We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Investing or waiting

ian-d

Posts: 371 Forumite

Really brief question, are you guys/gals currently investing in shares, funds, bonds etc, or are you waiting to see where the market goes? I know the saying "don't time the market" is very apt, but history would tell us that the markets are currently very high and due a substantial dip. If you had a large sum to invest right now, would you throw it all in safe in the knowledge it should be worth more in 20 years; throw in a little bit now and ride the average, or wait.

0

Comments

-

History tells us that 'the markets' are generally high more often than they are low. It's important that you are comfortable with your investments so if drip feeding over the rest of the year takes the edge off for you I'd say that was a valid approach. In 20 years time you won't remember their current levels0

-

You said it yourself. "Don't time the market" is sensible, which is why everyone says it, because they and you can't predict the future.

Clearly if you have a massive life changing lump sum to invest and you select something high risk and it absolutely tanks tomorrow, you would be upset. So for that reason you could avoid the same emotional pain by investing more conservatively or slowly drip-feeding, keeping much of your money in cash.

However, that emotional crutch doesn't avoid the actual financial pain that you'll still get if you slowly slowly invest your money over a period ending a year or two from now, at generally increasing prices, and then the big market crash happens the day after you finish. It is the same issue as investing it all today and getting a crash tomorrow, except missing out on some dividends and investment returns over the next year or two which could have nicely cushioned the blow.

There is always going to be a crash at some point. That is why the market rewards you for investing. Nobody would pay you a decent return if you were taking no real risks. Sometimes the 20-year returns are better than in other 20-year periods. It is much easier to identify those with hindsight, rather than up front.

Personally I invest most or all months; I know I'll need money in retirement or later life, and currently have a job that usually more than covers my short and medium term living costs, so "most or all months" is when my spare money becomes available to invest for the longer term. I fiddle with allocations but don't particularly want to stop investing altogether, even if some things seem quite expensive.

If some things look really expensive, it's usually a case of "buy less of the really expensive things and relatively more of the less-expensive things", rather than, "hoard it all in cash and gamble when to invest the accumulated massive cash lump sum at some point down the line".0 -

Really brief question, are you guys/gals currently investing in shares, funds, bonds etc, or are you waiting to see where the market goes?

Why would I wait? I know where the market goes long term. If I have spare cash I put it in my ISA or SIPP, no point waiting on it but obviously if there is a dip then you end up buying more units.

You also say "the market" is high? Which one is that? I hope you're not planning on putting all your money in the FTSE100?Remember the saying: if it looks too good to be true it almost certainly is.0 -

At the moment if my ISA tanks tomorrow by say 20% I will have lost my gains over the last 7 years. I will still have the money I put in, and I would keep putting money in because it will rise again. Same for my AVCs.

Now, even if I lose at least I have tried. At least I have attempted to take advantage of investing rather than sitting on it at low interest rates, or in a tin under my bed (like my grandmother used to tell me her dad used to do). I started from nothing, and I have gained a lot...by getting educated, by getting a good job, a warm cozy home, friends and a loving partner. I have a good company pension. Anything else is a bonus!If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.0 -

Really brief question, are you guys/gals currently investing in shares, funds, bonds etc, or are you waiting to see where the market goes? I know the saying "don't time the market" is very apt, but history would tell us that the markets are currently very high and due a substantial dip. If you had a large sum to invest right now, would you throw it all in safe in the knowledge it should be worth more in 20 years; throw in a little bit now and ride the average, or wait.

No, it wouldn't tell us that. It will tell us nothing.

If it was that simple to divine what was going to happen, it would dip right now, and also you'd be fabulously rich since you seem to know what the market will do

(and as someone else asked what is "the" market ? UK? Global? USA???? )

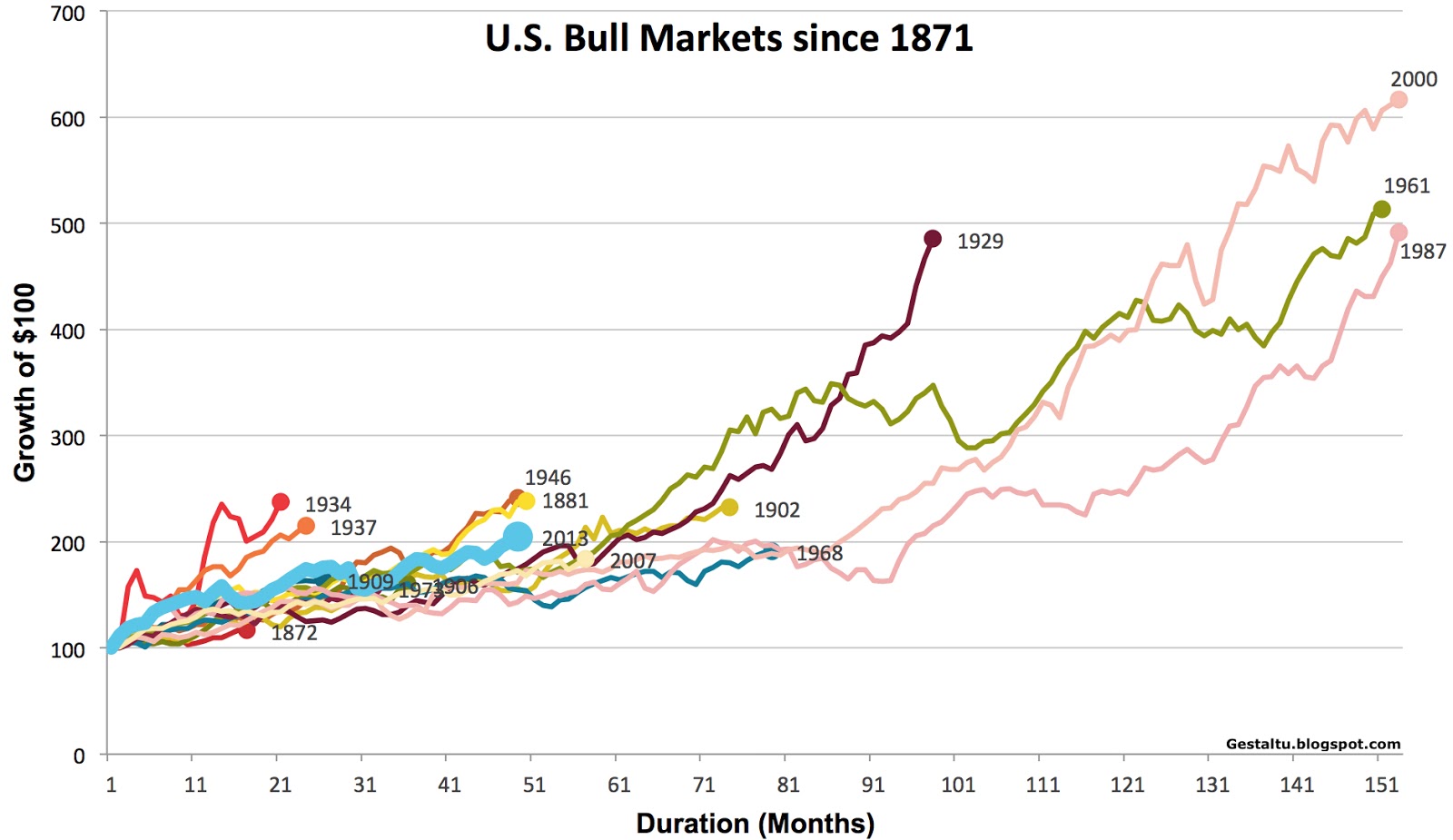

FWIW someone posted a picture the other day of relative length of US bull markets. It wasn't this one, but it was close. So, looking at this, what is history telling us ? Is it telling us that the growth could continue another 10 years? No idea.

Do what makes you feel good, but understand that if the majority really thought it would fall, then it would fall right now. 0

0 -

Bravepants wrote: »At the moment if my ISA tanks tomorrow by say 20% I will have lost my gains over the last 7 years.

Which implies your investment, assuming it is equity based, won't 'tank' 20% tomorrow. Those who that could realistically happen to, their gains are likely to have been far in excess of 20%.

At the end of the day it's a judgement call, if a decision to invest an amount in a certain way works in your favour you get to feel clever about it and if it goes against, you get to feel cheated.

As time goes on the initial impact of that investment decision over the short term should become increasingly muted long term. What matters is that there is a plan, with a long term focus.

I'm about to increase direct US exposure by 50% in my income portfolio this week or next, madness!!'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0 -

i am a novice investor. i have learnt that if you are a novice investor, like myself, drip feeding into investment pot is the best.

for more experience investors and traders, they can afford to time the market.

best to drip feed for ten to fifteen years before you think of timing the market.Another night of thankfulness.0 -

Replace the word novice with nervous.'We don't need to be smarter than the rest; we need to be more disciplined than the rest.' - WB0

-

Some people say that lump sum investing is better because you will get higher dividends earlier. Drip feeding takes advantage of pound cost averaging. I usually drip feed, but last year I dropped £15k straight in without fear. This year I'm back to drip feeding.If you want to be rich, live like you're poor; if you want to be poor, live like you're rich.0

-

elephantrosie wrote: »i am a novice investor. i have learnt that if you are a novice investor, like myself, drip feeding into investment pot is the best.

for more experience investors and traders, they can afford to time the market.

best to drip feed for ten to fifteen years before you think of timing the market.

drip feeding 10/15 years - assuming you dont have all the cash upfront but receive it as salary monthly for example. if i had a lump sum to invest by drip feeding i would never spread it over 10 years. probably 1 year max.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards