We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Blackmore Bond

bosphorus54

Posts: 3 Newbie

Hi,

I was wondering if anyone had an experience with Blackmore Bond and would recommend it?

Thanks

I was wondering if anyone had an experience with Blackmore Bond and would recommend it?

Thanks

0

Comments

-

Blackmore comes up regularly, use the search function. It is not a cash savings product if that's what you thought, there is no FSCS protection and you could lose all your money. See its risk page

https://www.blackmorebonds.co.uk/risk-factors0 -

And if you want to know more about the people behind Blackmore, I highly commend to you this list of articles which the directors have had removed from Google via a spurious defamation complaint.

Note that none of the articles have actually been ruled as defamatory in a court of law, or even subject to a defamation suit, to the best of my knowledge.

(8-11 are irrelevant as Blackmore Partners in the US are a different firm, but somehow they got caught up anyway.)

https://www.lumendatabase.org/notices/159452930 -

bosphorus54 wrote: »Hi,

I was wondering if anyone had an experience with Blackmore Bond and would recommend it?

Thanks

Personally, I would not recommend a 100% loss potential, very high-risk unregulated investment with no FSCS protection to hardly anyone.

What is it about such a high risk option that you have been drawn to it?I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Anyone attracted to Blackmore Bonds may want to consider the fate of London Capital bonds where investors are waiting to find out if they get any money back

https://forums.moneysavingexpert.com/discussion/5346049/london-capital-and-finance&page=23

From the link in post #3 above it appears that Blackmore bonds are trying to get any review on MSE removed from Google so they don't appear in searches. These 4 threads on MSE no longer appear on Google

https://forums.moneysavingexpert.com/discussion/5609965

https://forums.moneysavingexpert.com/discussion/5608646

https://forums.moneysavingexpert.com/discussion/5594752

https://forums.moneysavingexpert.com/discussion/5558563

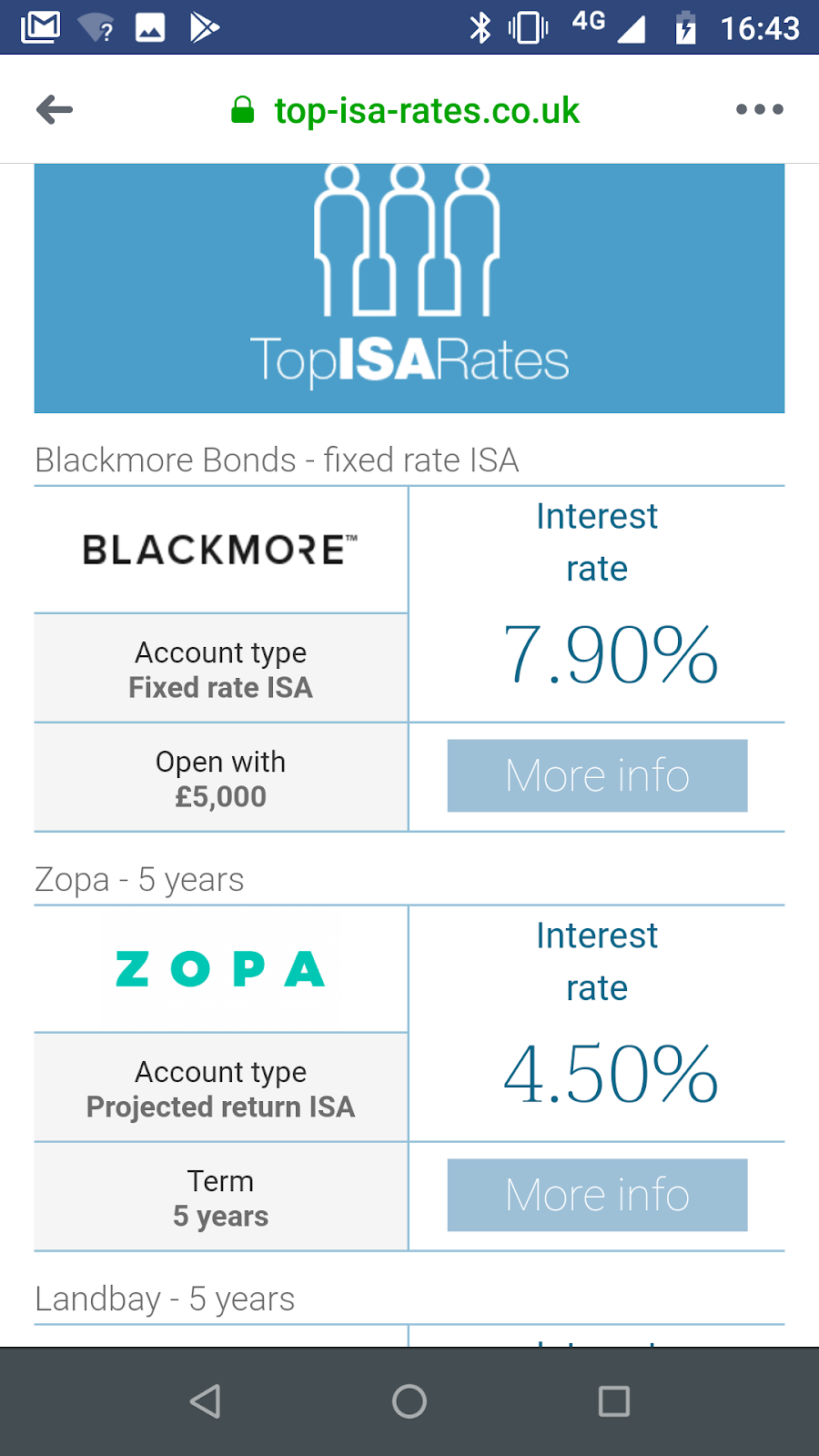

Blackmore Bonds are being promoted heavily by a website called Top ISA rates with some incredibly misleading information linking them to cash ISAs - they are nothing of the sort. That's before even looking at the history of the people behind Blackmore bonds and the investors that have previously lost money with them.

https://damn-lies-and-statistics.blogspot.com/2019/01/top-isa-rates-misleading-fake.html

Remember the saying: if it looks too good to be true it almost certainly is.0

Remember the saying: if it looks too good to be true it almost certainly is.0 -

At the present time you have,

Low Risk

Best 5 year fixed savings in a bank = 2.7%.

This is protected by the FSCS scheme up to £85,000.

Medium Risk

The FTSE 100 has a dividend yield of about 4%.

This is a risk investment with the 100 largest companies in the UK.

High Risk

In my opinion, this anything which claims to offer a return anywhere near twice that of the FTSE 100 (i.e. 8%).

Remember the saying:

If it looks to good to be true, you do not understand the risks involved.0 -

Before investing in any such ultra high risk mini bonds you had better say goodbye to your money as you might not see it again.0

-

Look up Blackmore Bonds Plc at Companies House before you invest.0

-

If you are looking for an investment with the potential to lose all your money with no redress, this is absolutely one to strongly consider.0

-

I can smell them from here and the smell isn't decent at all. Stay away unless you want to waste the money and never see it again!Save £12k in 2019 #154 - £14,826.60/£12kSave £12k in 2020 #128 - £4,155.62/£10k0

-

Like with P2P lending etc a critical point is what % of your investments are involved in these types of products

Taking a risk to get 8% return with 5% of your investable funds is one thing , punting 50% is quite another .0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards