We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Second cash Lifetime ISA to launch next week - MSE News

Former_MSE_Megan_F

Posts: 418 Forumite

Nottingham Building Society will launch its cash Lifetime ISA on Tuesday - making it only the second provider to offer this type of savings account, which gives a 25% bonus for buying your first home or to put towards your retirement...

Read the full story:

'Second cash Lifetime ISA to launch next week'

Click reply below to discuss. If you haven’t already, join the forum to reply.

'Second cash Lifetime ISA to launch next week'

Click reply below to discuss. If you haven’t already, join the forum to reply.

Read the latest MSE News

Flag up a news story: news@moneysavingexpert.com

Get the Free Martin's Money Tips E-mail

Flag up a news story: news@moneysavingexpert.com

Get the Free Martin's Money Tips E-mail

0

Comments

-

MSE_Megan_F wrote: »Nottingham Building Society will launch its cash Lifetime ISA on Tuesday - making it only the second provider to offer this type of savings account, which gives a 25% bonus for buying your first home or to put towards your retirement...Read the full story:

'Second cash Lifetime ISA to launch next week'

Click reply below to discuss. If you haven’t already, join the forum to reply.

Bit pointless matching Skipton's rate. Even 1.1% would've attracted more customers.0 -

Skipton did increase the rate from 0.5% to 1%, only half of which is explained by the base rate increase. Is it possible they knew of Nottingham's launch and had to react?0

-

Malthusian wrote: »Skipton did increase the rate from 0.5% to 1%, only half of which is explained by the base rate increase. Is it possible they knew of Nottingham's launch and had to react?

More like Nottingham reacted to Skipton.0 -

No, they followed both base rate increases separately, by going from 0.5% to 0.75% immediately following last November's base rate rise and then tracking this month's one independently of that.Malthusian wrote: »Skipton did increase the rate from 0.5% to 1%, only half of which is explained by the base rate increase. Is it possible they knew of Nottingham's launch and had to react?0 -

The fact that they won't allow transfers from other LISAs or HTB ISAs is a terrible decision... I expect them to most likely receive little to no new business as I believe the majority of people who both know about what a LISA is and can make use of this product have already committed elsewhere.0

-

But that doesn't take into account the fact that there are circa 60,000 18th birthdays every month, so there's a constant stream of savers who are newly eligible.The fact that they won't allow transfers from other LISAs or HTB ISAs is a terrible decision... I expect them to most likely receive little to no new business as I believe the majority of people who both know about what a LISA is and can make use of this product have already committed elsewhere.

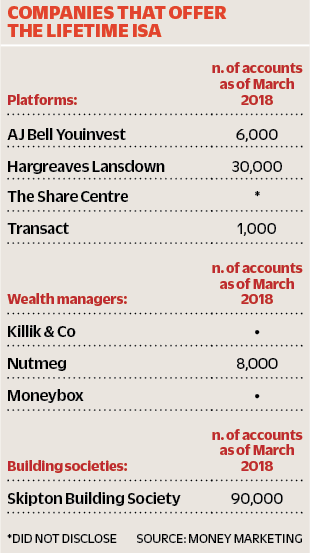

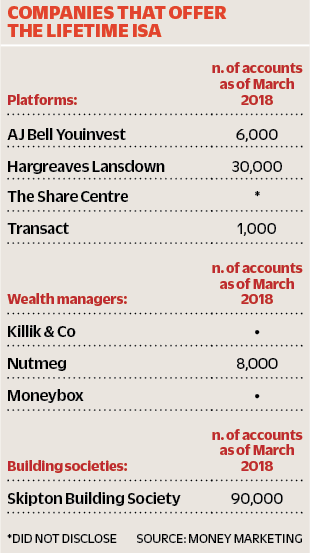

Couple that with the relatively low number of LISAs that had been opened by March this year and it's easy to see that there's plenty of potential new business out there, which will become more apparent as we head towards next year's retirement of the HTB ISA scheme: 0

0 -

Malthusian wrote: »Skipton did increase the rate from 0.5% to 1%, only half of which is explained by the base rate increase. Is it possible they knew of Nottingham's launch and had to react?

I was told in branch is was supposed to be launched in July but the base rate news made them delay to end of August. Obviously in anticipation of Skipton raising the rate.0 -

But that doesn't take into account the fact that there are circa 60,000 18th birthdays every month, so there's a constant stream of savers who are newly eligible.

Couple that with the relatively low number of LISAs that had been opened by March this year and it's easy to see that there's plenty of potential new business out there, which will become more apparent as we head towards next year's retirement of the HTB ISA scheme:

Foresters Friendly Society do one too.

https://www.forestersfriendlysociety.co.uk/saving-investing/lifetime-isa/at-a-glance/Free the dunston one next time too.0 -

The article says you won't be able to transfer in from any existing LISAs or H2BISAs.

Does that mean you can transfer from cash ISAs or not (just curious doesn't affect me) seems weird.

No transfers is rather annoying, I've got a Skipton Lisa and I'd rather have it with Nottingham than Skipton as I've got a branch within walking distance (the closest Skipton is 30 miles away) and I've got other accounts with Nottingham, would be easier to have it in one place.If you don't like what I say slap me around with a large trout and PM me to tell me why.

If you do like it please hit the thanks button.0 -

how many LISA I can actually have? 1 or more?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards