We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The fed just raised interest rates by .25%

Comments

-

Thrugelmir wrote: »Been clearly flagged. So a rise in rates should be no surprise.

Will it ripple out further is the question.

Unless I have misunderstood something, it has already been priced in, so it is actually expected.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

I make out like a bandit when the $ is strong so bring it on...0

-

chucknorris wrote: »Unless I have misunderstood something, it has already been priced in, so it is actually expected.

May still result in a ripple effect. The UK for example is on all counts is a net borrower in the global markets. Rates offered will need to remain competitive. As Carney said not so long ago. The UK is dependent on the charity of strangers. After the December Fed rate move. Mortgage rates moved above 4% in the US. Much more attractive to buy US securitised mortgage debt as an investment.0 -

Thrugelmir wrote: »Action now is to address the storms ahead in the future. That's why the storm doesn't materialise. Takes time for even minor adjustments to filter through.

You've been talking about an imminent interest rate storm since 2008 and it never happened. You'be been wrong on this so many times it's untrue. America and the uk lost it's triple a rating and nothing hapened. You need to accept facts, we are in a new age of low interest rates and will be here for many many years to come.Proudly voted remain. A global union of countries is the only way to commit global capital to the rule of law.0 -

You've been talking about an imminent interest rate storm since 2008 and it never happened. You'be been wrong on this so many times it's untrue. America and the uk lost it's triple a rating and nothing hapened. You need to accept facts, we are in a new age of low interest rates and will be here for many many years to come.

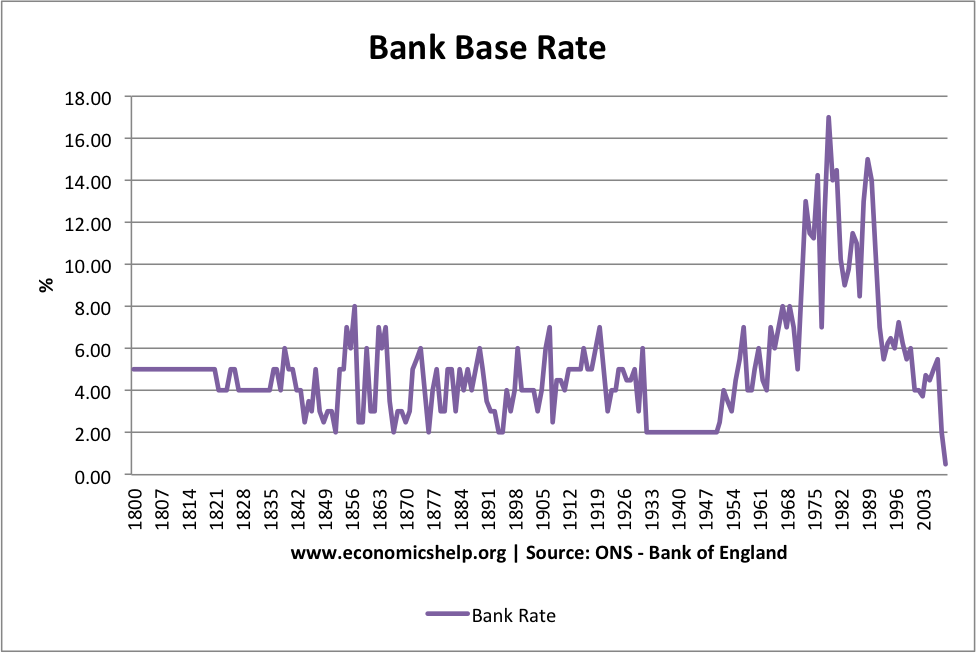

Base rates are likely to go back to long-term averages:

Long term averages are about 5%. I have never seen any compelling argument that makes me think that anything has changed in the world to keep interest rates low.

Economic policy has been set for the benefit of the baby boomers for decades. I see no reason for that to end now they are retiring. If anything that means interest rates being kept higher rather than lower as boomers are going to require inflation to be kept low to prevent the value of their pensions being eroded.0 -

You've been talking about an imminent interest rate storm since 2008 and it never happened. You'be been wrong on this so many times it's untrue. America and the uk lost it's triple a rating and nothing hapened. You need to accept facts, we are in a new age of low interest rates and will be here for many many years to come.

I've never used the word storm. Nor ever suggested when. Though I would use the word complacency. Only ever a question of when the tide will finally turn. No one foresaw the extent of Central Bank intervention required to maintain stability in the global financial markets. Or the cheap funding provided to UK institutions to provide liquidity for mortgage lending. The US hit the rocks in 2005/06. In time terms is further along the road to recovery. Of course the UK could follow the Japanese model of secular stagnation. Burdened with debt with a rapidly ageing population to support.0 -

The MPC just need to grow some balls and raise the rates.0

-

The MPC just need to grow some balls and raise the rates.

At some point their hand will be highly likely to be forced.

The US has plenty of form when it comes to trashing other countries' currencies. As John Connally put it, "The dollar may be our currency but it's your problem".

The markets have priced in an even money chance of two further rate rises this year of 25bps each which would put the Fed Funds target rate range at 1.00-1.25%. The Fed themselves reckon there is a chance of 3 more rate rises this year.

Who is going to lend money to Britons at negative real rates when they can lend to Americans at positive or at least neutral real rates? Especially if it seems likely that the debts are going to be repaid in devalued pounds. The MPC has got some tough choices ahead of it. Ditto the ECB as it goes.0 -

davomcdave wrote: »Who is going to lend money to Britons at negative real rates when they can lend to Americans at positive or at least neutral real rates? Especially if it seems likely that the debts are going to be repaid in devalued pounds. The MPC has got some tough choices ahead of it. Ditto the ECB as it goes.

Chinese are certainly concerned. As it's monetary expansion (debt) that's fuelled growth. Capital outflows on the back of a strong greenback won't be helpful.0 -

this all points to an even higher dollars. i have said for a whislt US stocks are going to rise a lot. they have specially in pound terms. its not to late, i expect this to continue for sometime.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards