We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

LC&F -- Help! 😢

Comments

-

David_Evans wrote: »It is certainly not being marketed to retail investors (at the moment, anyway).

.

I think you'll find they were https://damn-lies-and-statistics.blogspot.com/2019/01/top-isa-rates-misleading-fake.html Remember the saying: if it looks too good to be true it almost certainly is.0

Remember the saying: if it looks too good to be true it almost certainly is.0 -

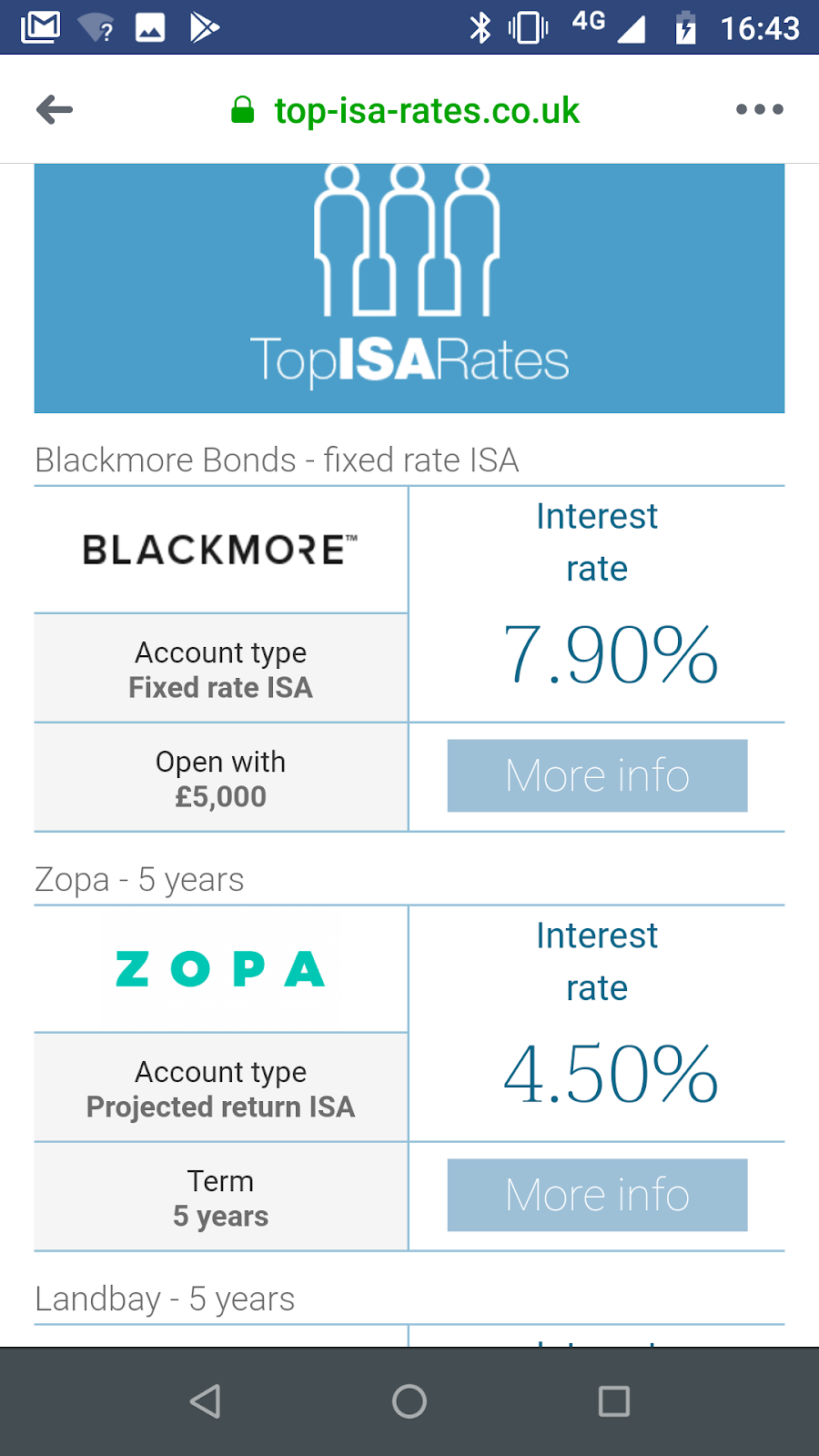

It certainly IS being marketed to retail investors, in exactly the same way that the LCF bonds were - not by the company itself, but by supposedly independent savings comparison websites.

If you (as a retail investor) want to find the best rate ISA you can get, then Google will point you at a website with "top ISA rates" in its name that will promote Blackmore bonds to you - described as a Fixed rate ISA with a 5-year term with an interest rate of 8.5%.

There is no mention of the additional risks that Blackmore involves on the "comparison" site, and for example the Virgin Money cash ISA appears further down the list that you see, as if to suggest that they are comparable.

This type of promotion has been going on for years now.

I see.

Maybe the comparison sites should take some responsibility for this?

Personally, I always like to know where my money is going.

But if you look at the Blackmore website today, I certainly would not say it's aimed at retail investors. They do make that very clear.

To me, Blackmore should really be put into the P2P (debt) sector or high risk venture capital etc.

These are not something that I have any experience of. But for those willing to do proper due diligence, maybe it is for them.

I would want to know the directors and the companies very well before getting involved.0 -

Silly_Shirl wrote: »Yes, with a big green tick, on the 'secured' column, that makes dummies like me think it's safe:mad:

Aren't all bonds secured against the assets of a company?

In the sense that bondholders are above shareholders, in the event of liquidation of those assets?0 -

Won't let me paste a link as I'm new, but copied this from an interesting info site:

Thoughts on Finance, Current Affairs and General Consumer Ripoffs - Damn Lies and Statistics

Inspired by the Disraeli phrase that there are 3 types of lies, "Lies, Damned Lies and Statistics", I aim to highlight misleading news stories based on statistics and dodgy extrapolation of data as well as warn about financial products that appear too good to be true, the future of UK politics and investments. "Nothing but lies, damn lies and statistics" has never been truer with headlines and adverts that bear no resemblance to the underlying data that produced them!

Home

London Capital & Finance

High Risk Bonds

About

Saturday, 26 January 2019

Blackmore Bonds Warning - How Safe Are They Really?

After the notice issued by the FCA about London Capital and Finance where investors are currently waiting to find out if they will get their money back from the company the warnings by the FCA are equally applicable to Blackmore Bonds that use the same methods as LCF to attract new business.

Both companies used websites called Top ISA Rates or Best Savings Rates to promote themselves. These sites are specifically used to target investment into the high risk bond products by promoting the bonds alongside savings accounts.0 -

Yes, LCF stated assets secured... they lied!:embarasse0

-

Those are not comparison sites, they are shill sites made to look like comparison sites. There's a whole industry behind luring in hapless retail investors because anyone who knows enough to be classed as a sophisticated investor wouldn't touch these products with a bargepole.David_Evans wrote: »I see.

Maybe the comparison sites should take some responsibility for this?0 -

The loans are asset backed. It's just that in a distressed sale the assets would be worth a fraction of what they were valued at when the loans were written.Silly_Shirl wrote: »Yes, LCF stated assets secured... they lied!:embarasse0 -

The loans are asset backed. It's just that in a distressed sale the assets would be worth a fraction of what they were valued at when the loans were written.

Exactly.

Most companies are run on debt with very few actual hard assets held.

This means if they go bust, there's nothing much to seize by the creditors.

All the money has already been paid to the top management in wages etc.

Shareholders (and bondholders) are left to fight over very little, if anything.0 -

Those are not comparison sites, they are shill sites made to look like comparison sites. There's a whole industry behind luring in hapless retail investors because anyone who knows enough to be classed as a sophisticated investor wouldn't touch these products with a bargepole.

I am far from being a sophisticated investor.

But I know that comparison sites are only really advertising sites - they need to make money somehow.

If I saw an advert on TV for gold coins, I would not assume the TV company had actually checked the coins were not fake.

I'd assume that the bullion company had paid enough money to the TV company to get an advert on TV.0 -

I'm not saying that it takes a sophisticated investor to see through these "investments" - far from it. But the only way these products attract investment is to pull in those who do not understand them.David_Evans wrote: »I am far from being a sophisticated investor.

But I know that comparison sites are only really advertising sites - they need to make money somehow.

If I saw an advert on TV for gold coins, I would not assume the TV company had actually checked the coins were not fake.

I'd assume that the bullion company had paid enough money to the TV company to get an advert on TV.

You seem to be confusing these shill sites with legitimate comparison sites, which do not mislead the consumer and which provide a useful service to those looking for the best savings rates.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards