taunt a FTB who is trying to do due diligence in the face of contradictory messages. After all, we meet plenty here who don't even try.OP, are you perhaps here on an exchange visit with Crashy Time?

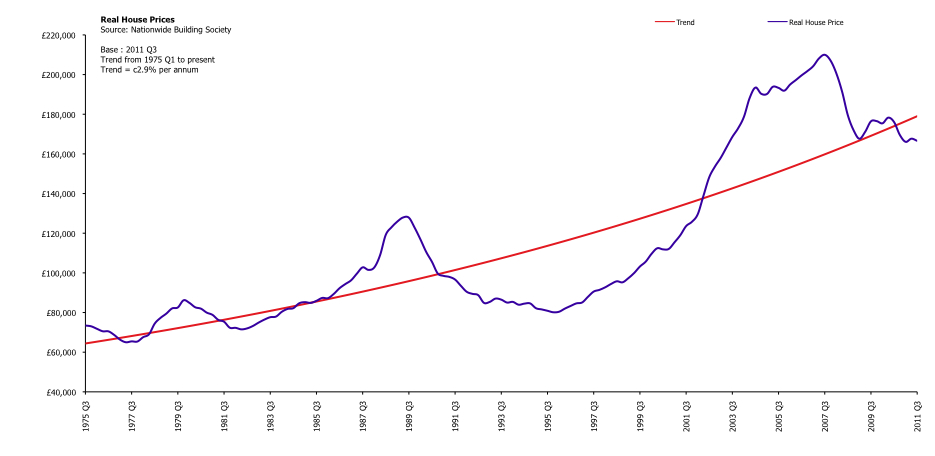

Adrian's graph is a simplification, for as most of us know, there are plenty of places where the recovery after the last crash didn't happen in 2013. It was too bloody long for me as it was, and our area recovered fast. Yes, overall, property is a good long term bet, but when times are tough it's the ???? houses that are passed over.0 -

...

That is irrelevant. I'm sure before the last crash there were many people showing others similar graphs. If the prices reach levels where people simply cannot afford anymore to buy a property, there will be riots. The only sustainable way to have prices that keep rising is to have incomes that keep rising accordingly. When a certain balance is not there anymore, we have crashes that are meant to reset the whole game. Right now, we are very close to a system reset. The only way to avoid it is to have higher incomes. This can be done with printing money, but they need to be backed up by productivity and innovation. Anyway. I'm just speculating now.

The basic problem remains. The property is one with a high risk of surface flooding. The offer was placed not being aware of this. Some people say this is not a big deal, some say it might be a problem.

The 10.000 GBP reduction is meant to cover some of the mitigation actions. To be honest, I have no clue what the work would involve. Considering 50 pounds insurance increase due to this risk, in 25 years I will pay 1250 GPB more than what I should pay. Again, I'm just speculating. The decision to decrease our offer it's supposed to be an "educated" one. Maybe I'm wrong, who knows? I can only hope everybody will stick to the good old common sense. We will see.0 -

Do you have any details of when the area that the property is in last flooded,and whether that particular property was affected.

I have a property in a high flood risk area,it last flooded 43 years ago..whilst I understand there is always a risk of flooding it would be wrong to devalue the property based on a risk alone.

However if your property is a recent flooder then you might want to rethink and run,depending on the area and severity.

Personally I wouldn't devalue a property because of a risk but I might think twice about buying if it has experienced flooding in very recent years.in S 38 T 2 F 50

out S 36 T 9 F 24 FF 4

2017-32 2018 -33 2019 -21 2020 -5 2021 -4 20220 -

need_an_answer wrote: »Personally I wouldn't devalue a property because of a risk but I might think twice about buying if it has experienced flooding in very recent years.

Normally, I would just walk away. The problem is we've got emotionally involved to some extent :wall:0 -

A piece of paper is a guide for you to investigate further. All these searches will reveal potential issues - whether it's contaminated land or subsidence risk - the highlight doesn't mean that the actual house is affected or is likely to be.

It isn't an invitation to reduce the price until you have solid facts. Of course, you can try, but the vendor will expect a good reason.

I have bought and sold a house in a village which the River Severn runs past, and on occasion, straight into . The searches show it as a risk, the Environment Agency maps don't. The EA map has to be right because the house is up a hill. If that house flooded, I'd be recommending arks for everyone.

. The searches show it as a risk, the Environment Agency maps don't. The EA map has to be right because the house is up a hill. If that house flooded, I'd be recommending arks for everyone.

I've also bought and sold a house that did flood, some 14 years before we owned it. The vendors informed us why, and I was able to verify it. It wasn't a high risk to me. It hasn't flooded in the 11 years since - and I saw the brook pretty high.

The advice is to do some proper research here.Everything that is supposed to be in heaven is already here on earth.

0 -

That's one theory I suppose. Not from my experience, but I'm certainly open to other's opinions, guesses and idealisms.If the prices reach levels where people simply cannot afford anymore to buy a property, there will be riots.

I would remarket too if you offered -£10k (just my opinion of course - others may drop).2024 wins: *must start comping again!*0 -

Normally, I would just walk away. The problem is we've got emotionally involved to some extent :wall:

Emotionally involved?

in what way....sorry if its that you love the house etc etc then you shouldn't be trying to squeeze the price further from the vendor.

Its your risk to take on not theirs to sell you cheaply.in S 38 T 2 F 50

out S 36 T 9 F 24 FF 4

2017-32 2018 -33 2019 -21 2020 -5 2021 -4 20220 -

Have you requested a quotation for buildings insurance yet?

If not, try.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0 -

Of course it's a simplification - in that it's a single national figure.Adrian's graph is a simplification, for as most of us know, there are plenty of places where the recovery after the last crash didn't happen in 2013.

"Irrelevant"? No. It's simple historical fact. And, of course, as the disclaimer legally says... "past performance is not necessarily a guide to future performance"That is irrelevant. I'm sure before the last crash there were many people showing others similar graphs.

However, you cannot simply hand-wave it away because it doesn't suit your own over-simplified bald statement - "these things are cyclic". The simple fact is that the historical data is NOT cyclical.

Let's look even longer-term... and, even better, let's put it into real terms, to cancel out inflation...

Cyclical? No.0 -

It really is high time FTBs had to pass an exam before being allowed to offer on any property, imho. I may contact the Ministry of Fairness (copyright shortcrust) and see if they know how I can get hold of the Ministry of Common Sense. :rotfl::rotfl:

There are many FTBs who have this common sense already, but don't come on to this forum with stupid questions. But being a FTB, it's easy to get spooked given that it is the largest purchase that you've ever made in your life, and you are swamped with worries that your dream home can be pulled from under you at a moments notice thanks to the utter BS conveyancing processes that we need to put up with in this country.

In fact, I've seen just as many second/third-time buyers posting equally as stupid questions - I refer you to the "why isn't my house selling" threads, where it is immediately obvious why it isn't.

Whilst you're looking at that, perhaps you could climb down from your high horse?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards