We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Generational Inequality

davomcdave

Posts: 607 Forumite

AKA the ruggedtoast memorial thread.

Some older people's reply to what they think of ruggedtoast being PPR'd

There is an interesting new report out from the Resolution Foundation:

http://www.resolutionfoundation.org/app/uploads/2017/02/IC-intra-gen.pdf

This is the graph that really stood out for me. Compares incomes after taxes and housing costs for 'P20' (the 20th percentile or the bottom fifth of earners), people at the median and people in the P80 (the 80th percentil or the top fifth of earners). For everyone except the very richest retired people earn more. on average, than those in work:

Who is losing out? In relative terms the poor.

Some older people's reply to what they think of ruggedtoast being PPR'd

There is an interesting new report out from the Resolution Foundation:

http://www.resolutionfoundation.org/app/uploads/2017/02/IC-intra-gen.pdf

Over the course of the 20th Century, years of economic growth and rising living

standards meant that we came to take for granted that the income of each generation

would be higher than its predecessor. For example, average baby boomer incomes at

age 55 were £10,000 higher than among members of the silent generation at the same

age. Average silent generation incomes were in turn £6,000 higher at age 55 than those

recorded by the greatest generation. Both equate to generation-on-generation income

growth rates of around 50 per cent. Improvements of a similar scale were evident among

members of generation X at younger ages. This pattern has been a key measure of our

progress as a nation.

However, this generation-on-generation progress appears to have stalled in the 21st

Century. Members of the youngest of the generations to have reached adulthood –

millennials – have not to date secured incomes that are any higher than those of

generation X at the same ages. In part, of course, this reflects the impact of the financial

crisis – incomes have suffered across all generations in the last decade. But if current

economic forecasts turn out to be right, and government policy remains unchanged, then

the outlook for the group looks little better. By 2020-21, many millennial households

will have reached their mid-30s and yet might still be no better off than members of

generation X were at the same age.

This is the graph that really stood out for me. Compares incomes after taxes and housing costs for 'P20' (the 20th percentile or the bottom fifth of earners), people at the median and people in the P80 (the 80th percentil or the top fifth of earners). For everyone except the very richest retired people earn more. on average, than those in work:

Who is losing out? In relative terms the poor.

0

Comments

-

'Typical pension incomes': I can tell you that there are pensioners in my family whose incomes are nowhere near £35,000 p.a. and under £12,000 p.a. And what is meant by 'working age' income? I can tell you that many of today's pensioners had extremely low incomes when they were in their twenties, thirties and forties (at a time when interest rates were extraordinarily high). I can also tell you that there are people in their thirties in my family, and others I know of, who have no drive to work (despite having a 'uni' education), live with their parents, complain, and swan around on permanent gap years rather than striving to achieve something in life. There are others who do have a lot of drive, and are doing extremely well using their own initiative and determination (without any complaining).

Reports like the above are just intended as a prelude to impoverishing elderly people, many of whom have worked incredibly hard for decades, paid in, raised ungrateful children, and attempted to save for their futures – and now have to pay astonishingly high fees for their own care, which wasn't the case in the past, when such care was provided. They are also intended to cause a split and hostility between generations – conveniently ignoring the fact that many of those born in the Eighties and onwards feel they 'deserve' to be handed everything on a platter, and are soft and completely uninformed and untaught about how their parents and grandparents lived. They should be careful what they wish for: their relatives could be forced to spend their inheritances (something that their parents did not commonly receive), and they may stop receiving money from their parents to finance their lifestyles.

And why are they not rising up about (and informed about) the fact that due to automation and an increasing world population (giving rise to ever-decreasing wages, something striven for by uncaring global corporations), the situation with regard to obtaining work is likely to get much worse in the future? People need to toughen up in this country, and realise life doesn't owe them a living, and that you have to work incredibly hard to get anywhere (unless, of course, you inherit, which is arguably not the best thing for individuals). They also need to realise that it takes time to build up 'wealth' – it doesn't just drop out of the sky. Those in past generations in Western society worked much harder than people do nowadays, in far worse working conditions and with far fewer expectations than people tend to have now. Yes, there are affluent pensioners, especially people like MPs and those working for taxpayer-supported establishments, but there are also very many people who are not in this position.

I suppose the next suggestion will be to opt for the Soylent Green solution…0 -

I'm sure there's a perfectly valid reason why housing costs are stripped out.

But I'd like to know what the lines look like with it added back in.0 -

'Typical pension incomes': I can tell you that there are pensioners in my family whose incomes are nowhere near £35,000 p.a. and under £12,000 p.a.

If you read the report or my OP then definitions are laid out. The plural of anecdote is anecdotes not data. I know lots of poor people but that doesn't mean everyone is poor. The data sets out pensioner versus worker incomes at different percentiles and tells a story. That story might be annoying but do you think it's inaccurate based on data?Reports like the above are just intended as a prelude to impoverishing elderly people, many of whom have worked incredibly hard for decades, paid in, raised ungrateful children, and attempted to save for their futures – and now have to pay astonishingly high fees for their own care, which wasn't the case in the past, when such care was provided. They are also intended to cause a split and hostility between generations – conveniently ignoring the fact that many of those born in the Eighties and onwards feel they 'deserve' to be handed everything on a platter, and are soft and completely uninformed and untaught about how their parents and grandparents lived. They should be careful what they wish for: their relatives could be forced to spend their inheritances (something that their parents did not commonly receive), and they may stop receiving money from their parents to finance their lifestyles.

Reports like this are based on data. You reply seems to be based on prejudice and fear.And why are they not rising up about (and informed about) the fact that due to automation and an increasing world population (giving rise to ever-decreasing wages, something striven for by uncaring global corporations), the situation with regard to obtaining work is likely to get much worse in the future? People need to toughen up in this country, and realise life doesn't owe them a living, and that you have to work incredibly hard to get anywhere (unless, of course, you inherit, which is arguably not the best thing for individuals). They also need to realise that it takes time to build up 'wealth' – it doesn't just drop out of the sky. Those in past generations in Western society worked much harder than people do nowadays, in far worse working conditions and with far fewer expectations than people tend to have now. Yes, there are affluent pensioners, especially people like MPs and those working for taxpayer-supported establishments, but there are also very many people who are not in this position.

I'd love to see the data you base this on. I would imagine that in a world where women are no longer fired for getting married/getting pregnant that families work far longer hours than previously. I'm sure you have data to back this up and I look forward to you linking to it.0 -

I'm sure there's a perfectly valid reason why housing costs are stripped out.

But I'd like to know what the lines look like with it added back in.

It's a normal measure of disposable income for economists to measure it ex-tax and housing costs. I'm not sure why other things like necessary travel and utility bills aren't included TBH.0 -

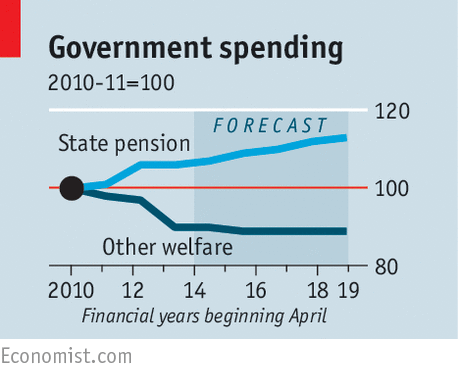

Drip, drip, drip - It is all about means testing the State pension.'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

-

davomcdave wrote: »It's a normal measure of disposable income for economists to measure it ex-tax and housing costs. I'm not sure why other things like necessary travel and utility bills aren't included TBH.

Yes they should include lifestyle costs as well, it is obvious that the young 'need' more money to enjoy themselves than old fogeys 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Drip, drip, drip - It is all about means testing the State pension.

TBH that seems to be the only reasonable outcome, especially after Brexit and the backlash against immigration.

If something is unsustainable then it won't be sustained. The cost of paying pension promises, especially with the ludicrous triple lock, are high and add to that the cost to the NHS (taxpayer) of an aging population is horrible.

Boomers are just starting to retire. This is absolutely the issue of our times. Trump and Brexit are side shows.0 -

This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0

-

davomcdave wrote: »It's a normal measure of disposable income for economists to measure it ex-tax and housing costs. I'm not sure why other things like necessary travel and utility bills aren't included TBH.

Yes I understand that.

But it don't take a genius to work out that if housing costs have rocketed disproportionately by age group, then that in itself could explain changes.

I don't know if they have or haven't, because there is no information provided.

Edit: oh yes actually there is. At least on ownership....0 -

Yes they should include lifestyle costs as well, it is obvious that the young 'need' more money to enjoy themselves than old fogeys

There is a conversation about how to measure income.

Is it my gross salary?

Salary less tax?

Salary less tax plus welfare payments?

Salary less tax and housing costs plus welfare payments?

Salary less tax and housing and other assumed necessary costs plus welfare payments?

Something else?

Salary less tax and housing costs plus welfare payments is imperfect as I could live in a castle or a bedsitter but most often used I believe.

The sticks that are often used to beat the young (THEY ALL HAVE iPHONES!!!!) apply to boomers. Boomers had phones when they were young. My parents had a phone in the 1970s as did my grandparents. A mobile phone is as much a luxury today as a landline was in the 60/70s. There was an episode of Minder where we were to mock the characters because they couldn't afford a landline so Terry was required to stand next to a phone box.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards