We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The light is well and truly on!'

Comments

-

I have two current accounts, one has all my income coming in and my bills go out of that one and one I transfer money over to weekly for food, petrol, pocket money and general spending.

Then I have the following savings accounts:

Contingency

Clothes

House maintenance

Car (includes tax, insurance, maintenance and breakdown)

Presents

Holiday childcare

Holiday

Isa (for house deposit)

I get money in weekly so I have set up a standing order to come out of my current account to each of those savings accounts each week. When I started in January this year I found I was using the weekly savings amounts each week especially clothes, but now I have some money saved up in there which will help with things like school shoes etc.

I suppose you could have one savings account and then keep track of what each bit of money is in there for on a spreadsheet but I like to have separate accounts so I can see at a glance how much I have in each category.

I have only been doing this since January and I have seen such an improvement in my spending habits since then. I have had some luck with my debts but in general giving myself so much to spend each week really helps.0 -

Was it a hassle to open the various accounts?

We have our joint current account with Nationwide, then DH's current account (he's had it since a student!) that is where all our bills come out of.

I have a cashbuilder account with nationwide too. This was pretty much dormant until January this year when I started the virtual sealed pot challenge over on the other board, so it currently has over £130 in there (incidentally, I forgot about it in my SOA). Its not for anything in particular, but I don't want to touch it, so I'm kind of forgetting about it.

I also have a Smile (co op) savings account. Our child benefit goes into that and I transfer it if and when I need too. Any money I make from sewing also goes in there, and I try to keep that for holidays and Christmas.

For some reason (and I don't know why) I am nervous of having lots of bank accounts. Maybe its because I've been struggling with keeping track of direct debits, and the thought of money moving from our current account worries me. I don't think I'm explaining that well though!!!Virtual Sealed Pot No.070 -

Frustratingly, I've just had an email to say that one of the direct debits I've moved today isn't allowed. Its the council sports centre one of £28.50. As its a cheap rate as I am an employee, it can't come out of an account that is solely in my husbands name

I've already increased the dd to that account taking this amount (£28.50) into account. I feel like I'm paying for it twice now

I've already increased the dd to that account taking this amount (£28.50) into account. I feel like I'm paying for it twice now  I guess I could change it again though, but I wanted it all to be streamlined

I guess I could change it again though, but I wanted it all to be streamlined  Thats burst my bubble a bit. Virtual Sealed Pot No.070

Thats burst my bubble a bit. Virtual Sealed Pot No.070 -

Morning!

I had a lovely night out with friends last night, I only spent the money I'd been given for the cushion I'd made, so I was pleased with that! We had a fun night, and it didn't cost a lot

Bank balance checked this morning and all is looking ok there. I'll certainly be able to pay extra off my Next or littlewoods account, but want to wait until my pay goes in next week to do that. In the meantime, I'm still PADding the next account daily! It's surprising how that makes a difference, but it's time to make bigger differences too!

Today will be food shopping, My freezer stash of meat is running low and I've got a musclefood order scheduled for next week, so it'll be a make do week until then!

I'm going out with a friend this afternoon to do some geocaching, no spends, but some fresh air

This evening, my youngest daughter is sleeping over her friends house as a birthday sleepover! Somehow though, I've agreed to daughter no.3 having a friend here to sleep!!! So the adult:child ratio is not decreased at all, but I fear my sleep will this tonight!!!

After sorting a lot of things out moneywise yesterday, I feel the need to do something today too! I guess the keeping a cap on spending is what I'm doing, but I feel I should be doing more!! At the moment I'm trying to get into a more conscious mind about spending money, it's working, so it's all good!

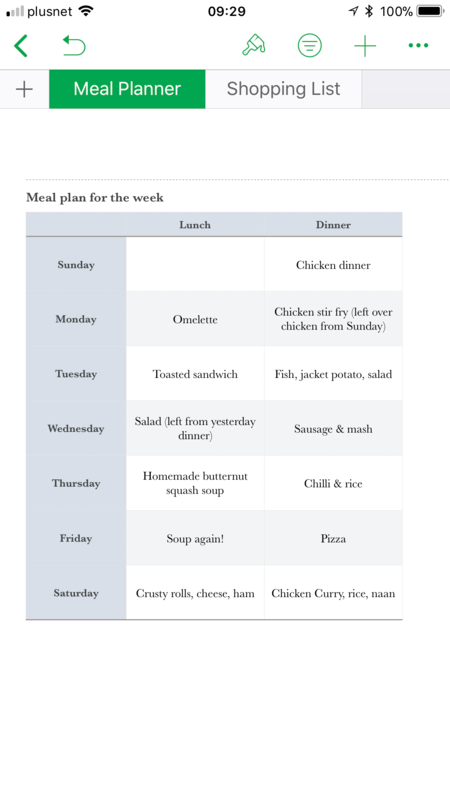

Right, I've finished my cup of tea so I'm going to leave you for now, I'll be back later with my meal plan and grocery spends!

Have a good day everyone xxVirtual Sealed Pot No.070 -

Ooooh got me wanting a Jacket Potato now! I always forget these when I'm meal planning!0

-

Grocery shopping done £42.50 spent at Lidl. I actually prefer Aldi, and think it's cheaper, but it's about 22 miles further away! There's a new Aldi being built a few miles away though

Virtual Sealed Pot No.070

Virtual Sealed Pot No.070 -

Morning!

Dh is working 9am-9pm today, the type of job he does means there's no pay enhancement for working a weekend, so it sometimes feels like it just eats into family time. But it's got to be done so no point in moaning!

Talking of moaning, I had a down day yesterday, or should I say evening. We have to do daughter #2 student finance application and all I could see was debt and it just feels never ending. Daughter then had a typical teenage hissy fit about how she can't get a job and study, even the school have apparently said her chosen degree will be a extremely hard work and no time for anything else - I doubt that very much!!!

and it just feels never ending. Daughter then had a typical teenage hissy fit about how she can't get a job and study, even the school have apparently said her chosen degree will be a extremely hard work and no time for anything else - I doubt that very much!!!

Just feels all too much at the moment ;(

I'll bounce back, I always do, I'm just fed up of having to at the moment.Virtual Sealed Pot No.070 -

Don't worry about DD2 - I imagine once she's settled in and realises she wants money for going out etc she'll make it work!

0

0 -

She'll have to...

I'm going to go out for a few hours, walk the dog etc, hopefully it'll clear my head a bit...Virtual Sealed Pot No.070

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards