We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Curve card now refusing refund?

Comments

-

I have two automated payments taken from my card every month in different foreign currencies. The GBP pending amounts are often a little different to those of the final transactions.

From Mastercard:

I'd guess in the OP's case the airline put a 'hold' on the total amount, then pushed two transactions through a few days later: one for the fight and one for baggage.

If the underlying USD charge was correct, I wouldn't be losing any sleep over this. When it comes to currency exchange, sometimes you win; sometimes you lose.

I know, but it's quite unusual for the difference to be a whole percentage point, that's why I was wondering whether Curve were charging their 0.5% weekend fee for USD as well.

Though saying that, I guess nothing is particularly unusual with GBP nowadays!0 -

callum9999 wrote: »I know, but it's quite unusual for the difference to be a whole percentage point, that's why I was wondering whether Curve were charging their 0.5% weekend fee for USD as well.

Though saying that, I guess nothing is particularly unusual with GBP nowadays!

Neither the 7th March or 11th March were on a weekend.

I think your second point (Brexit?) is the likely answer.

https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html:

7th March 2019: $125.68 = £96.01

11th March 2019: $125.68 = £96.97

The $125.68 was extrapolated from the date and figure of £96.01 given by the OP.

5p difference to what the OP was charged.0 -

All support queries were conducted via email.... so agree with other posters that the phone advisers could have easily been confused.

.....

I'd be amazed if a Customer Service agent would actually TALK like this:I have now refunded the extra charge and you should see this amount in your account in 2-3 working days.

We apologise for the inconvenience caused and please let us know if there's anything else we can help you with.0 -

Same here! I've never experienced this. Usually with pre-auth, the same (initial) transaction goes through or drops-off. Here, two new transactions have been introduced, and then the initial transaction (pre-auth) disappeared.I am surprised that what initially appeared as one transaction while pending was subsequently submitted as two separate transactions.

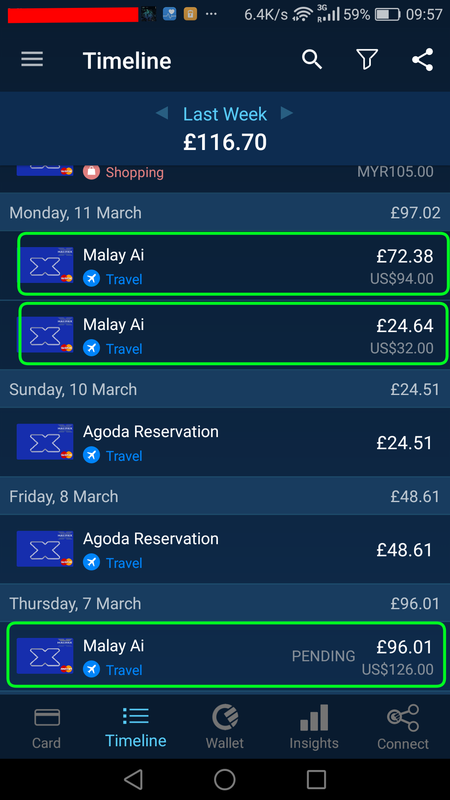

When I made the booking, it was made as one transaction. i.e. I did not buy the flight ticket, logoff, then access website again and purchase luggage allowance. Here is a screenshot of my curve transactions:Was this made as one transaction or two? Did you pay for the baggage in a separate transaction to the tickets?

Neither transaction 1, nor transaction 2 or 3 correspond with the MasterCard currency calculator rates. I checked rates for both date of transaction, rate for following day and the day after. Please see my post to follow.As the pending GBP amount would have only been an estimate and would have varied according to the exact exchange rate on the day that the transaction was finalised, what you need to check is if the USD amounts correspond. If they do, then you are not due your £1.01 refund.

I never touch DCC with a bargepole.There will almost always be a difference between the pending transaction amount and the amount actually charged with a foreign currency transaction. I am assuming here that you did not accept DCC.0 -

This is just confirming that rate on transaction date and processing date may be different. Anyway, Curve uses the interbank rate (mid-market rate) not mastercard rate.From Mastercard:Foreign exchange rates are specific to the date and time Mastercard processes the transaction which may be different from the transaction date.

It makes sense because, when I do the conversions using the mastercard currency calculator (MCC) they do not match to either monday 11 March or tuesday 12 March.

Here are the rates (according to MCC):

For 94 USD transaction -

11 Mar 19 = 72.53 GBP

12 Mar 19 = 72.04 GBP

The curve app has transaction under Monday 11 March 2019 for 72.38 GBP

MCC rates For 32 USD transaction:

11 Mar 19 = 24.69 GBP

12 Mar 19 = 24.52 GBP

The curve app has transaction under Monday 11 March 2019 for 24.64 GBP

Surely not!......I think your second point (Brexit?) is the likely answer.....0 -

You learn something new every day. Yes, as OceanSound says, Curve actually uses the interbank rate rather than allowing MasterCard to handle the conversion process with their rates. They load conversions by 0.5% for transactions made at the weekend and, depending on the volume of foreign currency spending you do each month (and your Curve product) you may have the conversion rate loaded with 1.5% or 2%.

That explains why we can't match things up with the MasterCard rates. Nevertheless, the principle is still the same. Transactions will be cleared at the Interbank rate available on the day of clearing by Curve and this will probably differ from the Interbank rate used at the time of authorisation several days earlier, because all rates move, be they MasterCard rates or Interbank rates.0 -

My subjective experience has been that the pending amount (therefore exchange rate) is what is carried through to the final statemented amount (therefore exchange rate).

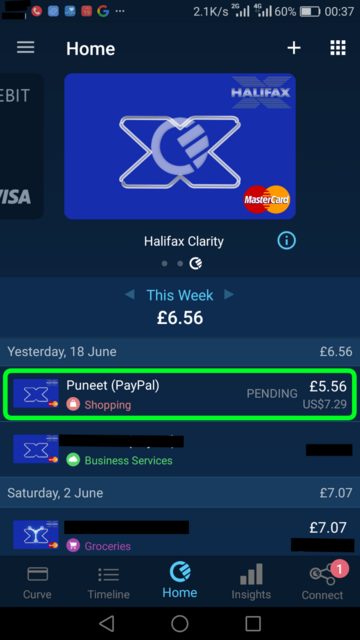

I've used Curve linked to Halifax Clarity to purchase items on ebay on several occasions. Here is an example. The price of item was 7.29 USD. Soon after purchasing I opened the curve app and took screenshot. See below:

it shows GBP amount as 5.56 after converting 7.29 USD. The 5.56 GBP was the statemented amount on my clarity credit card when the statement was produced. See below:

Actually, soon after making a transaction you can click/tap on the transaction and see 'transaction details.. It will tell you:

a) the amount in foreign currency

b) the amount in GBP

c) Exchange rate

d) 'You saved approx x.xx in FX fees

I've never seen any of the above change between the day of transaction and the day when it's 'cleared by Curve'. Presumably, if the 'cleared' rate is different, curve would need to re-calculate the 'you saved approx x.xx amount'?..I've never seen this happen.

Where is this mentioned?..Can you tell us the source where you saw this? Curve website? The whole point of services like Curve and Transferwise is that they use interbank (mid-market) rate, which is the fairest rate, and it's the current (real) rate. i.e. it's not a historic rate, it's not a future 'utopian' rate. When I use both services, I use xe.com and check the rate, and it always matches. (with transferwise I check before transaction. With Curve I check after transaction) . There is little point if either service charges the interbank rate when the 'transaction is cleared'.Terry_Towelling wrote: »..Transactions will be cleared at the Interbank rate available on the day of clearing by Curve and this will probably differ from the Interbank rate used at the time of authorisation several days earlier,.....

Perhaps someone can post if they've experienced any different (to what I've experienced above).0 -

I have a theory.

Quite possibly, Curve has an arrangement with MasterCard to settle for all transactions at the auth stage. That would explain why transaction amounts don't vary between auth and clearing.

However, because the authorised transaction was never cleared, that process wouldn't carry through. Instead the retailer split the transaction into two smaller ones that in themselves had never gone through the auth stage. Curve will not have matched the single preceding auth message with the two clearing messages and they have simply been cleared as two 'new' items using the rate on the day they cleared.

So, it is the retailer's actions that have brought about the difference and, in the process, highlighted what Curve is doing.0 -

Has anyone experienced similar when booking an airline ticket through Malaysia Airlines? (I wasn't going to name the airline to begin with, but now feel it will be useful for others to be aware. e.g. you can consider using a prepay card in USD to avoid the fluctuations in currency. I noticed Malaysian Airlines also offer paypal option. However, Paypal conversion is almost always dearer, so unless you happen to be using USD already in your paypal account, it's not a viable (MoneySaving) option).

What about bookings with other airlines?

I've never experienced this authorisation payment first, then 4 days later process final payment as offline payment scenario with other airlines.0 -

OceanSound wrote: »I've never experienced this authorisation payment first, then 4 days later process final payment as offline payment scenario with other airlines.

That's because Curve seems to be paying for the transaction at the 'first point of contact' - at the authorisation stage. Because they do this, the later clearing message (which will still come through) is normally dropped where it can be matched to the prior auth message.

In your case the clearing message couldn't be matched to the prior auth because the sale had been split up and that will have meant Curve had to reverse the unmatched auth and settle at the rate in force at the time the transactions actually cleared.

The most common model for transaction processing (from any retailer) is for the retailer to seek an authorisation from your issuer. That transaction is converted to sterling at the rate on that day for the purposes of authorisation. The card issuer does not settle the transaction with Visa/MasterCard at that stage but waits for the retailer to actually clear the transaction (could be days later). When the clearing message comes through (on a different day at a different exchange rate) the card issuer settles with the Payment Scheme and bills the card account with the clearing amount.

This is known as double-message processing (auth and clearing). What curve is trying to exploit is single-message processing (clearing at the auth stage) within what is largely still a double-message world.

You will have come across this on other credit cards and 'traditional' debit cards where a transaction starts out as a pending amount (auth stage) and then clears later (clearing stage).

The newer entrants to the banking world are trying to clear transactions up-front because that gives them the opportunity to benefit from your money before they actually have to pay it away themselves.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards