We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Stamp Duty on main residence

Dunmore

Posts: 27 Forumite

Hi. The new stamp duty rules have got me a little confused to say the least.

My situation is that my wife and I bought a property in 2006 as our main residence and let out my flat.

We sold that residence in 2008 and have been living in rented accomadation ever since. We still have the let flat

I beleive that if we buy a main residence within 3 years of when the new rules came in we will not be liable for the higher stamp duty.

Am I correct?

Thanks

Darren

My situation is that my wife and I bought a property in 2006 as our main residence and let out my flat.

We sold that residence in 2008 and have been living in rented accomadation ever since. We still have the let flat

I beleive that if we buy a main residence within 3 years of when the new rules came in we will not be liable for the higher stamp duty.

Am I correct?

Thanks

Darren

0

Comments

-

That is incorrect. The higher rates will apply."Real knowledge is to know the extent of one's ignorance" - Confucius0

-

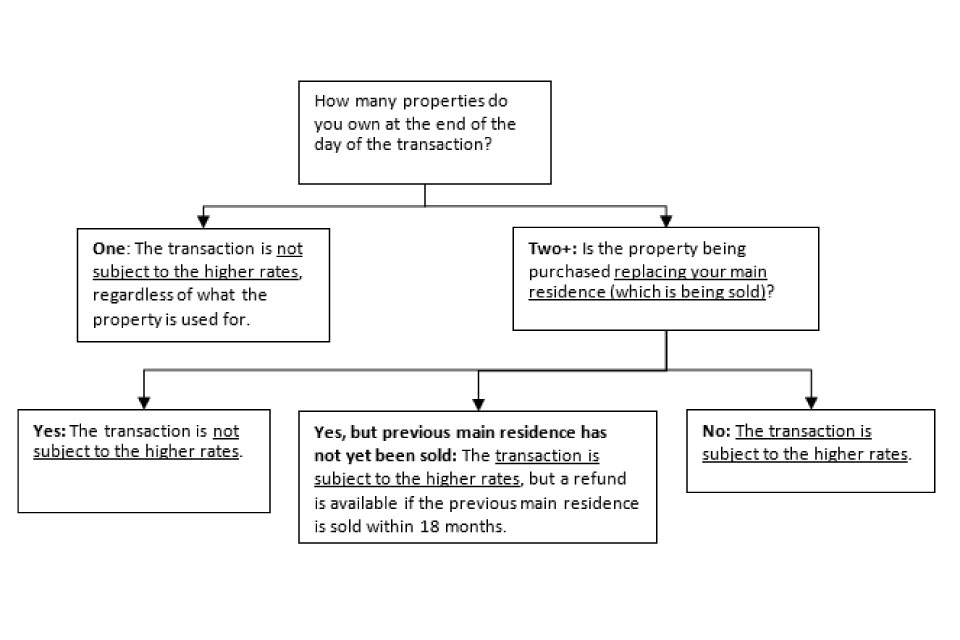

Not quite. If you buy a new main residence, and still own another property, then you pay the 3% hike. BUT if you sell your existing main residence within three years of that purchase (or the two are tied together in a chain), then you can reclaim the 3% premium.

So, since you aren't selling your existing main residence, then you pay the 3%.

You're going into the purchase owning one property, you're coming out of it owning two.

From .gov.uk

https://www.gov.uk/government/consultations/consultation-on-higher-rates-of-stamp-duty-land-tax-sdlt-on-purchases-of-additional-residential-properties/higher-rates-of-stamp-duty-land-tax-sdlt-on-purchases-of-additional-residential-properties0 -

you are categorically liable for the higher rate SDLT. There are transitional rules, but they do not apply to your scenario

- you have not (nor intend to) lived in the flat as the marital home within a 3 year period of the date you purchase the new marital home - see chapter 8 Q&A :

"I currently live in rented accommodation but own a property that is rented out. I am now looking to purchase my first home, for me and my family to live in. Will I have to pay the higher rates of SDLT on this purchase?

A2. Yes, the higher rates of SDLT will apply as following the purchase you will own an additional residential property (and will not have replaced your main residence, i.e. sold a current main residence and purchased a new one)."

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/509184/GuidanceNote_Final.pdf0 -

Thanks for everyone's answers

What I still don't understand is I am replacing my main residence having disposed of my previous one 8 years ago

Can someone please explain what this rule is trying to do as I know if I owned my main residence I would not be liable. So whats the difference?

Thanks0 -

It is raising money by taxation of folks with 2 properties, when they change property.

It's not trying, it actually works.

Yes of course but why are they not raising taxes from people who currently own their own residence and sell to buy another still leaving them with 2 properties. It is this subtlety I want to try and understand.

Thanks0 -

Because they aren't buying an additional property. You are.0

-

What I still don't understand is I am replacing my main residence having disposed of my previous one 8 years ago

No, your main residence is currently a rented property. You haven't lived in a property you've owned for the thick end of a decade.Can someone please explain what this rule is trying to do as I know if I owned my main residence I would not be liable. So whats the difference?

The difference is that you currently own one property, and will own two properties at the end of this transaction.0 -

AnotherJoe wrote: »Because they aren't buying an additional property. You are.

Ok I understand, but doesn't the fact that it will be my main residence count? I am just replacing the main residence i sold 8 years ago.

The flow chart above is vague in that it says "being sold". If that categorically means not sold already then I get it but I don't think this is what it means. I think this means that the property must be sold so you only remain with a main residence.

Thanks0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards