We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Where is the best place to put a lump sum of money

L_A86

Posts: 4 Newbie

I have over £20k which is currently in my bank accounts savings account but the interest is rubbish.

The savings are likely to increase to over £30k in the next few months.

I would like to move the lump sum to get a better interest rate- I need to have access to the money as it could be used in the next 6-9 months for renovation work.

I have looked on here and seen some better interest rates, am I better off going for a higher rate savings account or an ISA.

Please help?

The savings are likely to increase to over £30k in the next few months.

I would like to move the lump sum to get a better interest rate- I need to have access to the money as it could be used in the next 6-9 months for renovation work.

I have looked on here and seen some better interest rates, am I better off going for a higher rate savings account or an ISA.

Please help?

0

Comments

-

There are various high interest savings accounts available, most with a cap on how much can be paid in. You may need to open various current accounts to be able to use these. See the savings link on this website."We act as though comfort and luxury are the chief requirements of life, when all that we need to make us happy is something to be enthusiastic about” – Albert Einstein0

-

In your situation I'd probably stick it in Marcus at 1.5%. You can safely put up to £85k into this account.

Sure, you can open various current accounts and regular savers, but the difference between 1.5% and 3% on £30k for 6 months is £22.50.

EDIT: Woops, it's £225, not £22.50. Maybe it is worth doing after all 0

0 -

In your situation I'd probably stick it in Marcus at 1.5%. You can safely put up to £85k into this account.

Sure, you can open various current accounts and regular savers, but the difference between 1.5% and 3% on £30k for 6 months is £22.50.

I've registered for an account with Marcus, waiting for it to be processed.Save £12k in 2019 #154 - £14,826.60/£12kSave £12k in 2020 #128 - £4,155.62/£10k0 -

If you have a specific date that you need the money for then a cash ISA is likely to be pointless as you can get better rates outside.I have looked on here and seen some better interest rates, am I better off going for a higher rate savings account or an ISA.

Please help?

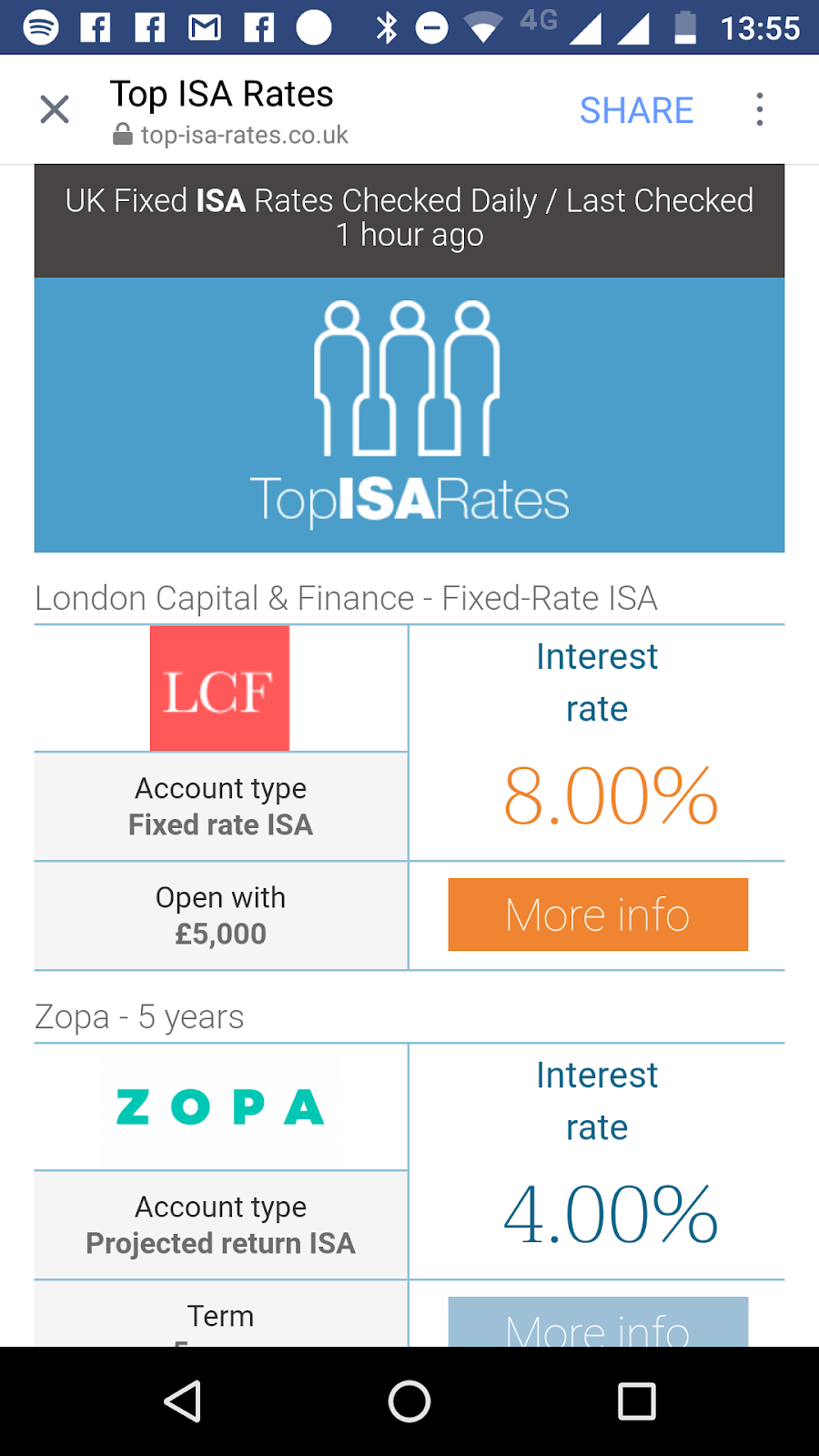

Just be VERY careful when you search online for best rates. Not every ISA that is listed is a cash ISA. The example below is one that could lose your money as it's an unregulated, high risk investment ISA but it is an ISA. Wasn't sure if you were aware of the difference as you'd not mentioned cash ISA. Remember the saying: if it looks too good to be true it almost certainly is.0

Remember the saying: if it looks too good to be true it almost certainly is.0 -

Thank you, we thinking of fixing it for a year now to get a better interest rate.0

-

Two of you? £20K? A brace of sole and one joint Nationwide FlexDirect account would see £7.5K of the £20K make £366 over a year. Drip feeding another £6K of the remaining £12.5K from a 1.5% savings account to a pair of Nationwide's regular savers would make another £203.Thank you, we thinking of fixing it for a year now to get a better interest rate.

The remaining £6.5K if left in the 1.5% savings account would make £97.

So that's a total of £666, equivalent to 3.33%. And all of it easily accessible without penalty.

What's the best one year - totally inflexible - fixed rate account paying?

Not convinced? OK, how about a couple of switching incentives thrown in at £200 each by referring each other for the FlexDirect accounts. Now we're up to £1,066...or a 5.3% gross return on your £20K.0 -

Thank you that is alot to take in.

I thought the flex direct you have to pay in £1000 a month to get the 5% on up to £2500. How is it £7.5k ?0 -

-

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards