We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much can house prices keep rising ?

Lloyd90

Posts: 112 Forumite

I was talking this over with a friend the other day.

Considering the average UK Salary now is £26,000, and to get a mortgage I am under the impression that you can lend up to five times your income (now minus expenses, so even less than before), that assuming the average couple is on a household income of £50,000 (which I think is generous) then how long before people are totally priced out of the housing market ?

Can property continue to climb and climb?

Considering the average UK Salary now is £26,000, and to get a mortgage I am under the impression that you can lend up to five times your income (now minus expenses, so even less than before), that assuming the average couple is on a household income of £50,000 (which I think is generous) then how long before people are totally priced out of the housing market ?

Can property continue to climb and climb?

0

Comments

-

I was talking this over with a friend the other day.

Considering the average UK Salary now is £26,000, and to get a mortgage I am under the impression that you can lend up to five times your income (now minus expenses, so even less than before), that assuming the average couple is on a household income of £50,000 (which I think is generous) then how long before people are totally priced out of the housing market ?

Can property continue to climb and climb?

I don't know if prices will continue to increase and it's futile to speculate.

What i do know is when you strip it down to basic economic principles, i.e supply and demand there isn't going to be a massive lowering of prices.

The simple fact is people have to have somewhere to live and population growth is far outstripping house building.0 -

In quite a large part of the country the average salary will buy you a two bed house with people only needing to borrow about 3 times the salary. It is only the south east where housing is expensive.0

-

In the 1930s you could buy a new build 3 bed semi in the North London suburbs for about £700. That house today would probably be worth in excess of £500,000. Of course during the intervening years house prices has gone up and down, but the above may just persuade you that house prices tend to rise over a long period.

So even if there was to be a fall, in a few years they would rise again to a figure in excess of that before they fell.If you are querying your Council Tax band would you please state whether you are in England, Scotland or Wales0 -

In quite a large part of the country the average salary will buy you a two bed house with people only needing to borrow about 3 times the salary. It is only the south east where housing is expensive.

Incorrect.

Those parts of the country where houses can be found that are ''only 3 times average salary'' are places where the vast majority of the local population are earning nothing close to the ''average salary'' of £26k.

And even those houses that are ''only 3 times average salary'' ie £78k will be run down houses needing large amounts spending on them in the most undesirable areas.0 -

Perhaps they meant 3 times the 'household income' of £50k so £150k, although I agree some of those places where housing is cheap tending to have some of the higher rates of unemployment etc.

Also from my own experience whilst one partner tends to be on the "average income" quite often one partner is on less (and sometimes one or both are on more".0 -

Comparing the price of a house, now, even with its value 40 years ago is not as simple as it appears, because wages were much lower then (many earned well under £100/week).

Likewise,as a child, I marvelled at my mum's tales of buying a 'poke bag' of sweets for a farthing (Quarter of an old penny , so about a tenth of a decimal penny) in the 1920s, but then weekly wages were a couple of pounds (if you were lucky).0 -

You forget that most housing is not sold to first-time buyers, but is trading up the ladder, so the relevant figure is the difference between the sale and the purchase.I was talking this over with a friend the other day.

Considering the average UK Salary now is £26,000, and to get a mortgage I am under the impression that you can lend up to five times your income (now minus expenses, so even less than before), that assuming the average couple is on a household income of £50,000 (which I think is generous) then how long before people are totally priced out of the housing market ?

Can property continue to climb and climb?

Yes, the inability of FTBs to get on the ladder at all will affect how people move up the rungs, of course, but it's certainly nowhere as simple as "average salary x lending multiplier = sky falling in"0 -

Houses by and large sell... i.e. people find a way to afford them, regardless of what average salaries are doing. By and large, people aren't at their absolute financial limit either.

So there's plenty scope for prices to rise more and more, though not skyrocketing. Of course, you'll have pockets where prices will keep rising faster, some areas where they'll slow and some where they'll reduce. On average, I don't imagine anything drastic happening either direction for the next while.0 -

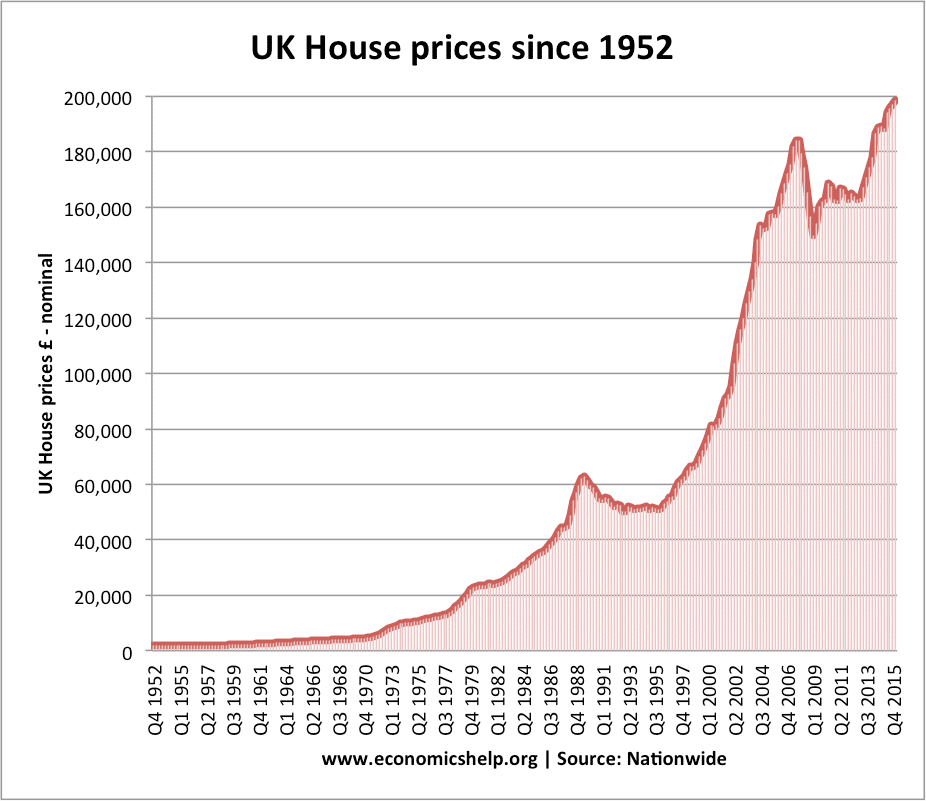

The house price crash crew will have you believe that Brexit, S24, weak pound, Basel 3, stagnant wage growth, economic uncertainty etc will cause a collapse in house prices of over 50%, some of the deluded souls believe 80% is on the cards. Sure there will be peak and troughs along the way but I cannot see the graph changing much in our lifetimes., 300,000 homes per year needed just to keep up versus approx 150,000 per year built for the last 10 years. On top of that net migration running at between 200 and 300k per year, you do the maths.

0

0 -

how long before people are totally priced out of the housing market ?

In almost no areas of the country can you afford to buy a house based purely on your mortgage.

The equation is obviously skewed by deposits - whether from savings or inheritances. Not to mention foreign investors.

The fact is, huge parts of the aged 18-30 market are already priced out of the housing market and have to save and/or await an inheritance. Increasing lifespans also make it more difficult. I've lost my train of thought because I typed 18-30 and back when I was in that age bracket, it meant something "different"!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards