We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Joint mortgage/one name on deeds/second home stamp duty - HELP!!

JT1986

Posts: 4 Newbie

Hi,

I have a question regarding second home increased stamp duty and joint mortgages.

The scenario is as follows –

My partner and I aren’t married. My partner already owns a flat which we both currently live in. We want to buy a new place together but keep the old flat to rent out. Will we be stung with the increased stamp duty or not as we’re changing our main residence?

(Added background (in case it makes a difference to anything) is that I currently own a third share in a flat worth £80,000 but I believe that’s below the £40,00 threshold for second home stamp duty so isn’t relevant to anything here but please tell me if it does).

If the answer is no then great, no need to read on…

If the answer is yes, then our backup plan is to buy the second place and just put my name on the deeds but have both of us on the mortgage, does anyone have any advice in this area? Or a list of mortgage providers who are willing to do that? I’ve heard that Metro Bank do but are there anymore?

Any help that anyone can provide would be fantastic.

Thanks,

J

I have a question regarding second home increased stamp duty and joint mortgages.

The scenario is as follows –

My partner and I aren’t married. My partner already owns a flat which we both currently live in. We want to buy a new place together but keep the old flat to rent out. Will we be stung with the increased stamp duty or not as we’re changing our main residence?

(Added background (in case it makes a difference to anything) is that I currently own a third share in a flat worth £80,000 but I believe that’s below the £40,00 threshold for second home stamp duty so isn’t relevant to anything here but please tell me if it does).

If the answer is no then great, no need to read on…

If the answer is yes, then our backup plan is to buy the second place and just put my name on the deeds but have both of us on the mortgage, does anyone have any advice in this area? Or a list of mortgage providers who are willing to do that? I’ve heard that Metro Bank do but are there anymore?

Any help that anyone can provide would be fantastic.

Thanks,

J

0

Comments

-

Hi,

I have a question regarding second home increased stamp duty and joint mortgages.

The scenario is as follows –

My partner and I aren’t married. My partner already owns a flat which we both currently live in. We want to buy a new place together but keep the old flat to rent out. Will we be stung with the increased stamp duty or not as we’re changing our main residence?

(Added background (in case it makes a difference to anything) is that I currently own a third share in a flat worth £80,000 but I believe that’s below the £40,00 threshold for second home stamp duty so isn’t relevant to anything here but please tell me if it does).

If the answer is no then great, no need to read on…

If the answer is yes, then our backup plan is to buy the second place and just put my name on the deeds but have both of us on the mortgage, does anyone have any advice in this area? Or a list of mortgage providers who are willing to do that? I’ve heard that Metro Bank do but are there anymore?

Any help that anyone can provide would be fantastic.

Thanks,

J 0

0 -

as for one name on deeds and two on mortgage I really cant see any bank doing that, or a solicitor sanctioning basically fraud0

-

If you put the new property in your name you won't pay the extra 3% SDLT.

Yes, a few Lenders will do single owner/joint mortgage consult a good broker.I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

glentoran99 wrote: »as for one name on deeds and two on mortgage I really cant see any bank doing that, or a solicitor sanctioning basically fraud

Thanks for your reply but actually according to this Zoopla article HMRC have confirmed that it is entirely within the law - zoopla .co.uk/ discover/buying/q-a-new-3-stamp-duty-surcharges (sorry about the gaps but I'm not allowed to post links as I'm a new user)

We have no intention of committing fraud, this just appears to be one of the rare occasions where the government rewards people who aren't married rather than the usual tax breaks for people who are married...0 -

If you put the new property in your name you won't pay the extra 3% SDLT.

Yes, a few Lenders will do single owner/joint mortgage consult a good broker.

Thanks a lot, could you recommend any lenders? We will use a broker eventually but I'm just wanting to get an idea of where we stand at this point so that I can model out our options.0 -

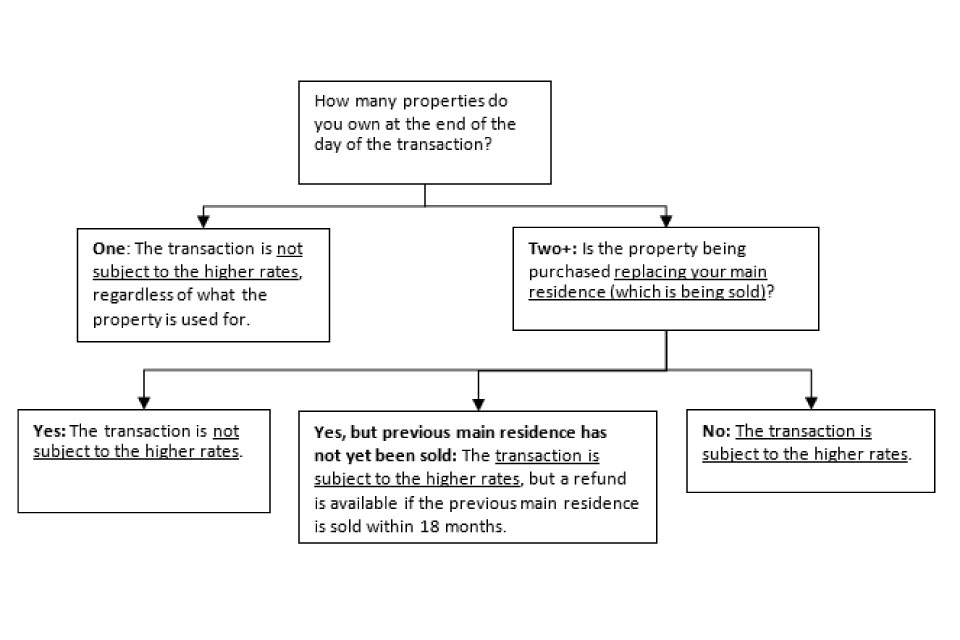

glentoran99 wrote: »[IMG]https:// assets.publishing.service. gov.uk/government/uploads/system/uploads/image_data/file/47781/SDLT-diagram.jpg[/IMG]

Thanks very much, that's a very useful chart0 -

Thanks a lot, could you recommend any lenders? We will use a broker eventually but I'm just wanting to get an idea of where we stand at this point so that I can model out our options.

The brokers on this board aren't allowed to name lenders because it could constitute giving advice.

I read the link you provided which says, "However, so long as you are NOT married, it's possible to get around this by the person who does not already own a property, buying the new one in their sole name. We've had confirmation from HMRC that this will NOT be regarded as tax avoidance."

I'm not sure if having a mortgage in joint names with one legal owner will get round this as presumably you will be a beneficial owner if not a legal one. It's maybe something you should check out.

Stamp duty land tax: Higher rates for purchases of additional residential properties0 -

'Joint borrower, sole proprietor' is the perfect solution to the SDLT surcharge.

It's going back to the old days of guarantor mortgages.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0 -

kingstreet wrote: »'Joint borrower, sole proprietor' is the perfect solution to the SDLT surcharge.

It's going back to the old days of guarantor mortgages.

Is a guarantor the same as someone who will, presumably, have entitlement to capital proceeds from the sale of the property, to income or to occupy the property?0 -

Thanks for your reply but actually according to this Zoopla article HMRC have confirmed that it is entirely within the law - zoopla .co.uk/ discover/buying/q-a-new-3-stamp-duty-surcharges (sorry about the gaps but I'm not allowed to post links as I'm a new user)

We have no intention of committing fraud, this just appears to be one of the rare occasions where the government rewards people who aren't married rather than the usual tax breaks for people who are married...

Apologies, I was mislead0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards