We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Barclaycard/travel card

Leesa23

Posts: 1 Newbie

in Credit cards

Hi, just need some clarity please, I am just confirming that the Barclaycard platinum cc is different to the barclaycard platinum travel cc ? We are going away next week and thought we were sorted with our payment method, also MSE states there are no fees from ATM withdraws on a barclaycard but there Barclays website says 2.99% on both purchases and withdraws ?

0

Comments

-

You really need to check the paperwork that came with your card, but yes, the Platinum Travel CC is different from other incarnations of the Platinum CC.

If you did not specifically apply for the Platinum Travel CC, then your card probably does have high fees for overseas spending - but it might be a bit late to apply for a new one now.0 -

Just looking at my first B/Card Travelcard statement after a trip which covered Germany, Austria and Hungary. I thought the B/Card offer was no transaction fee and no cash advance fees at least for the next two/three years. Spoke to Halifax Clarity who confirmed if cash is withdrawn from ATM abroad, interest is paid until cash is put back, so Barclaycard seemed the best bet. Statement shows an ATM withdrawal in Euros in Budapest that offers both Forints and Euros. There is a Cash Advance Fee of £10.98 on €400 and a locally imposed transaction fee of £4.13. I'm guessing some commission might have been applied by a third party organisation between Forints and Euros.

Looking at commercial transactions, there is indeed no transaction fee on any item. Exchange rate of around 1.11 / 1.12 Euros to £1 does not seem too bad either.0 -

I applied for the travel card a few days ago. I'm awaiting the card, but have been given my online banking details. It shows as a standard platinum card... however I did receive this email.With your new Barclaycard Platinum travel credit card you'll be able to make the most of your travels abroad.

So, when you're planning your trip, don't forget to pack your Barclaycard – it's an easy and secure way to spend wherever you are in the world. And until 31 August 2022 you won't pay a non–sterling transaction fee on your foreign ATM withdrawals or spend. Please see below for some important things you need to know.

A few things to remember

• Your usual non–sterling transaction fee (as stated in your welcome pack and statement) is 2.99% but, with this offer, you won't start paying this until 31 August 2022.

• Always pay or take out cash in the local currency to benefit from this offer and the competitive Visa exchange rate.

• Although you won't be paying a non–sterling transaction fee, the interest rates for purchases and cash withdrawals will stay the same.

Calendar Non–sterling transaction fee waived

from account opening until 31 August 20220 -

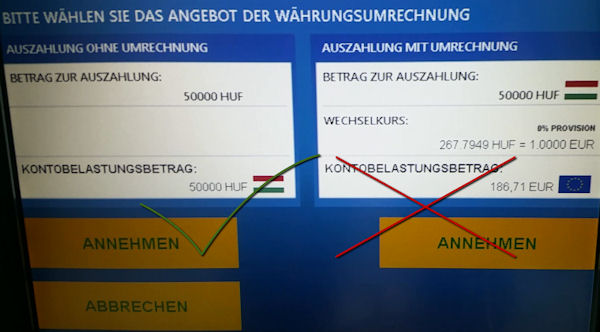

Stephen_Newman wrote: »Just looking at my first B/Card Travelcard statement after a trip which covered Germany, Austria and Hungary. I thought the B/Card offer was no transaction fee and no cash advance fees at least for the next two/three years. Spoke to Halifax Clarity who confirmed if cash is withdrawn from ATM abroad, interest is paid until cash is put back, so Barclaycard seemed the best bet. Statement shows an ATM withdrawal in Euros in Budapest that offers both Forints and Euros. There is a Cash Advance Fee of £10.98 on €400 and a locally imposed transaction fee of £4.13. I'm guessing some commission might have been applied by a third party organisation between Forints and Euros.

Looking at commercial transactions, there is indeed no transaction fee on any item. Exchange rate of around 1.11 / 1.12 Euros to £1 does not seem too bad either.

Hungary's local currency is Forints. You chose Euros at the ATM. For what reason, no one but yourself knows. You would lose perhaps 4% there straight away.

Then one might expect the card to transact the Euros to Pounds exchange at no further cost, but your choice of Dynamic Currency Conversion at the ATM appears to have broken the system.0 -

All non-sterling fees are waived until Sept 2022 for the Barclaycsrd Platinum Travel credit card, but not for other Platinum cards. Which do you have?Hi, just need some clarity please, I am just confirming that the Barclaycard platinum cc is different to the barclaycard platinum travel cc ? We are going away next week and thought we were sorted with our payment method, also MSE states there are no fees from ATM withdraws on a barclaycard but there Barclays website says 2.99% on both purchases and withdraws ?Evolution, not revolution0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards