We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

What will a financial adviser do for me?

Comments

-

If there's going to be a 30% drop in the next few months, why invest any of it now? Just wait for that drop and then invest the lot.

Oh wait, you don't know there's going to be a 30% drop in a few months. You only know there will be a 30% drop at some point.

So after a year with half your money on the sidelines missing the investment returns, you will either

- be bored of waiting and just go ahead and invest it (and then get the drop straight away and have to wait for the recovery over the subsequent eight years or whatever shape the next crash and recovery takes) , or

- you'll keep holding out for a drop for a couple more years and then perhaps the drop will only take the market back to a point higher than where it is today in total return terms.

Both of those scenarios are quite possible. If you decide not to invest now the money you want to invest, to catch a cheaper price, you are basically trying to gamble on a cheaper price becoming available and time the market which is a mug's game.

Of course, people position their portfolios for all sorts of outcomes based on gut feel and perception of risk and forthcoming market forces. If you don't like what you perceive to be the forthcoming market forces, don't invest at all, or select a less risky investment, which is how most people handle it.

But "invest now" is not my advice because if you do that and it turns out to have been the wrong side of the coin toss you will partially blame me, so screw that! Do what you like ! : D0 -

Even although I plan to invest long term I would be very disappointed if I invested my lot just now

That is always going to be a risk. Even if you wait until after a drop. There are many cases of a double dip occurring. You would be caught out if that happened. And in case you think about waiting for the second dip, then don't because a second dip doesnt always come.If I can afford to hold back some now, then if there is a big equity fall I would add to my investment then to hopefully get back into profit sooner when the markets recovers?

And what if that 20% drop comes after a 30% gain period? or

what if the 20% drop comes after a 10% gain period but you wait until you think it hits bottom but miss the rebound?

Dont forget you wouldnt be getting dividends until invested either.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

bowlhead99 wrote: »Basically it sounds like the second of the two potential options I'd guessed at in my comments above:

When you are looking at the cost of funds on a factsheet, the standard way to quote fees for comparability across investment managers is to use OCF (ongoing charges figure) of which the AMC (annual management charge) is the major component.

Some funds just have the manager pick up the day to day running costs for everything (e.g. administration and accounting, producing financial reports, audit and legal, etc) and build it into the price for the annual management charge so that the OCF is no higher than the AMC.

However, there are some other inherent costs of operating a fund which don't really get picked up as an operating expense, such as when the fund buys £1000 of shares in a company it has to pay £5 of stamp duty to the government and maybe £1-£2 of stockbroker commissions, and when it sells the shares later for £2000 it has to pay £2 of stockbroker commissions again. The fund would report that it bought the shares for £1007 and sold the shares for £1998 making a profit of £991 and has no reason to report any costs within 'ongoing charges' because the stamp duty and broker costs were not ongoing operating costs that get incurred day in day out. They only happen if the fund needs/wants to buy or sell and are just something that reduce the profitability of sharetrading compared to the £1000 profit you'd have in a perfect world where the fund could buy and sell what it liked without transaction costs.

While the £9 of transaction costs which the fund incurs are not included within OCF or AMC, they are something that impacts on overall performance (compared to, for example, a fund that just buys and holds its investments for ages and doesn't need to do any buying or selling). So there is something of a trend these days for investors to ask, in the interests of transparency, whether transaction cost data for a fund is also available in addition to the ongoing raw running costs. Some investors don't really get too excited by it so it is not something that the FCA makes managers put in the factsheets.

So, if the adviser is just saying you can have Option 1 which is a simplistic collection of passive funds which can 'float' from initial allocations (charges of 0.25%) or Option 2 which is monitored and rebalanced against a target and hedged to some extent (charges of 0.75%), then those are probably the numbers you can compare against other funds in the market. It sounds like the additional "For fees with an estimation of transaction costs, add 0.42% to the above." is the additional bit of 'transparency' to capture things that are not included in a management fee or ongoing charges figure but will impact returns. But other rival portfolio funds in the marketplace would also have such 'transaction costs', because they're unavoidable, but often not disclosed in the factsheets because the regulator doesn't demand that they are.

For example the fund group Standard Life produces their estimated transaction costs figures for their funds using some historic averages of actual costs compared to fund value over the last financial year. For their "UK Equity Recovery Fund", a highly active fund, they have 0.22% of broker commissions and 0.29% of 'transaction taxes' or stamp duty. Whereas for "Asia Pacific Growth Fund" they have 0.33% of broker commissions and 0% of taxes (because most asian countries don't have stamp duty). But the transaction costs on their less-active funds in cheap markets are lower.

To be honest 0.4% for transaction costs sounds pretty high to me if it is a portfolio which principally uses passive components / trackers (which you would expect to have low levels of purchase and sales transactions because they passively sit there without buying or selling). It would be difficult to see how the fund components themselves could create underlying transaction costs that high, and especially if that portfolio is being allowed to 'float' rather than being actively rebalanced. So maybe it is the IFAs transactional costs incurred at a level 'above' the individual passive funds which are being used - i.e. the IFA buying and selling the components of the portfolio over the course of the year if he is paying broker costs to buy ETFs etc in the portfolio on top of the platform fees.

Thanks again, BH. In fairness and credit to the IFA here he did say that hes not obligated to lay-out expected transaction costs but that he prefers to be transparent.

I was surprised that the transaction costs were estimated to be similar for all three options, as the latter two would incur more costs than the 'floating' passive portfolio due to daily rebalancing and hedging, etc.

Is currency hedging even worth it? Surely like markets, you need edge to do it well?0 -

Is currency hedging even worth it? Surely like markets, you need edge to do it well?

In my opinion no. I don't see the point in paying to take on risk and then paying again to have some of the risk removed. In your position I would be inclined to ask how well their hedging did in the Brexit aftermath and whether their investors were happy to (I assume) lose out on the returns UK investors holding global equities made from the fall in the pound.0 -

Thanks masonic, I know what you and Bowlhead are saying. Even although I plan to invest long term I would be very disappointed if I invested my lot just now, only to find there was a 30% drop in value in the next few months, and it took 3 years to get back to my original investment value. If I can afford to hold back some now, then if there is a big equity fall I would add to my investment then to hopefully get back into profit sooner when the markets recovers?

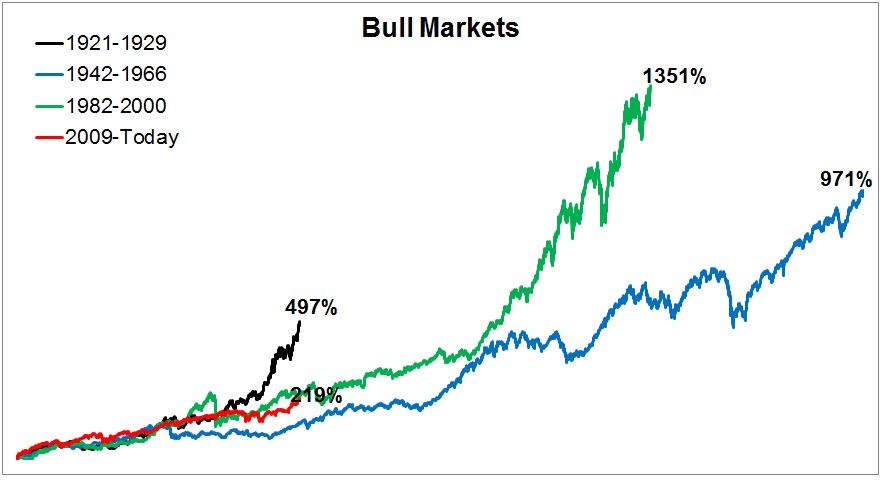

There could be a way to go before you see a 30% drop:

or perhaps not.0 -

I know what you are saying, but I have now invested this year's ISA allocation as a lump sum, and I am going to transfer a similar amount from my Virgin S&S ISA. I am just planning holding off a bit with this coming year's ISA allocation to see what happens. IF there is a big drop I think it would be a good time to invest it, maybe even in a higher equity VLS fund. While I agree it is a gamble to wait for a fall that might not happen, it also seemed to me a bit of a gamble to invest it all now. However I do take on board what you have said, so maybe I won't wait too long. Thanks.bowlhead99 wrote: »If there's going to be a 30% drop in the next few months, why invest any of it now? Just wait for that drop and then invest the lot.

Oh wait, you don't know there's going to be a 30% drop in a few months. You only know there will be a 30% drop at some point.

So after a year with half your money on the sidelines missing the investment returns, you will either

- be bored of waiting and just go ahead and invest it (and then get the drop straight away and have to wait for the recovery over the subsequent eight years or whatever shape the next crash and recovery takes) , or

- you'll keep holding out for a drop for a couple more years and then perhaps the drop will only take the market back to a point higher than where it is today in total return terms.

Both of those scenarios are quite possible. If you decide not to invest now the money you want to invest, to catch a cheaper price, you are basically trying to gamble on a cheaper price becoming available and time the market which is a mug's game.

Of course, people position their portfolios for all sorts of outcomes based on gut feel and perception of risk and forthcoming market forces. If you don't like what you perceive to be the forthcoming market forces, don't invest at all, or select a less risky investment, which is how most people handle it.

But "invest now" is not my advice because if you do that and it turns out to have been the wrong side of the coin toss you will partially blame me, so screw that! Do what you like ! : D0 -

Malthusian wrote: »In my opinion no. I don't see the point in paying to take on risk and then paying again to have some of the risk removed. In your position I would be inclined to ask how well their hedging did in the Brexit aftermath and whether their investors were happy to (I assume) lose out on the returns UK investors holding global equities made from the fall in the pound.

And I would imagine that such jiggery-pokery bumps the transaction fees up.0 -

Thought I would update this.

Met last IFA on Wednesday. 3% implementation fee, 0.25% platform fee and 0.75 ongoing.

And what do I get for this?

He will stick it in an L & G Multi.

Bit of a no-brainer, that one...0 -

Yes, not particularly surprising given that seasoned investors and IFAs alike on this thread have suggested that with your level of assets, a multi-asset fund is a sound solution - it is not like you have £100k+ to benefit from something more bespoke.

The upfront 3% and the ongoing 0.75% are par for the course for advisory fees on your sort of amount of capital and the platform fee is at the lower end of the percentage-based platforms.0 -

I'm not sure exactly how much the OP is investing, just a fair sized 5 figure sum, but to me the fees seem high for what the IFA is suggesting, especially the implementation fee, but if that is the going rate and the OP is okay with it, that's fine.bowlhead99 wrote: »Yes, not particularly surprising given that seasoned investors and IFAs alike on this thread have suggested that with your level of assets, a multi-asset fund is a sound solution - it is not like you have £100k+ to benefit from something more bespoke.

The upfront 3% and the ongoing 0.75% are par for the course for advisory fees on your sort of amount of capital and the platform fee is at the lower end of the percentage-based platforms.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards