We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

New Build - Paid SUBSTANTIALLY more than neighbour

Comments

-

It's a bit like talking to the guy in the seat next to you on a Ryanair flight...

Simple answer is that if you'd waited until the developer got desperate to shift the last few plots, you may have found there were none left. You got in early, you got the full choice.

What is it really £30k to use the toilet onboard now?0 -

Crashy_Time wrote: »No it isn`t, it is 30k, and as rates rise he is paying interest on it, the sooner debt is priced at sensible rates again the sooner people will stop thinking that getting into a few 100k debt is like buying a fish supper up the road, and hopefully more over-charging developers will start going bust

Sadly, the end of this tale isn't confirmation of impending doom, but rather a suggestion that we should become quantity surveyors...:D

Anyway...rent is debt for life.0 -

Given I work in PR, it would be fantastic....Guys, firstly I want to thank everyone for the replies on this. It's appreciated and has made me realise what not to do in the future.

However, today the plot thickened.

So, we had our demo visit today and the site manager, lovely man, let slip that Plot 11 was actually being bought by the Developers own quantity surveyor. I could see the sales rep twitching as he was saying it because she's aware I have logged this as a complaint with their head office (what you don't ask, you don't get right? I'm sure they don't want an unhappy resident 3 doors from the site office).

Now, are there any rules around insider trading or anything on sites like this? Given he's the company's Senior Quantity Surveyor for the region (found out his name and looked him up), surely there's something unethical about me being in a purchase process, 2 doors down having £31k knocked off the asking price and then a day or two later an offer being accepted on it from the Employee?

Again, I think it's a code of ethics, insider trading or something along those lines. The PR would obviously be poor so I'll not name the developer until they don't give me a satisfactory resolution!

Come work for us! We offer a discount on your home purchase if you buy on one of our new estates.

You're clutching at straws. They could give the house to him for free if they wanted to.0 -

FWIW, this is the main reason why developers are so keen to give incentives like stamp duty and upgrades rather than drop the price!0

-

ReadingTim wrote: »How many years have you been saying that now Crashy? And have any of your hopes and dreams come true? Thought not.

http://forums.moneysavingexpert.com/showpost.php?p=66170152&postcount=7

At least 3 and a half years.

House prices have gone up by around £35k on average in that time - https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/december2017

Give or take, £10k per year added to the fact home owners would have paid down some of their Mortgage in that time and probably paid less on a Mortgage than they would have in rent.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

Sadly, the end of this tale isn't confirmation of impending doom, but rather a suggestion that we should become quantity surveyors...:D

Anyway...rent is debt for life.

http://www.dailymail.co.uk/wires/pa/article-5434005/UK-mortgage-bill-increase-10-billion-1-rate-rise.html

People have been taking out 30 year mortgages though, they would have been better with the flexibility of renting, at least they would be able to move somewhere else without waiting years for a buyer?0 -

http://forums.moneysavingexpert.com/showpost.php?p=66170152&postcount=7

At least 3 and a half years.

House prices have gone up by around £35k on average in that time - https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/december2017

Give or take, £10k per year added to the fact home owners would have paid down some of their Mortgage in that time and probably paid less on a Mortgage than they would have in rent.

How have house sales done in that time? Don`t forget, a large number of people believed that property would be their pension.......0 -

Crashy_Time wrote: »http://www.dailymail.co.uk/wires/pa/article-5434005/UK-mortgage-bill-increase-10-billion-1-rate-rise.html

People have been taking out 30 year mortgages though, they would have been better with the flexibility of renting, at least they would be able to move somewhere else without waiting years for a buyer?

30 yr old decides to buy house, 30 year mortgage. What do they then own at 60 (which they could then sell and rent if so inclined)?

30 yr old decides to rent, 60 years of rent ahead of him?

I know its not as simple as that. Rent if you want to, lots of positive reasons to, but as a financially sound decision, no (IMO).0 -

30 yr old decides to buy house, 30 year mortgage. What do they then own at 60 (which they could then sell and rent if so inclined)?

30 yr old decides to rent, 60 years of rent ahead of him?

I know its not as simple as that. Rent if you want to, lots of positive reasons to, but as a financially sound decision, no (IMO).

Problem with your theory is that most 30 year olds can`t afford to buy. The market is broken, borrowing money to buy into an obvious bubble with interest rates only set to go up is a massive risk IMO.0 -

Crashy_Time wrote: »Problem with your theory is that most 30 year olds can`t afford to buy.

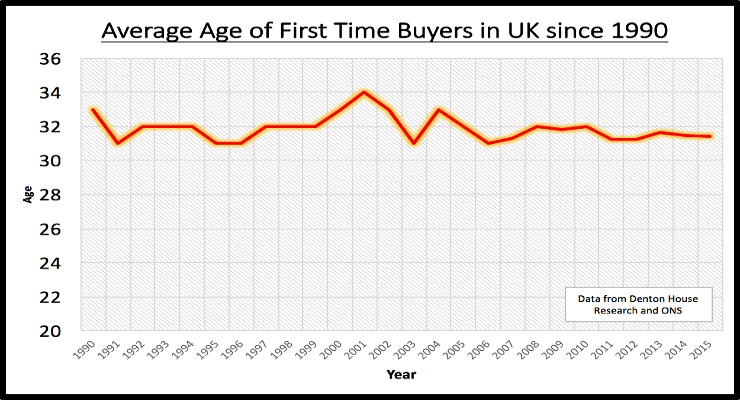

...and let's not forget the long-term ownership rate curve.

(Sorry, can't find a similar graph showing more recently than 2012, but other sources show a tidge under 63% for 2016, so pretty flat since 2012.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards