We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

UK Government's July surplus at 18-year high

Comments

-

The government has less chance of defaulting than an private individual. That's about as factual as statements about economics get.

You have neatly illustrated antrobus' point. The relevant risk is not the risk that the government defaults. The risk is that the project fails, e.g. the houses fall down or have to be rebuilt all over again to make them safe, or are built in a place where no-one wants to live.

Acting as if this risk, the risk of the housebuilding project being a failure, doesn't exist because the Government isn't going to default on the debt, leads to bad decisions. E.g. spending taxpayers' money on building worthless houses.

No, it's a boring commonplace coincidence. Household debt has increased since the year dot. Richer households can afford to borrow more money.Household debt has spiralled since austerity started. It is not some crazy coincidence.0 -

The UK government is not even remotely close to going bust. This was a false narrative peddled by right wingers about 8 years ago that has never left ...

So you say. But this is an economics forum, not a political one....

Greece and Venezuela chronically mismanaged their finances - as part of that they took on far too much debt.

Yes, exactly the point. Mismanagement of finances leads to excessive debt, which leads to a great deal of pain....

It is a naively simple deduction to then say that all national debt is damaging to the economy, but also a very simple narrative to sell to a public who don't understand economics....

Neither I nor anyone else has suggested any such thing on this thread....

The government has less chance of defaulting than an private individual. That's about as factual as statements about economics get. Risk premiums do not provide security when large numbers of people default....

Exactly that's the point the gilt rate is the risk free rate. But you appear not to understand that the risk premium is an economic fact....

When the government reduces money there is less money in the economy, and in particular less money going to the lowest portions of society (receivers of benefits and the majority of government paid employees). These people's living costs have not fallen, and therefore to get by going into debt is there main option.

The government has not reduced money. Billions in QE. Did you miss that?...

It's a very simple equasion. If you reduce the amount of money the government is putting into the economy then there is going to be a shortfall. If standards and costs of living remain equal and wages do not grow, as has happened, then private debt is the only real source or replacement for the money that has left the economy due to reduced government spending.

Household debt has spiralled since austerity started. It is not some crazy coincidence.

The recent increase in household debt is largely an increase in unsecured debt; largely credit cards and PCP motor deals. I can't see how the public's enthusiasm for 0% CC deals, or bright shiny new motor cars has any thing to do with government spending.

Besides you appear not to understand that government spending is a zero sum game in terms of aggregate demand. The government raises a few billion in taxes and spends those billions on whatever it likes. All that means is that individuals will spend x billions less, and exactly replaced by government of x billion.

Aggregate demand is only increased when governments run at a deficit. Which most of them do, apart from the likes of Norway. But the reality is that the deficit as a percentage of GDP needs to (over the economic cycle) at or lower than the growth in nominal GDP. Otherwise the pile of debt keeps increasing. In the worst worst case you end up bust, in the least worst case, the interest bill keeps rising, which has to be paid for somehow.

As a rule of thumb, the UK deficit needs to be about 2% or less of GDP. The EU works on a maximum of 3%. That's what is known as sustainable. The 10& deficit we had back in 2008ish was unsustainable. Something needed to be done. The deficit needed to be reduced. You have only two choices, cut spending or increase taxes. What's your pleasure?0 -

Ten years ago we had an idiot government who managed to get the annual deficit up to 10%+ of GDP. A few years of that and we'd have gone bust. Since 2010 we've had various flavours of government who have at least tried to sort the mess out. The fact that we are now in a position of 'fiscal sustainability', at least in the short term, means that the government can chuck a few extra billion quid at the NHS, social care, housing, free broccoli for the poor, or whatever your priorities are, can only be a good thing.

Ten years ago was the nadir of the Global Financial Crisis, are you suggesting that the Tory govt would not have applied similar remedies to the Labour govt to stave off disaster ( like bailing out banks)?'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Depends on what institutional demand is like at some point in the future.

Will be International demand that determines the price/yield. The UK is hardly flush with savings currently. Wouldn't take much for the annual interest bill to be the same as the total amount spent on the NHS. There's much work yet to bring debt levels back within manageable levels and on a long term stable footing. As history has shown only tales one maverick to reek havoc.0 -

The deficit needed to be reduced. You have only two choices, cut spending or increase taxes. What's your pleasure?

I would vote to hold spending stable and, through good economic policy, raise the national GDP above the rate of inflation, reducing the deficit.0 -

I would vote to hold spending stable and, through good economic policy, raise the national GDP above the rate of inflation, reducing the deficit.

GDP figures are adjusted for inflation, so if GDP growth is positive it's higher than inflation.

What you've described is basically what the government did.

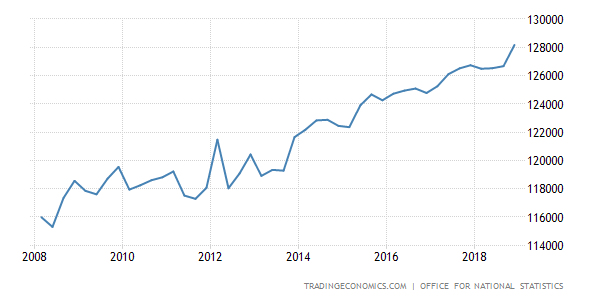

UK Gov spending courtesy of Trading economics: “I could see that, if not actually disgruntled, he was far from being gruntled.” - P.G. Wodehouse0

“I could see that, if not actually disgruntled, he was far from being gruntled.” - P.G. Wodehouse0 -

What you've described is basically what the government did

Are you seriously trying to claim that spending has not been cut since 2009?

There are a lot of muddying factors, like tax increases, increased pension contributions etc that mean the total figures do not always look like a drop. But the point is, the governments strategy was very clearly to take an axe to public spending to reduce the deficit. This is what they campaigned for, what they believe in and what they did. e.g. https://www.ifs.org.uk/publications/9180 (you have to read the whole thing unfortunately)

I'm well aware it's failed and that the state has barely shrunk at all, mianly because of very sluggish GDP growth. But it's surely undebatable that the policy was to cut spending instead of holding it steady?0 -

I'm well aware it's failed and that the state has barely shrunk at all, mianly because of very sluggish GDP growth. But it's surely undebatable that the policy was to cut spending instead of holding it steady?

Unsure where you get that impression from. While not headline breaking news. People haven't been sitting around idly twiddling their thumbs over the past few years. Always was going to a long slow drawn out process. Savings in many instances take time to achieve. As there's an upfront cost first to bare.

Government spend likewise impacts GDP. Much as the £25 billion of PPI payouts have. Hardly surprising consumer spend is suffering as a consequence that the peak has passed.0 -

-

Malthusian wrote: »It is unnecessary to claim facts.

A reduction in planned increases to expenditure is not a cut.

Indeed, as well as freezes, and capping increases to 1% where the economy is growing more and inflation is higher.

I do think it's a bit of a myth that there were these great swingeing cuts to the state. It has certainly declined but not to the huge scale that people seem to think.“I could see that, if not actually disgruntled, he was far from being gruntled.” - P.G. Wodehouse0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards