We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

FinancialBliss: My mortgage free journey…

Comments

-

financialbliss wrote: »Aims for 2010.

1. Mortgage.- [STRIKE]September – mortgage balance less than my first mortgage of £38,000[/STRIKE]

- [STRIKE]September – Daily interest for September drops below £5.00[/STRIKE]

With being away on holiday and then concentrating on the MFiT-T2 challenge once I got back, I've had precious little time to make any progress here.

Two important (to me) aims from the 2010 list can be crossed of this month. Firstly, I'm happy to say that our mortgage dipped below our first mortgage of £38,000. :j

Once the mortgage payments had cleared, it dropped to £37,049.77 - almost a full £1k less

While on holiday, I managed to track down a Nationwide and use their internet banking to get the mortgage balance as of 31st August, thus I was still able to accurately log the mortgage interest for August.

However, the September payments have seen the daily interest drop to less than a fiver per day - just done "internet banking" and the daily mortgage interest is now £4.86

Off to update charts, post #1 signatures etc.

May get another post in this evening, but feeling shattered and could probably do with an early night ZZZzzzz.

FB.Mortgage and debt free. Building up savings...0 -

Felt I needed to share this too....

Just noticed that in 2009 we reduced the mortgage by £11,000.04

With 3 more payments in 2010, we've already exceeded that at £11,450.19

OK, we've been transferring savings to the mortgage, but the mortgage is going in the right direction!

FB.Mortgage and debt free. Building up savings...0 -

Unless you strayed into the MFiT-T2 challenge thread, you could be mistaken in thinking that I’d got lost in cyberspace or something.

Without a post for ages in this diary, felt I should share some number crunching I’ve been doing.

More mortgage analysis.

Anyone who just dips into this diary semi-regularly would be hard pressed to fail to notice that I track the daily interest on the mortgage.

I’ve being doing this since January 2008 by taking the month end value and dividing by the days in the month. It’s 100% accurate and nice to have as Nationwide lump the interest for the year into one amount.

BUT, pre-2008, I’ve had no firm monthly or daily interest stats. So... with some historic mortgage data to hand, I went about creating some. I just happen to log the mortgage balance to an independent spreadsheet every Sunday. Thus having 4 or 5 values for a month, I can work out the average mortgage for that month and knowing the mortgage rate, the monthly and subsequently daily interest.

In nearly all cases from March 2004 to December 2007 when I was calculating the monthly values, the sum differed from the annual value which I had from Nationwide by a pound or two. I shared the difference out between the months. Not 100% accurate, but very nearly so.

Armed with some new data, I could create three graphs:

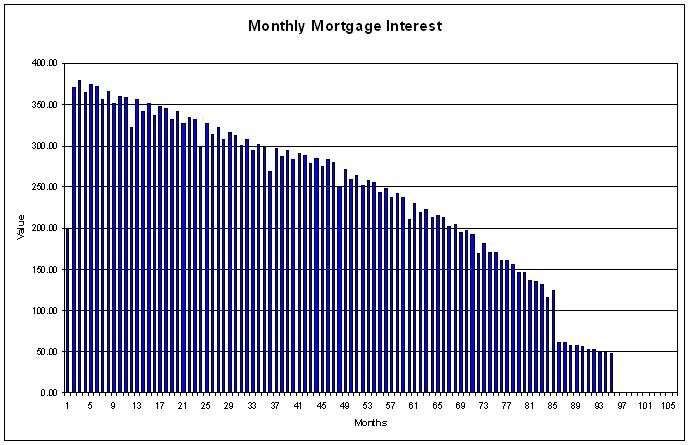

1) Monthly interest.

Does what it says on the tin. The monthly interest for the mortgage with pre-January 2008 values worked out as accurately as I could.

2) Daily interest.

Taking the monthly interest and dividing by the days in the month, this gives the daily interest for each month that has elapsed so far. At a height of 12.47 in March 2004, I’m now looking at about 4.87 for September 2010.

Knowing that I’ve altered the monthly payments and overpayments at various stages of the mortgage, I can spot some trends in the daily interest graph, eg it slows down at about month 33 (car purchase), and ramps up at about month 71 as I throw as much as I can at the mortgage in 2010.

3) Daily interest difference.

From the calculation of the daily interest for a given month, if you take the difference in daily interest from one month to the next, you get this graph. Unlike ‘2’, you can clearly see “slow” points in the mortgage reduction when the daily interest is dropping by just 2p per month and in 2010 where all daily interest values have dropped by a minimum of 16p.

1) Monthly interest.

2) Daily interest.

3) Daily interest difference.

I'll probably get around to adding these to post #1, but just wondering if there's a forum etiquette that dictates a maximum number of graphs in any one post... :eek::eek::eek:

Anyone else doing any weird and wonderful mortgage analysis?

Please do share!

Financial Bliss.Mortgage and debt free. Building up savings...0 -

FB - at the risk of sounding dense, I thought you had a fixed interest product like me, which terminates next year. Are your figures hypothetical ones, or am I missing something? Hmm.. I'm sure it's going to be the latter... Cheers, QB0

-

FB - at the risk of sounding dense, I thought you had a fixed interest product like me, which terminates next year. Are your figures hypothetical ones, or am I missing something? Hmm.. I'm sure it's going to be the latter... Cheers, QB

Hi QB,

Guess I can see where you're coming from. Putting the issue of slight differences of days in each month aside, I guess you were expecting fairly static daily interest values.

I've always overpaid on this mortgage - even in the very first month and the continued overpayments keep pulling the monthly and daily interest down, which is nice

As for the product - initially a Nationwide 2 year fix at 4.79% then a further 5 year fix, also at 4.79% Interest figures are very nearly 100% accurate!

Eg taking 2005 - first full year of mortgage, I know I had a total interest of £4,095.55, but I just didn't know the breakdown of this value. I've over the weekend broke the £4,095.55 down as best I can: January 2005: 358.11, February: 322.70, March: 356.53 etc.

Hope this helps.

FB.

PS First month was only a partial month, but the daily interest is correct.Mortgage and debt free. Building up savings...0 -

Ah ha... Yes, of course, I'd not taken the overpayments on board (doh, cos this is why we're here, after all!) so I'd been expecting the figures to be more static... The trends are looking good - you must be pleased

. My end of month analysis is simple in comparison, but one thing I do report on is the % of my house I now own outright, which would also lend itself to presentation in graph format!

. My end of month analysis is simple in comparison, but one thing I do report on is the % of my house I now own outright, which would also lend itself to presentation in graph format!

QB0 -

Putting in an appearance for the end of month stats. First some good news...

September stacks up as follows:

Opening Balance: 48,499.96

Opening Nationwide completion date: December 2014

Overpayments in Blue.

Interest in Red.

Balance in Green.

Month: Payment (Std / OP) / Interest (day) / Net reduction / Balance / Nationwide completion

January: 1,398.03 (898.03 / 500.00) / 191.83 (6.19) / 1,206.20 / 47,293.76 / Oct 2014

February: 1,429.33 (929.33 / 500.00) / 168.71 (6.03) / 1,260.62 / 46,033.14 / Sep 2014

March: 1,429.33 (929.33 / 500.00) / 181.65 (5.86) / 1,247.68 / 44,785.46 / Sep 2014

April: 1,429.33 (929.33 / 500.00) / 170.88 (5.70) / 1,258.44 / 43,527.01 / Aug 2014

May: 1,429.33 (929.33 / 500.00) / 171.45 (5.53) / 1,257.88 / 42,125.21 / Aug 2014

June: 1,429.33 (929.33 / 500.00) / 160.98 (5.37) / 1,268.35 / 41,000.78 / Jul 2014

July: 1,429.33 (929.33 / 500.00) / 161.17 (5.20) / 1,268.16 / 39,732.62 / Jul 2014

August: 1,429.33 (929.33 / 500.00) / 156.20 (5.04) / 1,273.13 / 38,459.49 / Jun 2014

September: 1,429.33 (929.33 / 500.00) / 145.97 (4.87) / 1,283.36 / 37,176.13 / Jun 2014

Totals: Payment / Interest / Net reduction.

Minimum: 1,398.03 / 145.97 / 1,206.20

Maximum: 1,429.33 / 191.83 / 1,283.36

Average: 1,425.85 / 167.65 / 1,258.20

Grand Total: 12,832.67 / 1,508.84 / 11,323.83

Balance outstanding: 37,176.13

Monthly interest down to less than £150! Got finances in place for October payments - this will see us skip the £36ks completely and jump straight into the 35's ending somewhere near £35,890 come 31st October.

FB.Mortgage and debt free. Building up savings...0 -

And now the first instalment of not so good news…

Credit cards.

Promised a while back (post 1449) to reflect on our credit card situation. We’ve currently got four cards. Alphabetically, we’re looking at:- American Express

- ASDA

- Barclaycard Goldfish

- Virgin Money

American Express.

Credit limit: 3,100.

This was obtained at the very end of July to replace the Barclaycard Goldfish as much as possible and we treat this as our main card where as previously we were using Goldfish - rewards diminished to the point where we we not getting much for the spending on the card. Looking likely to achieve the 1.25% cash back over the course of 12 months. Pay the balance off in full each month.

ASDA.

Credit limit: 5,000.

Originally obtained in June 2007 to get the 2p off fuel when purchased at ASDA forecourts. Recently dropped to 1p, thus the American Express (if we're getting 1.25%) is a better deal over this ASDA card. Have always paid off in full each month – balance is now zero.

Barclaycard Goldfish.

Credit limit: 10,000

Had this since 1997, originally for the rewards and was used until July this year as our main card, until the American Express was obtained. Still use this card, but now only when the Amex card isn’t taken by the retailer. Pay this card off in full each month.

Virgin Money.

Credit limit: 5,900.

Handy that I decided to list alphabetically, as it’s this last card where I’ve gone off the rails somewhat.

Back in April I had the opportunity to save £185 by exiting from the work travel scheme and purchase my travel pass independently as a one off purchase of £655. The savings were due to re-zoning and the work scheme dropping into the new zone structure, but I had the opportunity to purchase at the cheaper old zone price.

No brainer really. Obtained this Virgin Money 12 month 0% finance card and put the pass on this card with the intention of paying off in 12 chunks, ie similar to what I would have been doing on the work scheme.

Then decided to purchase a new PVR hard disc recorder £125 and a new tent £250 and suddenly, we’re already up to £1,000

Worse still, as well as paying off £1,429 per month on the mortgage, we have been paying £500 to a regular savings account (5%). Being loathed to compromise on either mortgage overpayments or the regular saver, we swapped to putting the spending on the Virgin money card and paying off a much smaller amount of the balance each month in order to free up cash and be able to fund the mortgage and regular saver, ie effectively borrowing at 0%.

At it’s worst, we had just shy of £3k on this card, but with the regular saver now finished, we’ve started upping the payments slightly, plus we have swapped to the Amex card and the balance now stands at £2,450

It’s a 0% card until March 2011, so this debt isn’t an issue just yet. I’ve also never paid anything ever in terms of credit card interest and don’t intend to start any time soon.

In case you didn’t spot the credit limits, totalled up, that £24,000 Scary numbers. :eek::eek::eek::eek:

I keep telling myself it makes sense to borrow at 0% and overpay mortgage (4.79%) and top up a regular saver (5%), but I honestly think I may have gone overboard just a little with this pay back your mortgage malarkey. It will be paid back and by March 2011 too.

Financial Bliss.Mortgage and debt free. Building up savings...0 -

financialbliss wrote: »

In case you didn’t spot the credit limits, totalled up, that £24,000

I'm on my way, Westfields here we come :rotfl:. Actually, I think I would struggle to spend 24k, even of someone else's money .financialbliss wrote: »I keep telling myself it makes sense to borrow at 0% and overpay mortgage (4.79%) and top up a regular saver (5%), but I honestly think I may have gone overboard just a little with this pay back your mortgage malarkey. It will be paid back and by March 2011 too.

.financialbliss wrote: »I keep telling myself it makes sense to borrow at 0% and overpay mortgage (4.79%) and top up a regular saver (5%), but I honestly think I may have gone overboard just a little with this pay back your mortgage malarkey. It will be paid back and by March 2011 too.

Financial Bliss.

There are worse sins than going overboard at 0% to save up to 5% FB, and you have it all under control. It WILL be gone by March 11 and the mortgage by Dec 12 :TA positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

I'm on my way, Westfields here we come :rotfl:. Actually, I think I would struggle to spend 24k, even of someone else's money

.

.

Gallygirl - you're probably right. If you break your spending up into "need" and "want", I know I'd struggle to spend 24k on "need" products - ie I don't really need a new 40" or larger flat screen TV.

But on the other hand, if I make a list of "wants", I'm sure I'd come shaking the collection tin to top up the £24k, as you'd not be able to get a very big sports car for that.

While I'm here, I sneaked an update in of the signature, graphs, last 100 steps etc and I also posted the recent graphs on the first post of this diary.

FB.Mortgage and debt free. Building up savings...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards