We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Taking Court Action Against Vodafone - Remove Default Notice

Comments

-

Thanks! I have contacted Jessica Investigates and given her the details, hopefully will get a response and some movement with this! So sick of it now!

Do you have any details of the other case she investigated? Would like to hear if their is anyone else in a similar situation with Vodafone?

Still no reply from the Vodafone reps on here??? Lee? Will? Becca? Sukhi? Anyone from Vodafone? Still claiming you have misplaced the emails you previously responded to???

Nah, surely they wont say that...

ROFLMAOHi AbbieA,

I replied to your email dated 30 March, reference number WRT135 [#15646794], on 31 March.

As no further emails have been received under the above reference, please reply to my last email and I'll get back to you as soon as possible.

Kind regards,

Lee

Social Media CARE

Vodafone UK

In debt and looking for help? Look here for the MSE Debt Help Guide.

Also, If you need any free and impartial debt advice, the National Debtline, Stepchange, and the CAB can help.0 -

If you are considering a legal challenge via the Courts then you can do this off of your own back and only need to take the full facts and the certain parts of the law that were broke to make your claim, I'd also hazard a guess here that if you took this to Court Vodafone would fail to attend and it would probably be found in your favour.

Far cheaper than getting a Solicitor involved, Whilst you could hire and seek all costs and hope that a Solicitor may get you more money it is still feasible to make the challenge yourself and come out winning.

Base the amount you seek here on true costs so far for everything including call costs, printed documents, paper, ink, and so on, Stick to actual costs only and keep any and all receipts here to tally the figure up, Do not add a figure for damages on a claim just add true costs plus damages sort.

Brush up on the facts here :- https://www.cps.gov.uk/legal/d_to_g/fraud_act/#a06

Seek damage also under here :- http://www.legislation.gov.uk/ukpga/1998/29/section/13

Damages for breach of the Data Protection Act

In relation to the claim for breach of statutory duty under the DPA, the judge called into question previous case law in which it had been found that damages for distress can be recovered under s13 DPA only if pecuniary damage has also been suffered. The judge did not ultimately decide the question as this was something that might arise for decision at trial but gave a preliminary view that "damage" in s13 DPA does include non-pecuniary damage.

A different case but gives you an idea here :- http://www.allenovery.com/publications/en-gb/Pages/Misuse-of-Private-Information.aspx0 -

If you are considering a legal challenge via the Courts then you can do this off of your own back and only need to take the full facts and the certain parts of the law that were broke to make your claim, I'd also hazard a guess here that if you took this to Court Vodafone would fail to attend and it would probably be found in your favour.

Far cheaper than getting a Solicitor involved, Whilst you could hire and seek all costs and hope that a Solicitor may get you more money it is still feasible to make the challenge yourself and come out winning.

Base the amount you seek here on true costs so far for everything including call costs, printed documents, paper, ink, and so on, Stick to actual costs only and keep any and all receipts here to tally the figure up, Do not add a figure for damages on a claim just add true costs plus damages sort.

Brush up on the facts here :- https://www.cps.gov.uk/legal/d_to_g/fraud_act/#a06

Seek damage also under here :- http://www.legislation.gov.uk/ukpga/1998/29/section/13

Damages for breach of the Data Protection Act

In relation to the claim for breach of statutory duty under the DPA, the judge called into question previous case law in which it had been found that damages for distress can be recovered under s13 DPA only if pecuniary damage has also been suffered. The judge did not ultimately decide the question as this was something that might arise for decision at trial but gave a preliminary view that "damage" in s13 DPA does include non-pecuniary damage.

A different case but gives you an idea here :- http://www.allenovery.com/publications/en-gb/Pages/Misuse-of-Private-Information.aspx

Thank you Stevie! That's really helpful info and I'll go through it all this weekend. It looks like my options are wait until September and hope that Vodafone sort the situation out for me or start a legal challenge now. As it is affecting my credit status and preventing me from buying my first house I can't really afford not to mount a legal challenge!

Thanks again for your help!0 -

hI Abbie

Have you heard anything from the papers yet0 -

Hi Guys,

Sorry for the late reply, just a little update. There has been no change since my last post. I have sent a few letters to the recommended media outlets and a few to various solicitors. No media outlet ever got back to me and the few solicitors that were willing to help warned that it would be expensive and advised that I wait until September anyway.

So here we are, it's September and the last contact I had from Vodafone Legal Team stated that 'the account will be left cancelled and collectable until the case concludes at court [in September 17]'.

This whole thing has dragged on far too long and is still making me feel sick.

I plan on writing another letter in response to the last Vodafone Legal Team letter asking for an update on the court case and again reiterating that this debt must be cancelled and all defaults removed from my credit score.

If anyone has any further advice, please let me know!! Thanks, Abbie xx0 -

Hi Guys,

Sorry for the late reply, just a little update. There has been no change since my last post. I have sent a few letters to the recommended media outlets and a few to various solicitors. No media outlet ever got back to me and the few solicitors that were willing to help warned that it would be expensive and advised that I wait until September anyway.

So here we are, it's September and the last contact I had from Vodafone Legal Team stated that 'the account will be left cancelled and collectable until the case concludes at court [in September 17]'.

This whole thing has dragged on far too long and is still making me feel sick.

I plan on writing another letter in response to the last Vodafone Legal Team letter asking for an update on the court case and again reiterating that this debt must be cancelled and all defaults removed from my credit score.

If anyone has any further advice, please let me know!! Thanks, Abbie xx

What a pain in the !!!!.

Talking to these general customer service bods isn't going to get you anywhere.

There's a dedicated credit control team at Vodafone in charge of outstanding balances etc. They are available on 03333 044 550. Sometimes the number doesn't work, annoyingly. Just says "thanks for calling, bye!". Vodafone a great, eh?:rotfl:

Anyway, whether you get through to them lot or not, you need one person at Vodafone to take control and ownership of the situation - this may require spending a lot of time on hold whilst they debate it internally.[FONT="]

[/FONT]If you can convince them that this account and any outstanding balances/defaults they have on record for it don't relate to you personally, they should be able to help. [FONT="][/FONT]You just have to be patient enough to stay on hold and DONT LET THEM tell you that someone will call you back, or that you need to email them etc. You've already done all of that.

Good luck.0 -

Hi Guys,

So my plan at the moment is to send another letter by recorded delivery to the UK Legal Team, in response to their last letter. I have drafted this:

Dear Sir/Madam,

I am writing to you in response to your letter dated 03/04/17. In it, you stated that:

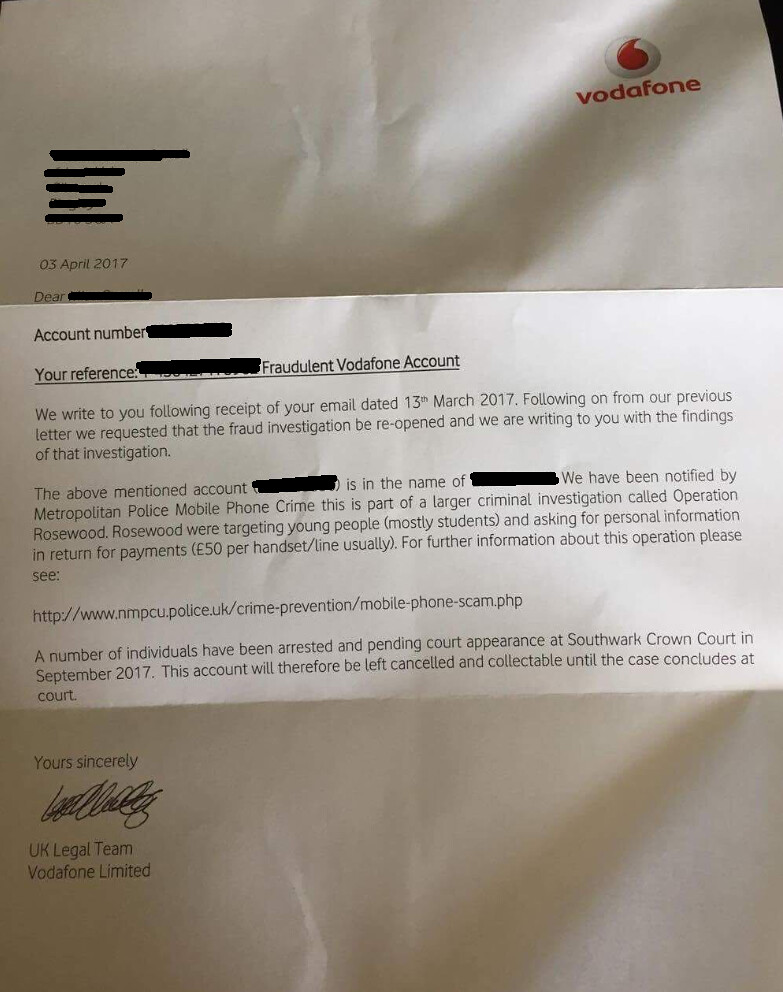

‘We write to you following receipt of your email dated 13th March 2017. Following on from our previous letter we requested that the fraud investigation be re-opened and we are writing to you with the findings of that investigation.

The above mentioned account (************) is in the name of *********. We have been notified by Metropolitan Police Mobile Phone Crime this is part of a larger criminal investigation called Operation Rosewood. Rosewood were targeting young people (mostly students) and asking for personal information in return for payments (£50 per handset/line usually)…

..A number of individuals have been arrested and pending court appearance at Southwark Crown Court in September 2017. This account will therefore be left cancelled and collectable until the case concludes at court.’

It is now September and you have still not responded to or acknowledged my Letter of Claim, dated 14/02/17, written in compliance with the Practice Direction on Pre-Action Conduct, sent by recorded delivery and signed for on 16/02/17.

It was stated in this letter that your “...attention is drawn to the Civil Procedure Rules 1998 and in particular the Court’s power to impose sanctions if you fail to comply with the same. If you ignore this letter or fail to provide a detailed letter of response within 28 days, Court proceedings will be issued against you and this letter will be brought to the attention of the Courts in their dealing with costs. Your non-compliance with the Rules may increase your liability for costs.”

I therefore must once again request that Vodafone supply myself with:

1. Copies of the ID and supporting documents (both proof of signature and proof of address) used to open this account

2. The fraud investigation carried out by Vodafone, as referenced in both the Crystal Account Notes and Siebel Account Notes provided by Vodafone, in its entirety.

As your company has placed a "Default Notice” against my name, and I have never received such a notice, I require you to substantiate this data at your earliest convenience. You must do this by supplying me with a true copy of the proof of service agreement you refer to. Your obligation also extends to providing a statement of account. I enclose a £1 postal order in payment of the statutory fee, PO Serial Number **********.

You must also supply me with a signed true and certified copy of the original default notice and any notice of assignment. I would request that this data is provided to myself within the next 28 days, if you are unable to provide this data then I must insist that the default notice is removed from my files as unsubstantiated.

It is your duty to comply with my requests under the law.

Yours faithfully,

********

Any thoughts?

0 -

Hi,

Just to be picky, and to make sure you send a correctly formatted letter.

There won't be a service agreement, use of the phone or sim is considered acceptance of the contract.

They placed a "default" against your credit file, not a default notice, different things.

Failure to issue a default notice is just a technical breach which carries no penalty and can be rectified by issue of another notice.

Statement of account yes, notice of assignment yes, keep the £1.

Everything else is good.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Thanks! Most helpful indeed. I am still drafting this and also seeking advice on the legal beagles forum, but will update both asap.

Thanks again, it's really appreciated.0 -

Morning Guys,

I have decided to bring this forum fully up to date with a handy timeline.

July 14:

Fraudulent account set up in my name.

July 15:

Fraud discovered and immediately reported to the Police and ActionFraud who investigated and provided me with a crime reference number.

Reported to Vodafone who said they carried out a fraud investigation but deemed there to be no fraud found. They have asserted that the account is still collectable and have applied a default to my credit score.

I then requested that Vodafone supply me with details of any fraud investigation conducted, the identification documents and proof of address given when the account was opened and all other information pertinent to the fraud investigation, which they refused.

I also reported this to my bank who conducted their own investigation, determined that the signature used to set up the Direct Debit Instruction was fraudulent and recovered all monies paid to Vodafone.

August-November 17:

Numerous attempts to reason with Vodafone. 3 separate fraud investigations were conducted by them and all deemed that there was no fraud found.

I contacted the Financial Ombudsman who referred me to the Consumer Ombudsman who advised that they were unable to help at this time, I believe due to lack of evidence. Reasons stated as being the DDI matches the address, no fraudulent usage (just normal usage to UK landlines and mobiles) and the handset chosen was a low value handset not typically used by fraudsters.

December 16:

I made a request for information under the provisions of the Data Protection Act 1998 and obtained documents relating to the account. This was supplied on the 23rd of January and showed that Vodafone had been told by my bank that the Direct Debit Instruction contained a fraudulent signature and that the account had been referred to their internal Fraud team numerous times (for suspicious usage in Europe and £100’s in calls to Portugal and Spain) before the fraud was discovered by myself.

January 17:

Having obtained this I tried again with the Consumer Ombudsman who advised that I could not reopen an investigation that had previously been closed.

February 17:

I then tried the ICO following advice on this forum. I supplied them with all the evidence I have gathered and after several correspondences and they said they will investigate and have written a letter to Vodafone, though I haven’t heard anything since.

I also sent my first Pre Action Protocol letter, which has never been acknowledged or responded to.

Around the same time I first engaged with Lee from Vodafone this forum. The whole debacle can be read here but basically no progress was made.

March 17:

Follow up letter to the Pre Action letter was then sent, also ignored.

I was also given the CEO email at roughly the same time so emailed him, which prompted a response saying they will reopen the fraud investigation (having previously carried out 3 fraud investigations and stated that no fraud has been found each time and that they would not open any more investigations).

April 17:

I received a letter from the UK legal Team in response to the email (same one posted on here). In it Vodafone stated that this account is part of a wider fraud investigation for which arrests had been made and the case is due to be heard in September. This is their first admission to me of there being any kind of fraud on the account.

April – September 17:

Sought legal advice, most common response being that I should wait until the results of the trial.

September 17:

I am now concerned that I do not actually have any details of the trial other than the vague mention that I managed to extract from Vodafone after nearly 2 years of denial. I feel that I need to be proactive again and most likely will have to follow through and instigate a court case to get Vodafone to respond.

I have also contacted Lee again from Vodafone for advice and for details of the court case mentioned by the UK Legal Team (ie date of hearing? results?). I am in the process of drafting a final demand letter before instigating court action and will post it on here and the legalbeagles forum before it is sent.

Thanks again Guys, Abbie!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards