We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

MSE News: Bank switches topped 950,000 in past year - here are the winners and losers

Former_MSE_Naomi

Posts: 519 Forumite

Increasing numbers of current-account holders are switching banks, with almost one million switches taking place in the last 12 months according to the latest figures - here's how your bank fared and how to bag up to £185 in vouchers for switching...

0

Comments

-

Nationwide have lost the top 'net gain' position to Halifax.... perhaps due in part to Nationwide's killing off the revolving 5% FlexDirect loophole?

Surprising Halifax did so well though...

...and it should be pointed out the figures predate Barclays sudden fit of generosity. "In the future, everyone will be rich for 15 minutes"0

"In the future, everyone will be rich for 15 minutes"0 -

Would be nice to see as a percentage of their total current account customers otherwise the figures are not that useful.0

-

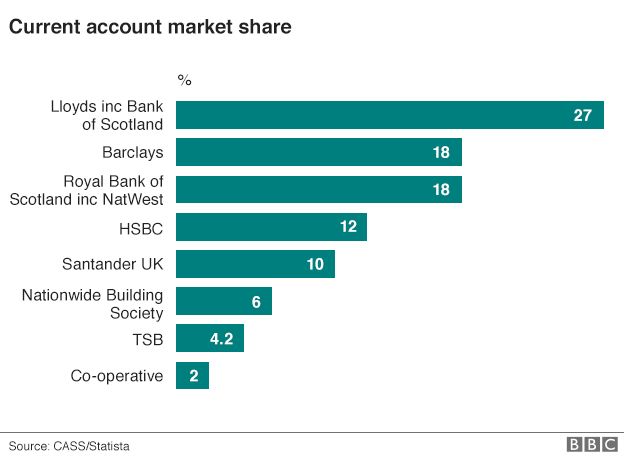

There doesn't seem to be a vast amount of readily-accessible public domain data about current account volumes by bank, but they can be approximated from the total volume being in the order of 70m accounts and (2014) market share at group level being:Would be nice to see as a percentage of their total current account customers otherwise the figures are not that useful.

As the MSE commentary notes, "these growing numbers still represent a tiny fraction of UK current account customers".0 -

Thanks - a very interesting graph have not seen it before0

-

I wonder how many of those 950,000 switches are MSErs withing multiple times in the same year...

If those are really the net movements for these banks through switching most of which will have been driven by cash incentives, then the amount of referral / cashback money they must have paid out to achieve these pretty minor movements cannot surely have been justified, especially where there's been a net loss (not that I'm complaining if someone wants to give me free cash ) 0

) 0 -

For assessing the cost of promotions, it's not really the net (gains minus losses) figure that's relevant but the larger total gains number, in that most of the gains will have resulted in a bonus being payable regardless of how many customers left, assuming that the baseline volume outside of promotional periods is mostly 'genuine' switchers of 'main' accounts, and that the extra joiners will largely be doing do to qualify for the incentive.If those are really the net movements for these banks through switching most of which will have been driven by cash incentives, then the amount of referral / cashback money they must have paid out to achieve these pretty minor movements cannot surely have been justified, especially where there's been a net loss (not that I'm complaining if someone wants to give me free cash )

)

The effect of such promotions can be seen by comparing gains from one quarter to the next, which are conveniently published side by side this quarter, as the reporting period moves from six months in arrears to three months, as per page 4 at https://www.bacs.co.uk/DocumentLibrary/CASS_dashboard_-_published_25_Jul_18.pdf0 -

And if you add both half yearly sets of figure together Nationwide is the clear winner and Barclays the clear loser.0

-

We have been with Barclays for over 25 years and never had any problems with them. I wouldn't switch away for a few quid. Opening additional accounts, like Tesco, for the interest rate, was the only move I considered worth making.I came into this world with nothing and I've got most of it left.0

-

Wanting to retain your existing current account is understandable but is by no means a reason for not switching [another account, even if you have to specifically open one] for a switch bonus. As we have discussed on several occasions, having more than one current account with separate financial institutions seems to be a very prudent thing these days, anyway.Shakin_Steve wrote: »We have been with Barclays for over 25 years and never had any problems with them. I wouldn't switch away for a few quid. Opening additional accounts, like Tesco, for the interest rate, was the only move I considered worth making.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.6K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards