We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Only Way is UP!

Generali

Posts: 36,411 Forumite

Well not in the short-term, anything can happen in the short-term but this is what Bill Gross, probably the most famous bond investor in the world, has to say about the current market for debt:

http://www.bloomberg.com/news/articles/2016-06-09/gross-says-negative-rates-are-like-supernova-that-will-explode

In further negative interest rate news, Commerzbank is looking at the possibility of holding large amounts of cash and/or gold in its vaults in order to avoid ECB negative interest rates:

http://www.reuters.com/article/us-commerzbank-ecb-idUSKCN0YU1HW

German life insurance companies, that have offered Equitable Life-style guaranteed returns are also feeling the pinch having offered rates of an average 2.7% but having to invest in bonds with a lower coupon (interest payment) as current bonds mature. At a interest rate of 1.5%, the average German life insurance company is insolvent in 2026. At 1% that is 2022. As of a few minutes ago, the so-called '10 Year Benchmark' (a kind of technically created imaginary yield on German bonds) was 0.033%.

https://www.fitchratings.com/site/pressrelease?id=1003249

http://www.bloomberg.com/news/articles/2016-06-09/gross-says-negative-rates-are-like-supernova-that-will-explode

A supernova is a star at the end of its life that suddenly increases greatly in brightness because of a catastrophic explosion that ejects most of its mass.

Gross has argued for some time that the economy is at the end of a decades-long cycle of expanding credit that has culminated in negative interest rates, a situation he said is unsustainable. Rather than spurring economic growth, low rates are promoting asset bubbles as investors reach for higher yields while punishing individual savers and industries that rely on interest rates, such as bank and insurance companies, according to Gross.

In further negative interest rate news, Commerzbank is looking at the possibility of holding large amounts of cash and/or gold in its vaults in order to avoid ECB negative interest rates:

http://www.reuters.com/article/us-commerzbank-ecb-idUSKCN0YU1HW

Commerzbank, one of Germany's biggest lenders, is examining the possibility of hoarding billions of euros in vaults rather than paying a penalty charge for parking it with the European Central Bank, according to sources familiar with the matter.

Such a move by a bank part-owned by the German government would represent one of the most substantial protests yet against the ECB's ultra-low rates, which have been criticised by politicians including Finance Minister Wolfgang Schaeuble.

German life insurance companies, that have offered Equitable Life-style guaranteed returns are also feeling the pinch having offered rates of an average 2.7% but having to invest in bonds with a lower coupon (interest payment) as current bonds mature. At a interest rate of 1.5%, the average German life insurance company is insolvent in 2026. At 1% that is 2022. As of a few minutes ago, the so-called '10 Year Benchmark' (a kind of technically created imaginary yield on German bonds) was 0.033%.

https://www.fitchratings.com/site/pressrelease?id=1003249

A reduction in the maximum guaranteed returns that German life insurance companies are allowed to offer their clients would not have any significant impact on their exposure to the risks of sustained low interest rates, Fitch Ratings says. We see the possibility of a long period of low interest rates as the biggest risk for European insurers and believe that German firms are the most exposed because of their previous widespread use of guaranteed returns.

0

Comments

-

the only "safe" places to invest are in equities and perhaps real estate.0

-

the only "safe" places to invest are in equities and perhaps real estate.

What happens to real estate if we aren't in a new normal after all and lending risk rates return to something like 6 or 7%?

Are you going to be able to convince the market that they must pay £2000 pm for a low end terraced house in South London, that the market is currently pricing at 1100 pm?0 -

What happens to real estate if we aren't in a new normal after all and lending risk rates return to something like 6 or 7%?

Are you going to be able to convince the market that they must pay £2000 pm for a low end terraced house in South London, that the market is currently pricing at 1100 pm?

property prices will fall0 -

What happens to real estate if we aren't in a new normal after all and lending risk rates return to something like 6 or 7%?

But what is going to drive interest rates up to 6 or 7% when the entire economy (not just housing) simply can't handle it, I just don't see it as a likely scenario.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

exactly.

remember rates moving higher correlates with higher inflation which means rents should rise. of course there is a tail risk of a sudden hike in rates to support sterling or out of control inflation but these are tail risks in the same realms as if you were to be hit by a bus.0 -

chucknorris wrote: »But what is going to drive interest rates up to 6 or 7% when the entire economy (not just housing) simply can't handle it, I just don't see it as a likely scenario.

Mortgage rates of 6-7% imply a base rate of about 5%, the long term average. That doesn't seem unreasonable unless This Time It's Different.

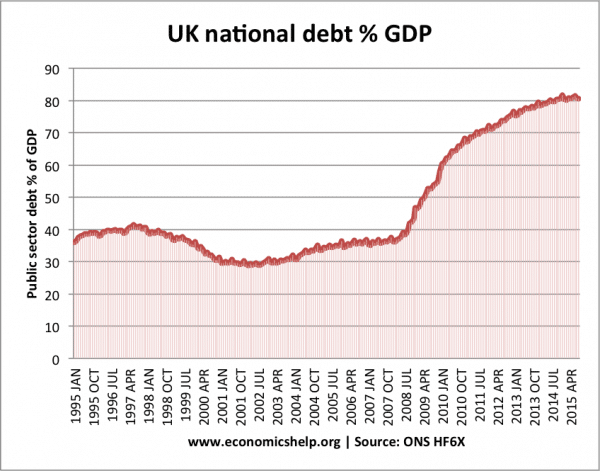

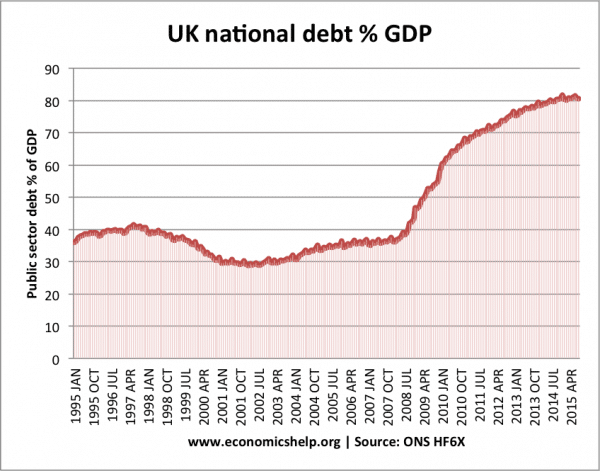

UK Debt is either a terrible problem:

Or not terribly significant:

Depending on your point of view.

Is inflation going to stay very low forever? What about when there's a big war in the Middle East and oil prices spike? Is that a ridiculous idea or an accident waiting to happen?

Then there's the huge amount of money printing that's been done. Surely there's at least a risk that at some point that will cause some inflation.

Then there's simply the huge distortions that are happening as a result of NZIRP or even ZIRP, per my original post.

It seems to me to be highly unlikely that something snapped about 5-6 years ago to move us from 400 years of positive real interest rates to permanent negative real interest rates. If we have made that move, what changed to make it happen? If the 1929-1936 Great Depression or the 1873-93 Long Depression couldn't do that, how could the GFC?

I ain't buying it.0 -

I see no event on the horizon likely to trigger a return to 5% base rates, frankly - that would imply an inflation rate of 2 or 3% which is also not looking probable. Therefore this would happen in consequence either of an event not on the horizon, and by defintion unforeseable, or because the consequences of something we do know about turn out to be unexpectedly different to what we anticipated.

The obvious candidate is Brexit; perhaps too obvious. A sterling collapse would make imports dearer and trigger inflation; a sterling rally would make exports expensive just as our right to export tariff-free to the EU becomes problematic.Neither looks encouraging. Either could trigger some sea-change.

I am with Lord Salisbury on this: "Whatever happens will be for the worse, and therefore it is in our interest that as little should happen as possible."0 -

westernpromise wrote: »...

The obvious candidate is Brexit; perhaps too obvious. A sterling collapse would make imports dearer and trigger inflation; a sterling rally would make exports expensive just as our right to export tariff-free to the EU becomes problematic.Neither looks encouraging. Either could trigger some sea-change.

..

Do you not think Trumpism will have a bigger effect?

A spot of protectionism in the USA combined with more aggressive foreign policy, perhaps a bit of sabre rattling, with just a tad of poking at one of the world's more fanatical religions.

He makes BoJo look like a model of calm.0 -

Mortgage rates of 6-7% imply a base rate of about 5%, the long term average. That doesn't seem unreasonable unless This Time It's Different.

UK Debt is either a terrible problem:

Or not terribly significant:

Depending on your point of view.

Is inflation going to stay very low forever? What about when there's a big war in the Middle East and oil prices spike? Is that a ridiculous idea or an accident waiting to happen?

Then there's the huge amount of money printing that's been done. Surely there's at least a risk that at some point that will cause some inflation.

Then there's simply the huge distortions that are happening as a result of NZIRP or even ZIRP, per my original post.

It seems to me to be highly unlikely that something snapped about 5-6 years ago to move us from 400 years of positive real interest rates to permanent negative real interest rates. If we have made that move, what changed to make it happen? If the 1929-1936 Great Depression or the 1873-93 Long Depression couldn't do that, how could the GFC?

I ain't buying it.

Isn't the current BoE policy that only internal excess demand inflation is worth worrying about and external commodity price inflation (like the 5.5% we had a few years ago) does not merit an interest rate response?I think....0 -

Mortgage rates of 6-7% imply a base rate of about 5%, the long term average. That doesn't seem unreasonable unless This Time It's Different.

I just don't buy it, I don't believe that the base rate will go back up to 5% until our economy is ready for it. I just can't see it happening, I think a 5% base rate won't happen within 5 years, probably nearer 10 years, feel free to quote me on this later.

If you made a spread of 6 to 6.3 years I would buy (not sell).Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards