We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

UK Government's July surplus at 18-year high

worldtraveller

Posts: 14,013 Forumite

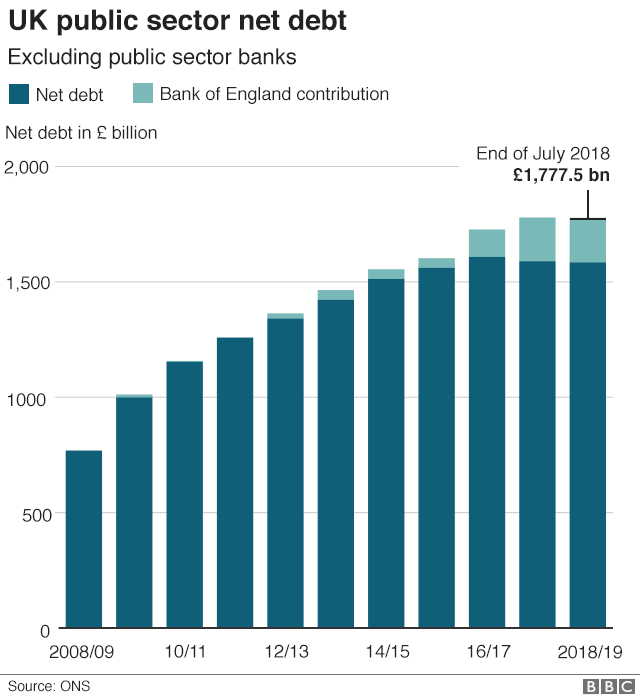

The government's finances were in surplus by £2bn last month, the biggest surplus for July in 18 years, official figures show.

The figure was up from a surplus of £1bn a year ago.

At the same time, borrowing in the April-to-July period fell to its lowest level since 2002.

Analysts said the reduction in borrowing should give Chancellor Philip Hammond extra money to play with in the Budget this autumn.

Borrowing for the financial year so far has reached £12.8bn, £8.5bn less than in the same period in 2017, the Office for National Statistics said.

BBC News

The figure was up from a surplus of £1bn a year ago.

At the same time, borrowing in the April-to-July period fell to its lowest level since 2002.

Analysts said the reduction in borrowing should give Chancellor Philip Hammond extra money to play with in the Budget this autumn.

Borrowing for the financial year so far has reached £12.8bn, £8.5bn less than in the same period in 2017, the Office for National Statistics said.

BBC News

There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...

0

Comments

-

Household debt in UK is worse than at any time on record.

The reduction in government spending is only pushing debt onto consumers. It hasn't improved our economy or our living conditions, in fact quite the opposite.

For example, if the government borrowed a load of money, it could build a load of houses. The government borrows at lower rates and is secure. House prices might return to normal levels and people would have to borrow less individually to buy houses. More people could then own houses, and society would be much better off, with probably a similar amount of total debt, but at lower interest rates and with the security of our collective tax money.

Isn't this what governments are for? Pooling resources for mutual gain? As a country our society and economic model is built on debt, it cannot operate without it. I don't personally see how trying to run it so that all debt is shouldered individually, rather than collectively via the government, makes any economic sense at all.0 -

The government currently borrows at lower rates and is secure.collectively via the government, makes any economic sense at all.

The huge debt pile is going to require refinancing in the future. One eye has to be on the future when the servicing costs will be far higher. The UK cannot roll it's credit card balance over to another 2% card indefinately.0 -

...

The reduction in government spending is only pushing debt onto consumers. ...

How exactly does that work?..

For example, if the government borrowed a load of money, it could build a load of houses. The government borrows at lower rates and is secure. ...

Bad economics.

Governments can borrow a load of money to do anything. They can frequently do so at lower rates, because lenders believe there is little risk of default. Hence gilt yields are regarded as a risk free rate of return.

If the private sector wants to borrow money to do something it has to pay a risk premium, depending on the risk of what it's'doing. If a government chooses to do the same thing, the risk still exists, and the risk premium is the same. Pretending that it doesn't exist, and not accounting for it properly, simply leads to bad decisions....

Isn't this what governments are for? Pooling resources for mutual gain? As a country our society and economic model is built on debt, it cannot operate without it.

The first thing a government is for is not to go bust. Unpleasant things happen to nations whose governments pile on the debt willy nilly. See Greece. See Venezuela, Etc and so forth,

Ten years ago we had an idiot government who managed to get the annual deficit up to 10%+ of GDP. A few years of that and we'd have gone bust. Since 2010 we've had various flavours of government who have at least tried to sort the mess out. The fact that we are now in a position of 'fiscal sustainability', at least in the short term, means that the government can chuck a few extra billion quid at the NHS, social care, housing, free broccoli for the poor, or whatever your priorities are, can only be a good thing.0 -

Thrugelmir wrote: »The huge debt pile is going to require refinancing in the future. One eye has to be on the future when the servicing costs will be far higher. The UK cannot roll it's credit card balance over to another 2% card indefinately.

Weighted average gilt yield is currently about 1.5%. Projected to gradually rise to 2.2% by 2020-21.

http://obr.uk/docs/dlm_uploads/The-outlook-for-debt-interest-spending.pdf

And the UK tends to borrow long, so there are no anticipated shocks in the pipeline.0 -

The first thing a government is for is not to go bust.

The UK government is not even remotely close to going bust. This was a false narrative peddled by right wingers about 8 years ago that has never left

Greece and Venezuela chronically mismanaged their finances - as part of that they took on far too much debt. It is a naively simple deduction to then say that all national debt is damaging to the economy, but also a very simple narrative to sell to a public who don't understand economics.If a government chooses to do the same thing, the risk still exists, and the risk premium is the same.

The government has less chance of defaulting than an private individual. That's about as factual as statements about economics get. Risk premiums do not provide security when large numbers of people default.How exactly does that work?

When the government reduces money there is less money in the economy, and in particular less money going to the lowest portions of society (receivers of benefits and the majority of government paid employees). These people's living costs have not fallen, and therefore to get by going into debt is there main option.

It's a very simple equasion. If you reduce the amount of money the government is putting into the economy then there is going to be a shortfall. If standards and costs of living remain equal and wages do not grow, as has happened, then private debt is the only real source or replacement for the money that has left the economy due to reduced government spending.

Household debt has spiralled since austerity started. It is not some crazy coincidence.0 -

Weighted average gilt yield is currently about 1.5%. Projected to gradually rise to 2.2% by 2020-21.

http://obr.uk/docs/dlm_uploads/The-outlook-for-debt-interest-spending.pdf

And the UK tends to borrow long, so there are no anticipated shocks in the pipeline.

The BOE isn't going to rollover £435bn of QE bought assets indefinately. 2020-21 is short term. Unwinding of QE and funding future spend may pose problems for much of the Western world.0 -

Thrugelmir wrote: »The huge debt pile is going to require refinancing in the future. One eye has to be on the future when the servicing costs will be far higher. The UK cannot roll it's credit card balance over to another 2% card indefinately.

There's an interesting article on the guardian at the moment. Essentially, an article on "hidden debt".

Shelter estimate that some households owe a further £19bn to the government. This is made up of tax credit repayments, council tax arrears etc etc.

The government is being urged to release such figures, but it was stated not to be in our interest.

So on top of the debt figure, you have a hidden debt. This debt (arrears) is mostly held by those who are burdened with the other debt.

I don't believe it's £19bn as shelter estimate, but got to be some reason why the government don't wish to release the figures?0 -

Thrugelmir wrote: »The BOE isn't going to rollover £435bn of QE bought assets indefinately. 2020-21 is short term. Unwinding of QE and funding future spend may pose problems for much of the Western world.

IIRC, the BOE bought up billions of government debt under QE. I read somewhere that the BOE, if it wished, could simply cancel the debt. How would that work?0 -

IIRC, the BOE bought up billions of government debt under QE. I read somewhere that the BOE, if it wished, could simply cancel the debt. How would that work?

Would simply leave the "cash" in the system. Downside could potentially be stagflation. No one knows how the experiment is going to pan out. Though global debt is now higher than it was in 2008.0 -

Thrugelmir wrote: »The BOE isn't going to rollover £435bn of QE bought assets indefinately. 2020-21 is short term. Unwinding of QE and funding future spend may pose problems for much of the Western world.

Well yes. But there are no plans to unwind QE purchases within the timescales of the OBR report. Eventually the BoE will have to do so. Flogging an extra £435bn of gilts on the market would probably mean a few extra basis points. Who knows? Depends on what institutional demand is like at some point in the future.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards