We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

£20,000 deposit but no mortgage!

Comments

-

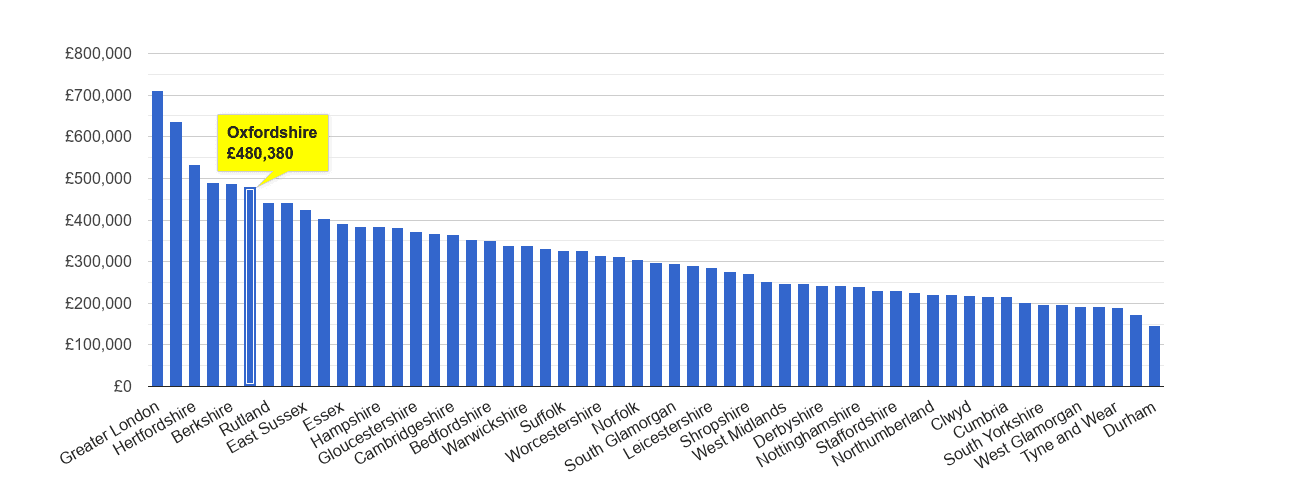

I wouldn’t be so impertinent as to ask direct questions of my acquaintance but I know that his son is a Civil Engineer two years into his first job in a booming industry. Looking through the vacancies columns he should be able to earn around £35,000 Salary £35,000 maximum borrowing at 4.5 salary £157,500 which means that living in Oxfordshire he doesn't have a cats chance in hell. Could the solution to my question simply be that failure to be able to obtain a mortgage can be laid at the feet of house price inflation?0

-

Yes, it does sound like it's "can't afford to buy a house in their desired area" rather than "being refused a mortgage by beastly lenders".

More appropriate board for those wanting to chat house prices:

https://forums.moneysavingexpert.com/forumdisplay.php?f=1490 -

I wouldn’t be so impertinent as to ask direct questions of my acquaintance but I know that his son is a Civil Engineer two years into his first job in a booming industry. Looking through the vacancies columns he should be able to earn around £35,000 Salary £35,000 maximum borrowing at 4.5 salary £157,500 which means that living in Oxfordshire he doesn't have a cats chance in hell. Could the solution to my question simply be that failure to be able to obtain a mortgage can be laid at the feet of house price inflation?

It can be laid at the feet of you apparently thinking everyone is entitled to buy anywhere they want. I'm sure he could buy in say, Leicester or Sunderland on those numbers.

If he chooses to live in the sixth most expensive county in the UK, then you'd expect him to be earning much better than average salary, especially as, when buying a property he is competing with couples who, roughly, will have at least 1.5x his spending power. 0

then you'd expect him to be earning much better than average salary, especially as, when buying a property he is competing with couples who, roughly, will have at least 1.5x his spending power. 0 -

You are right about being able to buy if one moves but job opportunities are not in the low cost areas. I am so fed up living in a permanent building area with three new estates being built in the village I live I would love to move to a less crowded county but my wife could not bear to lose contact with the children and grandchildren.

You stated, "It can be laid at the feet of you apparently thinking everyone is entitled to buy anywhere they want."

Well, I have to admit that I do believe that everyone is entitled to housing but what with disgraceful introduction of right to buy coupled with price inflation peoples opportunity is being restricted. The news carried a piece where a house in the Liverpool area I think was bought under the right to buy and sold within a month at a profit of £277,000. There was another report stating that 40% of houses bought under the right to buy are now being rented by new owners. With 1.5 million houses now sold the market has been distorted and the housing boom is not solving the affordable market question.0 -

You are right about being able to buy if one moves but job opportunities are not in the low cost areas. I am so fed up living in a permanent building area with three new estates being built in the village I live I would love to move to a less crowded county but my wife could not bear to lose contact with the children and grandchildren.

You stated, "It can be laid at the feet of you apparently thinking everyone is entitled to buy anywhere they want."

Well, I have to admit that I do believe that everyone is entitled to housing but what with disgraceful introduction of right to buy coupled with price inflation peoples opportunity is being restricted. The news carried a piece where a house in the Liverpool area I think was bought under the right to buy and sold within a month at a profit of £277,000. There was another report stating that 40% of houses bought under the right to buy are now being rented by new owners. With 1.5 million houses now sold the market has been distorted and the housing boom is not solving the affordable market question.

Entitled to housing - not entitled to own a house surely...

My understanding is if you sell your RTB property within 5 years you have to pay back the discount, so I'm not sure your news story is correct.0 -

I'm criticising a system that places first time buyers in a system that makes it extremely difficult to obtain a mortgage and I would like to understand why this should be.

First time buying levels are up https://www.ftadviser.com/mortgages/2019/03/14/first-time-buyers-shore-up-uk-housing-market/

If they can't get a mortgage then it's either because they can't pass affordability checks for the amount of money they want to borrow, or they have a less than perfect credit file.

Maybe he has a CIFAS marker for committing fraud or has never taken out credit before, so as far as the lenders are concerned he is an unknown risk.

It's impossible for anyone to know whether it's reasonable that he's been refused a mortgage with the amount of information you've given. Your criticism may be misplaced, in any case it's unlikely to make a difference to their plight.I wouldn’t be so impertinent as to ask direct questions of my acquaintance but I know that his son is a Civil Engineer two years into his first job in a booming industry.

I couldn't afford to buy a house two years into my first job "in a booming industry" either. Neither could my father, he ended up moving to another county after living in a static caravan for a while.Could the solution to my question simply be that failure to be able to obtain a mortgage can be laid at the feet of house price inflation?

Houses have only gone up in value because the people you are competing with can afford to pay more. New jobs have been invented that can earn more than laborers for example.0 -

Most likely there will be a mortgage of some sort for him. Would be helpful to know what mortgage he was asking for and his salary.

But things like credit scores, job security, previous debts, credit commitments like car/ credit card, dependants etc.0 -

We should be looking at this question from a macro point of view. Homes currently cost more than the average buyer can afford because wages haven’t kept pace with inflation, due to the existing Governments austerity policy. As a result there’s a sizeable chance that many people who would have been able to prior to the austerity fiasco will never own their home in the UK. The goal for most people is now to get on “the housing ladder”: buy a small house or flat, and gradually move to a nicer area. This wasn’t always the case. Back in the early 1980s, around half the population of the country owned their own home, and half rented – 30% in social housing, from their local council, and 20% from private landlords.

Margaret Thatcher’s introduction of right to buy meant that those who bought their council home saw the value of their subsidised purchase rise rapidly and housing was then seen less as a permanent home and more of an investment. Potential house buyers weren’t helped by councils stopping building homes.

So now we’re in crisis as a result of homes costing more than those earning wages that haven’t kept pace with inflation. The young are finding that their borrowing allowances have been harder hit than most.0 -

I wouldn’t be so impertinent as to ask direct questions of my acquaintance but I know that his son is a Civil Engineer two years into his first job in a booming industry. Looking through the vacancies columns he should be able to earn around £35,000 Salary £35,000 maximum borrowing at 4.5 salary £157,500 which means that living in Oxfordshire he doesn't have a cats chance in hell. Could the solution to my question simply be that failure to be able to obtain a mortgage can be laid at the feet of house price inflation?

So £157k mortgage, say 10% deposit, gets to almost £175k. For £175k you can get 3 bed properties in Banbury, so I really don't see your point.

I do agree about RTB and the housing market in this country being broken, but you seem to be barking up the wrong tree a bit.0 -

Move to Banbury and have a 36 mile return journey. No thanks.

"I do agree about RTB and the housing market in this country being broken, but you seem to be barking up the wrong tree a bit."

What tree am I barking up wrongly?.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards