We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

Comments

-

Hi FB, Fantastic thread!

I've browsed my way through it over the last week or so...

...I rcekon, even on worst case scenarios, we will clear the lot when the third matures in August 2013 - so the overpayments are being upped to achieve that!

Thank's for the inspiration - keep posting

Hi MrsNut,

Guess I must have inspired you, as you've just registered with the forums in November and your post count is 1, ie the post above is the only one you have made so far. I've just thanked you!

Keep posting - I'm sure I will. Hope you'll keep reading.

FB.Mortgage and debt free. Building up savings...0 -

Rather disappointed to find out that ING couldn’t “disabled” the term accounts after 8th October when they stepped in to rescue Kaupthing, blaming IT systems – why does IT always get blamed – easy option I guess?

Late week, our 3k savings that was in a Kaupthing term account got transferred back to the easy access savings account. Total in there at the moment is about 6k. We also got an e-mail saying this account is now at a rate of 4.46% gross (4.55 AER).

So, I’ve been pondering what to do with this ~6k. Some of this is needed to feed the existing Halifax regular saver – 10% which we’re feeding at £500 per month, but there’s still some cash in there to “play” with.

I’ve asked Mrs Bliss to open two regular saver accounts this week:

1) Barclays. Barclays currently have a fixed rate regular saver – at 7.75%. Intending to fund this at the maximum of £250 per month. Mrs Bliss has an appointment on Thursday to open this account. Despite this being a fixed rate regular saver, I’m hoping that we do manage to get this opened at the 7.75% rate, rather than at a lower rate - hope they don't drop it in the mean time.

2) Abbey. Abbey also doing a fixed rate regular saver – at 7.25%. Again, intending to find this at the maximum of £250 per month. Mrs Bliss already phoned for an application pack. Was hoping to get this today (Tuesday), but are hopefully we’ll get this soon. Again, hoping we can get our foot in the door at 7.25% and the rate doesn't get dropped.

I’ve read mixed comments about Abbey customer service, and until our Goldfish credit card was switched to Barclays, we had never had a Barclays product, so slightly new territory for us. In theory, once they’re set up they just run to completion, with minimal effort from us.

Note: Looked at other regular savers, but the remainder on offer seem to have "complications" such as need to open a current account and feed in at least £1,000 a month - the above two looked like the quickest of the remaining fixed rates on the market to open.

So Halifax plus Barclays plus Abbey: £500 + £250 + £250 is £1,000 per month feeding regular savers. All 3 regular saver accounts are better than the 6% savings interest rate needed to out perform my mortgage rate. That's also presuming tax is taken off - Mrs bliss being a stay at home should not pay tax on the above accounts.

I’ve also been reading back through my diary and post #63 on page 4 reports my saving / overpayment decision was to overpay on the mortgage.

Despite recent worries about overpaying or saving, I’ve been reading through threads and pages on MSE and elsewhere and I think my overpayment decision is still a good one, at least for me. I like the certainty of the debt cleared!

So the rough plan, which I outlined somewhere near the start of my diary is still:

Overpay on mortgage: This reduces our debt and remaining term on the debt.

Maximise savings rates: This helps to minimise erosion of savings due to inflation.

Hopefully the “new” regular saver applications above won’t get knocked back. Can’t envisage why they would, but in the current climate, who knows. I’ll report back when I hear the result of each.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

Just how do you do it FB?

£1,000 a month into savings

£1,000+ a month on the Mortgage

Mrs Bliss staying at home, so not earning.

Two junior Bliss's to feed, cloth and put through school.

From previous threads, I am sure you said you were earning about £40k per annum, so you can't be bringing in much more than £2,200 a month after tax?

So what do you live on?

How do you find all this money to save & overpay your mortgage?

I am really Intrigued, because I am in such a similar position to you with regards earnings and family size etc, but I struggle to even save £250/month let alone over pay the mortgage!0 -

Just how do you do it FB?

£1,000 a month into savings

£1,000+ a month on the Mortgage

Mrs Bliss staying at home, so not earning.

Two junior Bliss's to feed, cloth and put through school.

From previous threads, I am sure you said you were earning about £40k per annum, so you can't be bringing in much more than £2,200 a month after tax?

So what do you live on?

How do you find all this money to save & overpay your mortgage?

I am really Intrigued, because I am in such a similar position to you with regards earnings and family size etc, but I struggle to even save £250/month let alone over pay the mortgage!

Hi rca779,

Excellent question. I also think we've had a similar discussion before on this matter...

As I've been working on my budget in recent days, you're very close with my estimated net income. Including a very small amount of tax credits and child benefit, our household net monthly income is 2,415, due to a recent 2.45% increase.

From January, I'm hoping to pay 1,200 per month towards the mortgage, live off 1,215 and pay 1,000 to savings (actually 1,200 including 200 towards Natwest buy they're cycled back once they've been credited).

Correct - the numbers don't appear to stack up :eek:

However, we're just "recycling" existing savings money from one account to another on a month by month basis with the intention of keeping as much as possible at higher rates and as little as possible in lower rate accounts.

Actually, I ran the numbers past Mrs Bliss the other evening and she nearly had kittens too when she though we were going to have to live off about £50 a month :rotfl:

I know some people are building up a savings fund and overpaying on the mortgage, but as we have an existing savings pot and our goal is reasonably short - just 4 years now, my thinking is that we primarily work on the mortgage for the next few years, rather than mortgage and new savings.

Once cleared, we start building up a savings fund again. Well, that's the broad plan.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

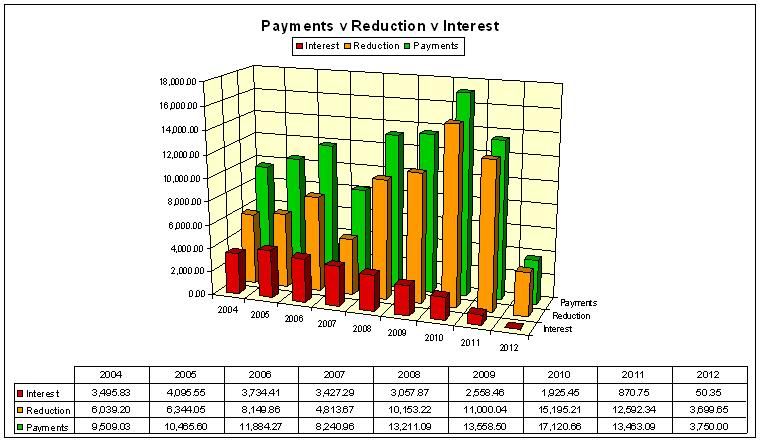

Ok, as I'm always looking for new ways to analyse the mortgage and review my progress, I've been working on a new graph. I've just added it to post #1, but I'll also put it here:

I've managed to squeeze the data chart onto the bottom, hopefully for the curious among you, just big enough to read...

Green: Shows total payments I've made to the mortgage in any one year.

Orange: Net reduction of the mortgage balance for any one year.

Red: Interest charged to the mortgage for any one year.

Take 2007 as an example. 8,240.96 paid to mortgage. 3,427.29 interest charged, thus 8,240.96 - 3,427.29, ie 4,813.67 reduction in the mortgage for that year.

Over the remaining years, the interest should drop away, I'm hoping to increase or at least maintain the payments, while the net reduction should steadily increase due to reduced interest.

Anyone else analyse their mortgage graphically? How about some graphs in your diaries then?

Financial Bliss.

PS - I've also tidied up post #1 and added this second graph in there too.Mortgage and debt free. Building up savings...0 -

OK FB, tell me how to do it and I'll post mine, which is looking very sorry for itself at the moment

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

FB - well done on concentrating on reducing your mortgage first and then do savings. Im doing a bit of both. I tend to pay extra into the mortgage £300 - £500 and then there is standard payments going into savings account of £330 every month. We looked this month and decided that we had a bit extra money in the bank account as its only 1 week until DH pay day (Im unemployed at the moment) so we were able to transfer to savings. I am increasing our savings at the moment as not sure if DH will be in a job next year (housing industry) so need to be as prepared as we can be. I still want to continue paying at least £200 to mortgage if we possibly can and is viable if I ever start this new job and DH stays in a job.MFIT T2 Challenge - No 46

Overpayments 2006-2009 = £11985; 2010 = £6170, 2011 = £5570, 2012 = £12900 -

OK FB, tell me how to do it and I'll post mine, which is looking very sorry for itself at the moment

Hi Gallygirl,

The data for the graph is sourced from a spreadsheet I maintain monthly. I've tagged the bits I'm interested in on a separate sheet, then put the chart on yet another sheet. Chart automatically updates each month on update of data.

After you've perfected the chart, right click on chart and select 'copy'. Open Paint and paste the image there. Save paint image; I typically save them as JPEGs - the image is a mere 55kb. Finally, upload to an on-line resource...

FinancialBliss has an account with PhotoBucket.com. Upload there and then use the URL link generated to link into the image from this forum.

May sound difficult, but once you've done a few, it's easy. The most "difficult" part is probably presenting / formatting the data in the first place. I originally had the chart as a line chart, but didn't like it.

Hope that helps,

FB.Mortgage and debt free. Building up savings...0 -

LOL - Love the graph:D0 -

FB - well done on concentrating on reducing your mortgage first and then do savings. Im doing a bit of both.

Hi Lynn11,

I try to review things regularly, but I'm sometime not too sure from one month to the next if we're doing the right thing!

We can borrow back from our overpayment fund, so I guess that's always nice to know.(Im unemployed at the moment)... so we were able to transfer to savings. I am increasing our savings at the moment as not sure if DH will be in a job next year (housing industry) so need to be as prepared as we can be.

Ouch. I've been unemployed before too, as has Mrs Bliss 3 or 4 times, once just after purchasing our first house. Hope things work out ok - sensible idea to have an increased savings pot.

FB.Mortgage and debt free. Building up savings...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards