We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Been left money and don't know what to do.

Comments

-

2 X £40k pension lump sums will generate £100k to basic rate taxpayers. £25k of that can be accessed tax free.tempus_fugit wrote: »Yes, this would be my priority as well. Followed by pensions contributions, S&S ISAs and interest-paying current accounts, in that order.

Surely better than paying off low interest debt.

An IFA could be worth the fees here.0 -

PeacefulWaters wrote: »2 X £40k pension lump sums will generate £100k to basic rate taxpayers. £25k of that can be accessed tax free.

Surely better than paying off low interest debt.

An IFA could be worth the fees here.

Dependent on how much the OP earns.0 -

-

PeacefulWaters wrote: »And any other half earns!

...and how much thy trust them.0 -

-

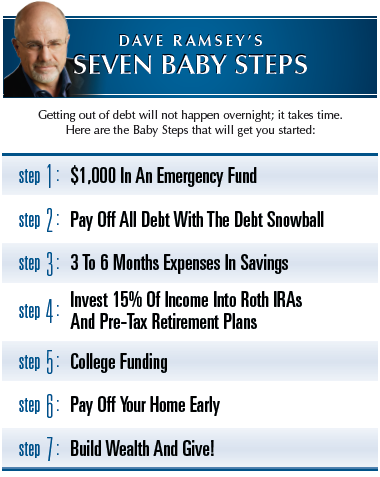

The Baby Steps

Step 3: 3 to 6 Months of Expenses in Savings

Step 4: Invest 15% of Household Income Into Retirement

Step 6:Pay Off Home EarlyHi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

Is the endowment going to cover the final payments to clear the mortgage? A lot of peoples have come up short by quite a ways and with you hoping to retire in two years but have 6+ years left to go on the mortgage you could well have a chasm to fill, so setting aside a large chunk may well be needed just to cover any shortfall. I would be looking into this first before deciding to move on anything else.

Thanks, at the moment the endowment is good and is covering the mortgage but like you say in another few years who can say. I will deffo keep a good size back 'just in case'.

Terry0 -

Step 2 is flawed with the value of tax relief, tax free lump sums and low interest rates. Should ge further down the list.The Baby Steps

Step 3: 3 to 6 Months of Expenses in Savings

Step 4: Invest 15% of Household Income Into Retirement

Step 6:Pay Off Home Early

Step 1 is flawed as it takes no account of individual spending commitments and involves a foreign currency speculation.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards