We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

Comments

-

Great information, thanks for sharing0

-

Great information, thanks for sharing

Thanks. Is in this weeks MSE email described as "The best EVER credit card."

Was looking at a Marks & Spencer card and getting the cash out via the sterling travellers cheques trick, but this comes with a 1% charge, so despite accumulating the money slower with just purchases, I avoid the charge.

As mentioned earlier, one to study over the coming weeks. The longer I leave it, the longer the final clear-the-card date, but I need to also make sure the offer isn't pulled :eek:

FB.Mortgage and debt free. Building up savings...0 -

Down on page 5! See there's lots of new diaries / threads this week - will have to try and drop in sometime...

Was a fabulous day (for January) - quite sunny and about 8c, so I decided to dust off bike and go for a ride. Managed 15.67 miles in 1h 32m - not a fantastic average speed at just 10.1mph, but I blame our son, who was at my parents when I dropped in on the way back, and wanted to go for a quick ride/detour home, so I was riding at his pace...:rotfl:

So, that's one of my 12+ mile rides, which I'll add into the 2012 objectives. Haven't managed to cycle to/from work in January yet and there are only 7 working days left (normal Monday - Friday days), so I better get a move on there.

Got our mortgage statement from Nationwide this week. Nothing that I didn't know except that while Nationwide lump the interest payments together for the whole year, I analyse and am able to break down into months and subsequently daily interest.

That's all for now - turning in at a semi-reasonable time (for me).

FB.Mortgage and debt free. Building up savings...0 -

Well done getting a bike ride in; your speed is up there with Olympic cyclists in comparison to mine.Pots: House £6966/£7100, Rainy day Complete, [STRIKE]Sunny day £0/£700[/STRIKE], IVF £2523/£2523, Car up-keep £135/£135, New car £5000/£5000, Holiday £1000/£1000, MFW #16 £2077/£3120

MFiT3 #86: Reduce mortgage from £146,800 to £125,000

Mortgage Sept 2014: £135,500, MF Oct 2035 Peak July 2011: £154,000, MF July 20360 -

Well done getting a bike ride in; your speed is up there with Olympic cyclists in comparison to mine.

Ha, Just spent an hour teasing out the formula I wanted, so that I could separate out to and from commutes:

Summary:

https://docs.google.com/spreadsheet/ccc?key=0AnhcWfGMRVgddFpTWDZIbnRTSnFDMlhKTHJhQS1aR1E#gid=0

Detail:

https://docs.google.com/spreadsheet/ccc?key=0AnhcWfGMRVgddGNmWGhidkNhWFZBLUZkeUNKeE5qM2c#gid=0

Oh - and I managed to commute in today - real data c/o Cateye bike computer... :eek:

Felt that the way in was much harder than I envisaged. Perhaps due to ride yesterday?

Had time to recuperate during the day and felt a bit fresher this evening (or was that the cold). Both there and back could not be more than 3c or 4c and icy patches this morning.

Can see me turning in seriously early this evening.

FB.Mortgage and debt free. Building up savings...0 -

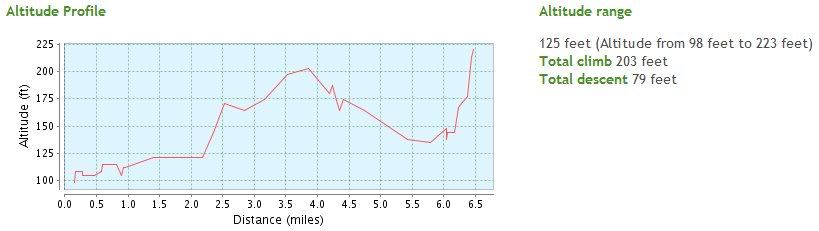

Decided to do a little digging around regarding the varying altitude of my cycle commute as that initial 47m 'to' leg makes me look very slow...

Turns out it's a little steeper than I envisaged:

Home: 98.172 ft / 29.923 metres

Work: 223.821 ft / 68.221 metres

Difference: 125.649 ft / 38.298 metres

In true - a picture paints a thousand words style, I've managed to find a site that displays altitudes (cycle streets.net with the output fed into site GPSies.com) and grabbed the generated image and uploaded to photobucket:

In short, my commute 'to' work is always going to take longer than the commute 'from' work as going to work I'm generally going up hill.

Feeling frustrated that there's a solitary commute time and aiming to do another sometime soon so that I've another time to compare to.

FB.Mortgage and debt free. Building up savings...0 -

Very quick post before I set off for work. Monthly interest for January as follows:

Opening Balance: 23,172.41

Overpayments in Blue.

Interest in Red.

Balance in Green.

Month: Payment (Std / OP) / Interest (day) / Net reduction / Balance

January: 900.00 (887.41 / 12.59) / 47.36. (1.53) / 852.64 / 22,319.77

Totals: Payment / Interest / Net reduction.

Minimum: 900.00 / 47.36 / 852.64

Maximum: 900.00 / 47.36 / 852.64

Average: 900.00 / 47.36 / 852.64

Grand Total: 900.00 / 47.36 / 852.64

Balance outstanding: 22,319.77

Ring-fenced mortgage savings: 3,310.00

Net mortgage: £19,009.77

Meaning I end January sub-20k :j More later...

FB.Mortgage and debt free. Building up savings...0 -

Morning FB, you must be delighted. Best wishes Tilly2004 £387k 29 years - MF March 2033:eek:

2011 £309k 10 years - MF March 2021.

Achieved Goal: 28/08/15 :j0 -

Tilly_MFW_in_6_YRS wrote: »Morning FB, you must be delighted. Best wishes Tilly

Ha, delighted now, yes, but not as delighted as I will be later in the week.

I've just had a credit card bill of £800-odd quid and the minimum payment is £27. Planning to pay just £30 this month, which frees up lots of cash I would have otherwise been putting on the credit card and I'm throwing this at... you guessed it, the mortgage.

Standard mortgage payment of £887.41 plus £12.59 mortgage overpayment, plus a further £1,100 into savings, meaning I'm paying £2,000 off the mortgage (directly / indirectly) in February.

Should see the mortgage effectively drop to just over £17,000 later this week, when mortgage savings taken into consideration.

FB.Mortgage and debt free. Building up savings...0 -

Wow FB, can't wait to see your £17K post :j

Forgive my memory but how are you handling repaying the CC card if you are using the money for the mortgage? I'm guessing that you must have enough time between your MFW date and the CC settlement date?

Regards

ATTMFW Start Date 1.4.08. Updated 23.1.18. MFW date 1.8.18

Original Mortgage o/s £187,643 / £71,904 (-115,739)

Repay o/s £92,661 / now £55,900 (-36,761)

Int Only o/s £94,982, now £16,004 (-78,978)

Total daily interest £1 [a) £0.77 b)£0.23

Total OP's:2018 target £TBC YTD £1,9950

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards